The Invesco QQQ Trust (QQQ) is one of the biggest NASDAQ 100 index (NDX)-tracking exchange-traded funds (ETF). QQQ’s investment objective is to earn returns in tandem with its underlying benchmark, which is the NDX. Having said that, no one knows for sure how much the NDX will increase in the upcoming 12 months, but TipRanks’ analyst forecast provides unprecedented insight into QQQ’s future movement.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

TipRanks’ exclusive ETF Analyst Forecast and Price Target tool shows that QQQ has a nearly 20% upside potential from today’s levels. Based on the recommendations of 1,724 analysts, the 12-month average Invesco QQQ Trust price target of $351.95 implies 19.9% upside potential. What’s more, the top analysts have given QQQ an average price target of $353.54, implying 20.4% upside potential from current levels.

Learn more about TipRanks’ forecasts and price targets for individual ETFs.

Additionally, the TipRanks tool also tells you that QQQ has a Moderate Buy consensus rating. Among a total of 1,724 analysts who have given ratings for the 101 holdings of QQQ combined, 65.72% have given a Buy rating, 29.76% have given a Hold rating, and 4.52% have given QQQ a Sell rating.

That’s not all – we also show you a list of the stocks included in the ETF with the highest upside potential and the lowest downside potential. For QQQ, AstraZeneca (NASDAQ:AZN) has the highest upside potential of 109.1% while Seagen (NASDAQ:SGEN) has the lowest downside potential of 7.3%.

How Does TipRanks Determine Analyst Ratings on ETFs?

TipRanks uses its proprietary technology to calculate the analyst forecast and price targets for ETFs, based on a combination of the individual performances of the underlying assets. At a glance, you will see the overall analyst rating, analyst price target, and upside or downside on an ETF.

Innovatively, we calculate a weighted average number based on the combination of all the ETF’s holdings. For instance, the average price forecast for QQQ is calculated by multiplying each of the 101 holding price targets by their weight (allocation) in the ETF.

Is Invesco QQQ Trust ETF a Good Investment?

The Invesco QQQ Trust ETF tracks the NDX and gives exposure to 101 companies, predominantly from the innovative technology and disruptive sectors. As an individual investor, you may not be able to buy shares of each of the companies separately.

Remarkably, QQQ has delivered an average annualized return of 16.20% in the past decade, ending December 2022. Moreover, QQQ has beaten the S&P 500 (SPX) nine out of the last ten years. Further, the ETF has a moderate expense ratio of 0.20%. Also, QQQ has a forward Price/Earnings (P/E) multiple of 21.29, which is well within investors’ reach and in line with the benchmark index.

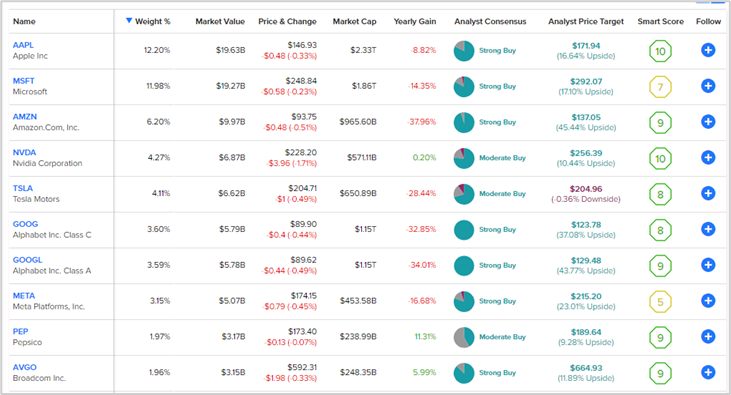

Here is a summary of the top 10 holdings of QQQ, which account for about 53% of its total holdings. Our data shows that eight out of the top 10 holdings of QQQ have an Outperform Smart Score on TipRanks. Furthermore, all these stocks have a Buy consensus rating (Strong or Moderate Buy).

Ending Thoughts

The Invesco QQQ Trust ETF is one of the best ways of gaining exposure to the solid growth potential of the technology sector. Further, our unique ETF Forecast and Price Target tool show that the QQQ ETF could offer decent upside potential over the next 12 months, making it an attractive investment opportunity.