The Invesco QQQ Trust (QQQ) ETF (Exchange-Traded fund) has trended higher so far in 2023, reflecting a recovery in the share prices of large technology companies. For instance, QQQ ETF, which has the Nasdaq-100 index (NDX) as its benchmark, gained more than 32% year-to-date, reflecting a swift recovery in the share prices of its top five holdings.

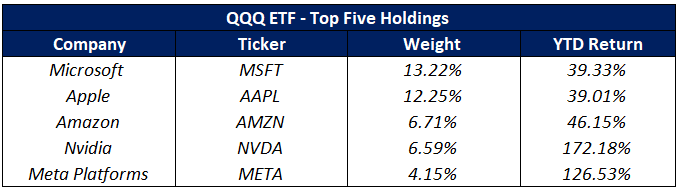

Its top five holdings include Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), and Meta Platforms’ (NASDAQ:META). The image below shows the weightage and performance of QQQ’s top holdings so far this year.

Is QQQ a Good ETF to Invest In?

Thanks to the uptrend in its top holdings, QQQ ETF has exceeded the broader markets with its returns. Despite the recent gains, it has an Outperform Smart Score of eight, implying it could deliver market-beating returns in the future.

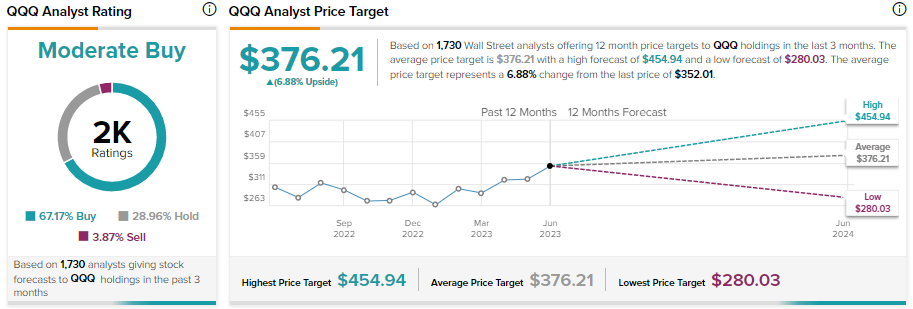

Per the recommendations of 1,730 analysts giving stock forecasts for the holdings of QQQ, the 12-month average price target of $376.21 implies 6.88% upside potential from current levels. Also, the ETF has a Moderate Buy consensus rating on TipRanks.

Among the Wall Street analysts providing ratings on its holdings, 67.17% have given a Buy rating, 28.96% have assigned a Hold rating, and 3.87% have given a Sell rating.

Overall, QQQ provides exposure to the top technology stocks. Thanks to the diversification, the ETF is less risky and has consistently outperformed the broader markets with its returns in the past decade. Also, its low expense ratio supports the bull case.