The healthcare sector has long been viewed by investors as a ‘recession proof’ defensive stalwart – and it is. When things turn south, consumers will pare back spending, but they’ll still need to see the doctor, fill prescriptions, and take care of themselves.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What we sometimes don’t see, however, is that healthcare stocks, particularly health tech stocks, also offer plenty of growth potential. People need healthcare in the good times, too, and are more willing to shell out top dollar during rising economic conditions.

And with sentiment growing that an economic ‘soft landing’ is on the way, Barclays analyst Stephanie Davis is looking at health tech stocks through the lens of profitability.

Davis sees the health tech sector poised for growth, noting that healthcare is the largest private sector in the US. Believing profitability is the key point for successful health stock investing, Davis writes, “While health tech & distribution has largely been viewed as a momentum growth sector over the past few years, we believe that business quality and profitability will come into focus as the group becomes defined by the haves and have nots.”

“With this in mind, we are positive on names further along the maturity curve that cater to core pockets of spend, including the distributors and sustainable health tech platforms, given business model durability and balance sheet flexibility,” the analyst added.

For investors, Davis has picked out 3 health tech stocks that are poised for growth this year. For a fuller view of their prospects, we also ran these tickers through the TipRanks database. Let’s delve in and find out just what the Barclays analyst finds attractive.

Health Catalyst (HCAT)

The first company that we’ll look at here provides data services in the health care industry. Health Catalyst is based in Utah and was founded in 2008; the company has built up a reputation for providing sound data and analytic services, tailored for healthcare client firms. Products include cloud-based data platforms, data analysis software, and a range of professional services designed to help clients smooth out the transition to modern data management.

At the practical level, Health Catalyst’s products allow its customers to solve data-related problems. The company’s solutions fit under a wide range of topics, including revenue cycle management, population health management, patient engagement, clinical quality and patient safety, and cost management. The company describes its mission as catalyzing measurable data-informed improvements in the health care system.

Health Catalyst’s products bring at least one major concrete benefit to medical-sector customers, in the form of realized savings. The company estimates that ‘unwarranted variation’ in the clinical care provided to patients can cost a typical medical organization between $20 million and $30 million for every $1 billion in revenue. A recent announcement from the company showed that WakeMed Health and Hospitals, one of Health Catalyst’s customers, has been able to leverage data services to reduce such unwarranted variation in care – and had achieved a variable cost reduction of $10 million.

On Health Catalyst’s financial side, the company’s total revenue in 3Q23, the last reported, came to $73.8 million, up 8% y/y and in-line with expectations. Health Catalyst reported adj. EPS of $0.03, 4 cents over the forecast. We should note here that this company’s non-GAAP earnings turned positive starting in 1Q23. Nevertheless, the shares have not enjoyed any of 2023’s bull market spoils and are down by 15% over the past year.

This opens up an opportunity for investors, as Barclays’ Davis sees it. She writes of Health Catalyst’s current conditions, “The crux of our thesis centers on HCAT’s underappreciated tech-enabled managed services (TEMS) opportunity, which we believe represents a source for revenue and bookings expansion. While concerns over TEMS’ lower gross margin weighed on shares in 2023, we note these contracts feature above-corporate average EBITDA margins and accelerate topline growth.”

Looking ahead, the analyst sees reasons for investors to buy in now, and lays them out clearly: “With our channel checks pointing to ongoing TEMS demand, an improving backdrop for core DOS platforms, and HCAT trading near its all-time lows, we forecast a favorable setup for the coming year and establish the name as a top idea for 2024.”

Davis quantifies her stance with an Overweight (Buy) rating and a $14 price target to point toward a one-year gain of 53% for the stock. (To watch Davis’s track record, click here)

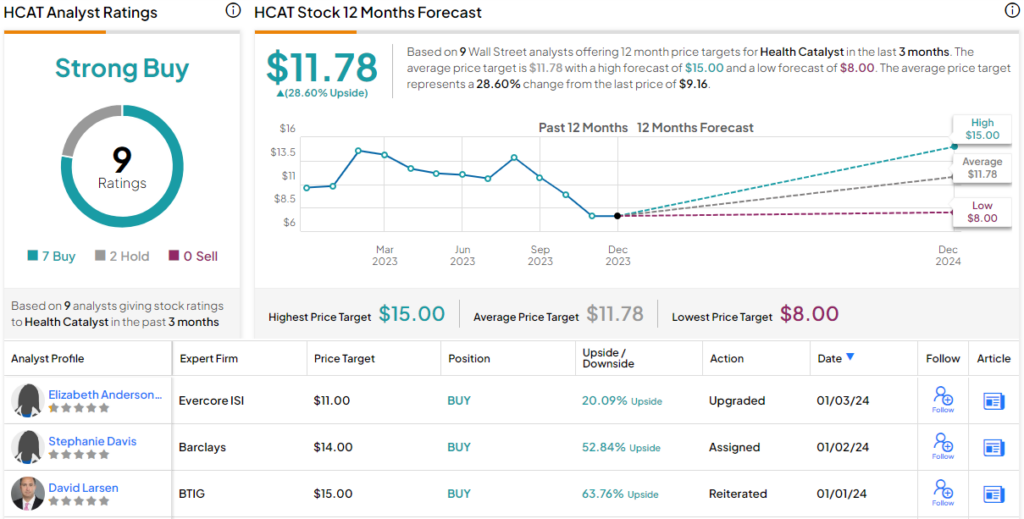

On the whole, it seems that Wall Street agrees with the upbeat take. The 9 recent analyst reviews here include 7 Buys and 2 Holds, for a Strong Buy consensus rating, while the $11.78 average target price implies a 29% one-year increase from the current trading price of $9.16. (See HCAT stock forecast)

R1 RCM (RCM)

Next on our Barclays-endorsed list is R1 RCM, a revenue cycle management firm whose business niche has given the company its stock ticker. The company’s business is providing a proven and scalable revenue cycle platform that will let health care organizations manage their revenue flow from the very beginning – when patients order services and check in at the facility – and through the middle and back ends, when patients receive care, facilities bill them, patients fill their insurance claims, and the insurers pay out to the providers. It’s a complicated sequence, but R1 makes it easier for all involved parties.

In addition to RCM services, the company can provide solutions for physician advisories, patient experience management, and coding management – all essential back-office tracking jobs in the healthcare industry. The company uses intelligent automation and data management insights to streamline its services and the organization-customer’s experience. The results lead to reduced costs, fewer errors in care and documentation, and faster cycle times for both patients and the back office.

In its last earnings release, from 3Q23, the company showed solid revenue growth – the top line was up 15.5% year-over-year, at $572.8 million, and beat the forecast by over $4.4 million. GAAP net income hit $1.3 million, marking a turnaround from the net loss of $29.5 million during the same period a year ago.

In another recent development, R1 announced last month that it had entered into an agreement with Providence, one of the largest health systems in the nation, to acquire the hospital provider’s revenue cycle management subsidiary, Acclara. The transaction will be conducted in both cash and stock warrants, involving $675 million cash on the barrel and warrants for the purchase of 12.2 million shares of R1’s stock. R1 will also receive a 10-year contract to provide revenue cycle services to Providence.

Turning again to Davis’s view, the analyst notes that the Providence agreement is a clear sign that R1 is focusing on its core competency, saying, “Over the past eight years since the company’s 2015 strategic review, we believe R1 has been at its best when it was focused on the blocking and tackling associated with multi-phased client ramps, while the company has been at its worst when the focus turned to projecting new deal close timelines. We view the recently announced Providence partnership as a welcome return to R1’s block and tackle heritage and believe this is not yet reflected in shares…”

Davis also explains why this stock should attract investors, writing of it, “Importantly, given a low number of variables within R1’s fee structure, contract conversion will be entirely execution driven; this puts the company’s fate comfortably in its own hands. We see a dependable low- to mid-teens-forward growth algorithm that features the lowest level of new wins reliance across our coverage universe. Further, this is within the backdrop of a secular shift to outsourced revenue cycle management that could drive upside to our estimates.”

Her stance on the stock is an Overweight (Buy) rating, and she sets a $14 price target to show her confidence in an upside potential of 39% for the next 12 months.

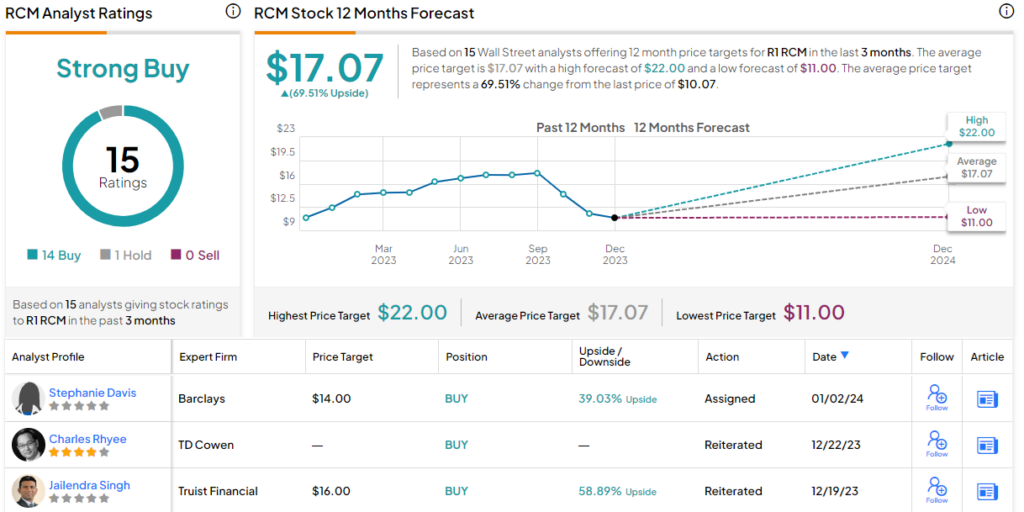

This healthcare tech firm gets a Strong Buy consensus rating from the Wall Street analysts, based on 15 recent reviews which break down to a lopsided 14 Buys and 1 Hold. The stock’s $17.07 average price target suggests 69.5% upside potential over the coming year, from the current trading price of $10.07. (See RCM stock forecast)

GoodRx Holdings (GDRX)

We’ll finish with GoodRx, a company that has applied modern online tech to bring pharmacy services and telehealth together in one package. The California-based company was founded in 2011 on the key insight that health consumers need access to better information in order make better spending decisions. They have built on that, and today GoodRx boasts a website that offers users a wide range of information at their fingertips, as well as pharmacy benefits to make it easier to fill prescriptions with either on-brand or generic medications, and a telehealth service to put patients and consumers into quick contact with medical professionals.

The chief service offered by GoodRx is summed up in the company’s name: better access, and discount pricing, for prescription medications. The company notes that medication non-compliance is a serious health issue, and addresses that problem by making discount pricing, coupons, and information on generic equivalents available to its users. This is backed up by a telehealth service, that can put consumers in direct contact with doctors, nurse practitioners, and pharmacists – all to make sure that each patient has the correct prescription, knows how to use it, and where to get it filled.

Finally, GoodRx makes an important service freely available on its website – extensive information on a variety of healthcare topics. These can range from finding the right information on a wide range of prescription drugs to locating real savings in the healthcare systems – and everything in between. The company collates and curates articles from medical professionals, and puts them at site users’ fingertips, on the theory that informed patients will make better healthcare decisions.

Some numbers will show both the scale of operations and the size of its addressable market. Since its founding, the company has facilitated over $60 billion in health consumer savings, has published over 200 billion daily pricing data points, and has seen an 80%+ repeat transaction rate.

In its last reported quarter, 3Q23, GoodRx posted top line revenue of $180 million. This result was considered somewhat disappointing; it was down almost 4% year-over-year, and missed the forecast by $8.26 million. At the bottom line, GoodRx’s earnings were in-line with expectations, at 6 cents per share by non-GAAP measures. With the Q3 results, the company published guidance for Q4 and full-year 2023, showing that management expects to see y/y quarterly revenue growth of 2% to 5%, even though the full-year will likely see a 2% to 3% y/y revenue decline.

Turning now to Barclays analyst Stephanie Davis, we find her upbeat on what she calls the company’s ‘stable path,’ writing, “We believe the lapping of FY23’s cross currents (Kroger, vitaCare) should result in growth acceleration and meaningful EBITDA margin expansion given the high incremental/decremental margin nature of volume. GDRX’s preliminary FY24 guidance solely reflects a stable outlook from FY23’s exit rate, which we believe to be conservative… Further, through direct contracting with retailers and newly signed integrated savings programs (ISP) with PBM partners, GDRX has created a likely more stabilized path forward, de-risking the out-year growth profile and minimizing tail risk.”

Getting to her own bottom line, Davis lays out a bullish course for potential investors here: “GDRX shares trade at a ~3-turn EBITDA discount from the onset of the Kroger client loss in May 2022; with expectations now rebased and management poised to re-establish a track record, we view this as an attractive entry point ahead of execution.”

These comments back up the analyst’s initiation of coverage as Overweight (Buy), and her $8 price target implies a one-year potential upside of 49%.

That bullish outlook puts Davis somewhat at odds with the Street’s consensus. The stock has a Hold consensus rating, based on 13 recent analyst reviews that break down to 4 Buys, 8 Holds, and 1 Sell. Shares are priced at $5.37, and their $6.68 average target price suggests a 24% increase in the coming year. (See GoodRx stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.