No matter the vagaries of day-to-day market action, the target for investors will remain the same as it always has been: To find stocks that promise profitability, and a positive return going forward. While difficult to find in today’s inflationary environment, profitable stocks are still the path to successful investing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Covering the Chinese vehicle market for DBS, the biggest bank in Asia, analyst Rachel Miu sees an opportunity for profits in the Asian electric vehicle (EV) niche. China has taken a full-on approach to encouraging adoption of EVs, and the country boasts a large number of innovative car makers focused on electrics.

Miu has picked out two EV stocks as likely candidates for a turn toward profitability as early as next year. We’ve used the TipRanks platform to check the details and find out what else makes them appealing investment choices. Let’s take a closer look.

Li Auto Inc. (LI)

Li Auto is one of the leading firms in China’s EV sector, and has specialized in the EREV niche, or extended range electric vehicles. These vehicles use a range extender – a small engine – to keep the electric system charged. Li has leveraged this technology to produce a line of electric SUVs, designed for the family market. The company, which was founded in 2015, began serial production in 2019. As of November 30, Li has delivered a total of 236,101 vehicles, and is working on a battery powered design.

This past December 1, Li announced its November delivery update – a total of 15,034 in the month, for a company record, and up 11.5% year-over-year. Li’s Li L9 model, a full-size 6-seater, lead the way in the company’s deliveries and was the top choice, nationally, in its category. Li also reported having a wide network to support its vehicles, with 276 retail stores in 119 cities, and 317 service centers in 226 cities.

Also this month, Li reported its financial results for 3Q22. Starting with deliveries, the company reported a 5.6% year-over-year increase, to 26,524 deliveries for the quarter. This supported a total revenue of $1.31 billion, of which $1.27 billion came from vehicle sales. The top line was up 20% y/y. Li saw a net loss of $231.3 million in Q3, along with a cash burn of $71.5 million.

Despite the high net loss, company management is sanguine about profitability going forward, saying that a combination of increased production, efficient execution, and cost management has the firm on track ‘to hit our profitability inflection point.’

DBS’s Miu agrees that Li has plenty going for it and also believes the company is heading for its first profitable year. She writes, “Li Auto is the first auto OEM to leverage EREV technology to break into the highly competitive EV industry with a sterling sales performance, despite a short operating history. The company aims to launch its first battery electric vehicle (BEV) model in 2023, creating its second long-term growth pillar… The company is expected to turn profitable in FY23 – the first among pure EV start-ups in China.”

Looking forward, and putting some numbers behind her comments, Miu rates the shares as a Buy and sets a price target of $29, suggesting a one-year upside potential of ~43%.

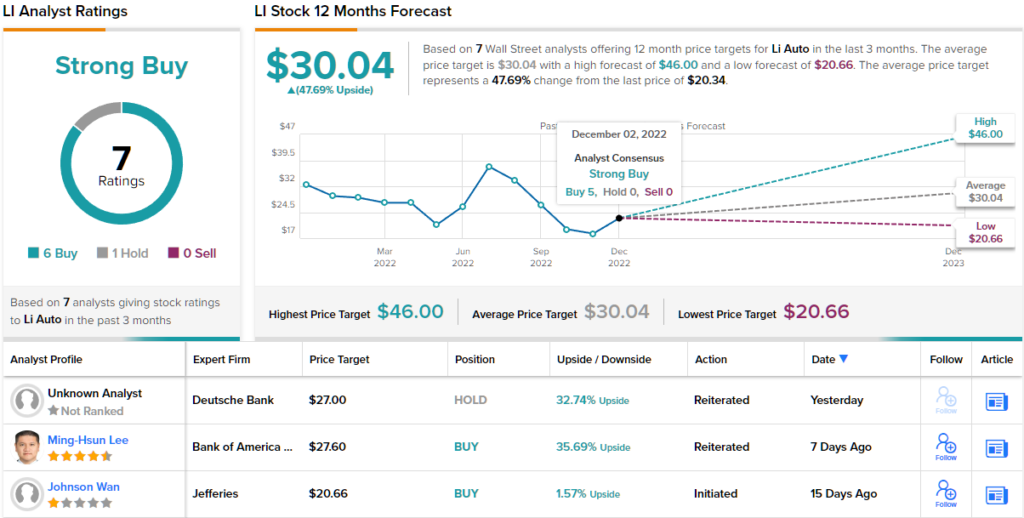

Overall, there are 7 recent analyst reviews on file for Li Auto, and they include 6 Buys against a single Hold for a Strong Buy consensus rating. The stock is selling for $21.36 and has a $30.04 average price target, implying a gain of ~48% in the year ahead. (See LI stock forecast)

Nio, Inc. (NIO)

Next up is Nio, another of China’s leading EV companies. Nio has been working on battery-powered EVs from its beginning, and has been making vehicle deliveries since 2018. Currently, the company has 6 consumer models on the market, including sedan, coupe, and SUV designs. In addition to vehicle production and delivery, the company also features the NioPower division, offering Batter-as-a-Service for EV owners. BaaS applies the popular ‘as-a-Service’ model from the software world to vehicle hardware, allowing customers to choose fast, economical options for swapping out whole battery packs and keeping their vehicles fully charged.

Last month, Nio reported solid delivery numbers, of 14,178 vehicles for November and 106,671 for the first 11 months of 2022. These numbers represented y/y gains of 30% and 31% respectively. Since it commenced vehicle deliveries, Nio has delivered a total of 273,741 EVs.

The high November delivery numbers came on the heels of solid 3Q22 numbers. The company saw a top line of $1.83 billion for the quarter, up 38% year-over-year and 24% sequentially. The Q3 top line was supported by quarterly vehicle deliveries totaling 31,607, up 29% y/y. Q3’s deliveries included 22,859 SUV models and 8,748 electric sedans. Despite the solid revenues, Nio is currently operating at a loss, of 30 cents per diluted share.

While Nio has yet to show a net profit, the company did turn profitable – at the gross level – as far back as 2Q20. In the third quarter of this year, the gross profit came in at $243.9 million. This was down almost 13% y/y, but represented a 29% gain from 2Q22.

In her note on Nio, Miu notes that the BaaS and the ‘robust’ design pipeline are both positive for overall revenues. Furthermore, the analyst says that we should expect strong sales to lift profitability going into next year with the financials improving on revenue and margin expansion.

“While the pandemic lockdowns and commodity inflation had affected its 2Q-3Q22 operations,” Miu went on to add, “we anticipate FY23F vehicle gross margin improvement on scale expansion and mix enhancement. Besides, stimulative measures to support the NEV (new-energy vehicle) auto industry is expected to be positive on sales. Lastly, improving supply chain and logistic on auto parts and components should smoothen EV production.”

To this end, Miu placed a Buy rating on NIO shares, with a $16 price target that indicates potential for ~30% share appreciation over the coming year.

All in all, this innovative EV maker has picked up 12 reviews from the Wall Street analysts, with a breakdown of 8 Buys and 4 Holds giving the stock its Moderate Buy consensus rating. The shares are priced at $12.65 and have an average price target of $16.81, suggesting a 33% upside on the one-year horizon. (See NIO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.