Prologis (NYSE:PLD) stock presents a compelling defensive investment opportunity after its recent underperformance and the company’s increased 2023 outlook, coupled with solid long-term growth prospects. Prologis is also likely to benefit from the Federal Reserve’s rate cuts in 2024-2025 and should be less affected by a potential recession. Therefore, I’m bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Prologis primarily manages logistics buildings spanning 1.2 billion square feet. The company operates in four regions – the U.S. at 85% of total net operating income (NOI = rents and other revenue minus operating expenses), Europe at 9% of total NOI, Other Americas at 4% of total NOI, and Asia at 2% of total NOI.

Prologis’s operations are reported in two segments: Real Estate (represents ownership, leasing, and development of logistics properties) and Strategic Capital (management of properties owned by unconsolidated ventures, i.e., where Prologis has a stake below 50% and mostly provides asset management services).

A Brief Look at Its Q2-2023 Results

Prologis delivered core funds from operations (known as core FFO, a cash-flow metric used by REITs) of $1.83 per share in Q2 2023, up 64.9% year-over-year. Excluding the $0.58/share contribution from the Strategic Capital business (which was absent in Q2 2022), the increase was 12.6%.

Additionally, same-store NOI increased 8.9% year-over-year in Q2, below the 9.9% growth achieved in Q1 2023 but above the prevailing 2022 rate. However, occupancy continued to trend down from the 98.2% reached in Q4 2022 and now stands at 97.2%.

Prologis was also very active in the capital markets, issuing $7 billion in debt at a weighted average interest rate of 4.9% and a weighted average term of 8.4 years. This brought the company’s current average cost of debt to 2.9%, with a solid average term of 9.7 years. For reference, the yield on its 4.375% 2048 USD bonds is now about 5.85%.

Interest Rates Peaking

With the Federal Reserve embarking on one of the fastest rate hiking cycles in history, markets and economists expect the Fed to largely pause for the remainder of 2023 before cutting rates in 2024 and 2025.

Markets currently give an 85% chance that the FED will keep the Federal Funds Rate unchanged at 5.25-5.50% at its September 20, 2023 meeting. The percentage drops to 70% for the November 1 meeting and about 65% for the December 13, 2023 meeting.

That said, the projections of the Federal Reserve are somewhat more hawkish than the market’s, with the Federal Funds Rate expected to be 5.6% at the end of 2023, 4.6% in 2024, and 3.4% in 2025.

As you can tell from the forecasts above and the interest rates Prologis currently funds itself at, refinancing should still be a drag on the company’s core FFO in 2024 before largely abating in 2025.

Prologis’ Implied Capitalization Rate

It is always important to consider the capitalization rate (the rate of return on a real estate investment property based on its expected cash flows) of a REIT you invest in and not just the yield based on core FFO. Usually, to increase returns, REITs borrow from banks and other lenders. This often results in a high core FFO yield.

However, if the REIT needs to sell a property on the market, the buyer will consider the capitalization rate, as it encompasses all cash flows of the property to equity and debt holders combined.

Prologis gets variable income from asset management aside from the rent income it gets from buildings. Thus, a true market-implied capitalization rate is hard to come by. Nevertheless, a good approximation would be to combine its core FFO forecast and interest expense and divide the sum by the company’s enterprise value.

In 2023, core FFO should be about $5.3 billion, and its interest expense should come out to ~$0.6 billion. Against an enterprise value of about $144 billion, its market-implied capitalization rate is about 4.1%.

The capitalization rate allows investors to compare REITs with different levels of financial leverage (the portion of the enterprise value funded by debt, which, at Prologis, is about 20%, a fairly conservative amount) since it looks at cash flows at the enterprise level rather than to shareholders specifically. A REIT with 40% leverage could boost returns to shareholders but is also riskier in times of interest rate increases or property market downturns.

The cap rate is also useful when comparing the absolute return potential of Prologis as an investment and makes it easy to compare it to other alternatives, such as government bonds. For instance, the 10-year U.S. government bonds also yield around 4% currently.

Last but not least, the 4.1% cap rate can be seen as the expected return before the use of leverage, inflation indexation, or rental growth. However, as I will highlight in the next paragraph, Prologis has an above-average growth profile currently.

Solid Long-Term Potential

As you can see from the 8.9% same-store NOI growth, Prologis is able to grow rents well above inflation. This is because the company has a lot of legacy leases at low absolute rent levels, which are adjusted to market rent levels when they expire. Indeed, CFO Tim Arndt highlighted on the conference call the company can generate an extra $2.85/share in earnings just by reletting its properties at current market rents, with any future inflation increases not factored in.

As a result, the forward-looking capitalization rate, which takes into account the $2.85/share earnings potential, can be calculated at about 6% currently.

Updated 2023 Outlook

Thanks to stronger underlying performance and a smaller interest expense, Prologis boosted its core FFO outlook to $5.56-5.60/share, up 8.1% from 2022.

After having fallen in the first half of the year, occupancy is expected to stabilize at about 97.0-97.5%. Likewise, same-store NOI growth is seen at about 9%, in line with Q2.

Is PLD Stock a Buy, According to Analysts?

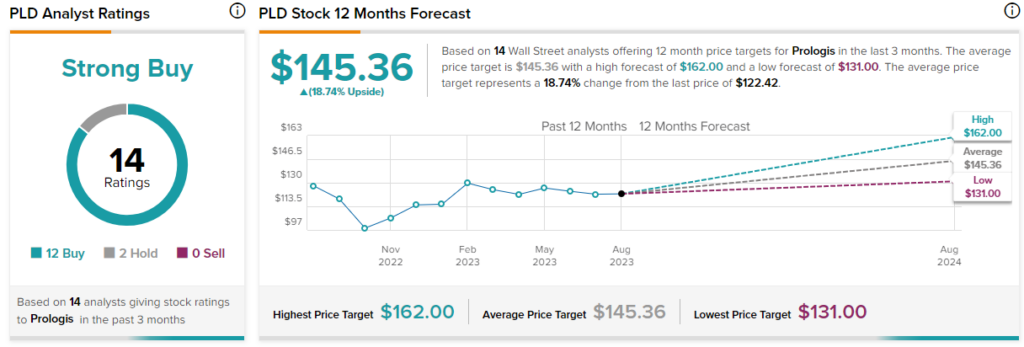

Turning to Wall Street, Prologis earns a Strong Buy consensus rating based on 12 Buys, two Holds, and zero Sell ratings. Additionally, Prologis stock’s average price target is $145.36, implying 18.7% upside potential.

The Takeaway

Prologis shares have moved sideways recently, despite the company increasing its full-year outlook and the prospect of rate cuts in 2024 and 2025. Thus, I reckon the shares are worth buying at the moment, especially if you want to allocate capital to a defensive sector that will be less impacted by a potential recession later this year or in 2024.