The Invesco QQQ Trust (QQQ) ETF (Exchange-Traded Fund) has advanced more than 24% so far in 2023, outperforming the 8% rise in the S&P 500 Index (SPX). Even after the solid year-to-date run, technical indicators reveal further upside.

QQQ tracks the Nasdaq-100 Index (NDX), providing investors exposure to many leading technology stocks. It comprises companies that are at the forefront of innovation and are focusing on attractive themes like cloud computing, augmented reality, mobile payments, streaming services, and electric vehicles.

The top three sectors that QQQ offers exposure to are tech, consumer discretionary, and healthcare, with the tech sector stocks accounting for nearly 66% of the ETF. Microsoft (MSFT), Apple (AAPL), and Amazon (AMZN) are the top three holdings of QQQ.

It is interesting to note that QQQ has outperformed the S&P 500 Index in nine of the last 10 years. Furthermore, QQQ has a low expense ratio of 0.20%, which makes it an attractive ETF investment.

What do Technical Indicators Signal?

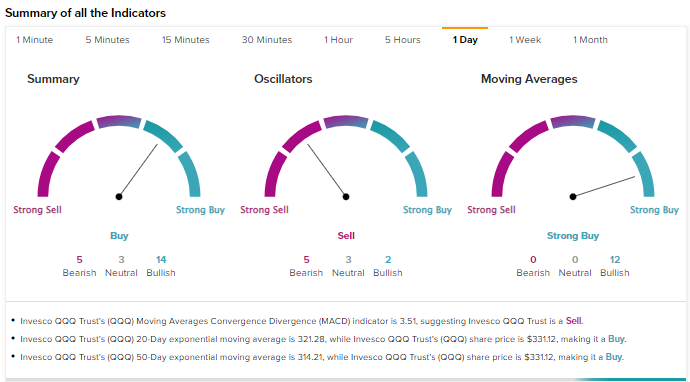

QQQ is a Buy based on TipRanks’ easy-to-understand summary signals that combine the moving averages and technical indicators into a single, summarized signal.

According to TipRanks’ Technical Analysis tool, the Invesco QQQ Trust ETF’s 50-Day EMA (exponential moving average) is 314.21, while its price is $331.12, making it a Buy. Further, QQQ’s shorter duration EMA (20-day) also signals a bullish trend.

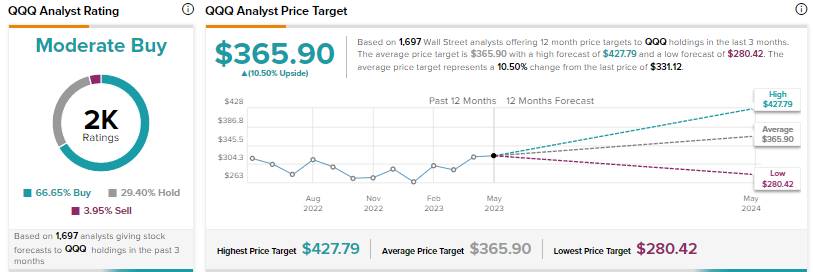

Aside from technical indicators, analysts’ consensus also indicates further upside. As per 1,697 analysts providing ratings on QQQ’s Holdings, the ETF is a Moderate Buy and the average price target of $365.90 implies 10.5% upside.

Further, of the 1,697 analysts offering recommendations on QQQ’s 102 holdings, 66.65% have a Buy rating, 29.4% have a Hold rating, and nearly 4% have a Sell rating.

Overall, QQQ is a Buy as per technical indicators and Wall Street analysts. Moreover, according to TipRanks’ Smart Score System, QQQ has a smart score of 8 out 10, which indicates that the ETF could outperform the broader market over the long term.