In this piece, I evaluated two health and fitness stocks, Peloton Interactive (NASDAQ:PTON) and Planet Fitness (NYSE:PLNT), using TipRanks’ comparison tool to determine which is in better shape. Peloton is an exercise equipment company that manufactures stationary bicycles, indoor rowers, and treadmills with touchscreens that stream live and on-demand fitness classes via a subscription service. Planet Fitness franchises and operates low-cost fitness centers with about 2,400 locations, making it one of the largest fitness club franchises.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shares of Peloton have plummeted 23% year-to-date and are now down 35% over the last year, while Planet Fitness shares are down 21% year-to-date but off only 9% over the past 12 months.

With such similar year-to-date declines, one might expect similar valuations, but that’s certainly not the case. Peloton is not profitable, so we’ll look at its price-to-sales (P/S) ratio to gauge its valuation and compare it to that of Planet Fitness, which is profitable.

The leisure industry is trading at a price-to-sales (P/S) ratio of 1.1, slightly below its three-year average of 1.7. We’ll also look at the price-to-earnings (P/E) ratio for Planet Fitness since it’s profitable; the industry is currently trading at a P/E of 31.9 versus its three-year average of 42.5.

Peloton Interactive (NASDAQ:PTON)

At a P/S of 0.8, Peloton Interactive is trading below its industry. While its valuation has come down dramatically from where it traded during the pandemic, the company’s recent problems and lack of profitability suggest a bearish view might be appropriate.

Peloton was one of the big winners of the pandemic era, and like many of those companies, it has come crashing down. Additionally, the company posted a worse-than-expected loss and a sequential decline in subscribers, largely due to a bike recall that has gone on for so long that many customers have canceled their subscriptions.

In its recent earnings report, Peloton reported a quarter-over-quarter decline of 29,000 subscribers, although the metric was still up 4% year-over-year. The company believes that 15,000 to 20,000 of those subscribers paused their subscriptions while waiting for the replacement for their seat post.

Over two million bikes sold since January 2018 have been affected by the recall, which cost Peloton $40 million in the last quarter, significantly more than previously expected. However, the company said it has received only about 750,000 replacement requests. While that was more than it had expected, the number of affected bikes suggests a lot more requests could be coming. Additionally, Peloton has only fulfilled about 340,000 of those requests so far.

The company also warned recently that it doesn’t expect to remain free-cash-flow positive in the next two quarters, citing seasonality, marketing expenses, and the timing of inventory payments. Finally, Peloton’s sales fell by 11% in Fiscal 2022 and 22% in 2023 — not a good trend.

What is the Price Target for PTON Stock?

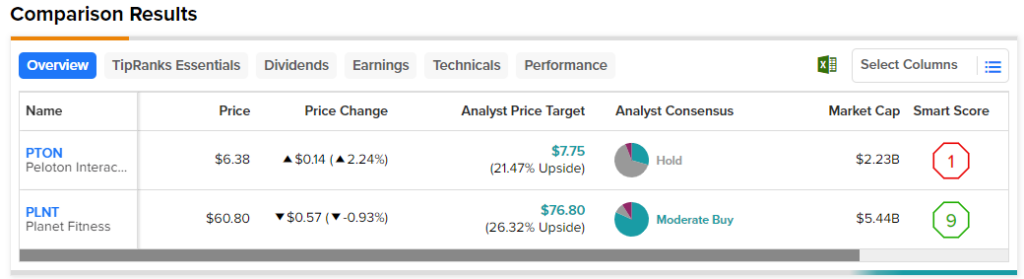

Peloton Interactive has a Hold consensus rating based on five Buys, 11 Holds, and one Sell rating assigned over the last three months. At $7.75, the average Peloton Interactive stock price target implies upside potential of 21.5%.

Planet Fitness (NYSE:PLNT)

At a P/S of 5.4 and a P/E of 41.7, Planet Fitness is currently trading at a sizable premium to its industry on both sales and earnings, although its P/E is slightly below the leisure industry’s three-year average. Given that the company is barely profitable and carrying significant net debt, a neutral view seems appropriate at current levels.

Generally, Planet Fitness’ numbers are moving in the right direction, with revenues up 47% year-over-year in 2021 and 64% in 2022. After plummeting in 2020 due to the pandemic, the company’s net income margin rose to 8% in 2021, 11.3% in 2022, and 12.8% in the last 12 months. Planet Fitness also beat earnings and revenue estimates in three of the last four quarters.

However, it has over $2 billion in net debt, and its debt-to-equity ratio is negative, which can suggest a high level of risk. The company took on significant amounts of debt to pay for more gyms, but it may be some time before those investments pay off, suggesting that a wait-and-see approach may be best.

Is Planet Fitness a Good Stock to Buy?

Planet Fitness has a Moderate Buy consensus rating based on nine Buys, one Hold, and one Sell rating assigned over the last three months. At $76.80, the average Planet Fitness stock price target implies upside potential of 26.3%.

Conclusion: Bearish on PTON, on PLNT

At the end of the day, it’s hard to find anything to like about Peloton right now. Meanwhile, Planet Fitness’ fundamentals are broadly trending in the right direction, making it look like a good long-term option. However, waiting for a better entry point may be best at current levels.