Procter & Gamble (NYSE:PG) is scheduled to announce its third-quarter results on April 21, before the market opens. Resilient demand for the company’s products, strong pricing power, and favorable foreign exchange movements are likely to have supported P&G’s performance in the upcoming quarter.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, it’s likely that high inflation had an impact on consumer spending power and, as a result, had some negative effects on the company’s Q3 results.

Wall Street analysts expect P&G to post earnings of $1.32 in Q3, lower than the prior-year quarter figure of $1.33. At the same time, the Street expects the company to report net revenue of $19.25 billion, down 0.7% from the same quarter last year.

Ahead of the company’s Q3 results, Barclays analyst Lauren Lieberman maintained a Buy rating on PG stock and raised the price target to $160 from $158. The analyst predicts that P&G’s well-known brands will contribute to the volume growth.

Is PG Stock a Good Buy?

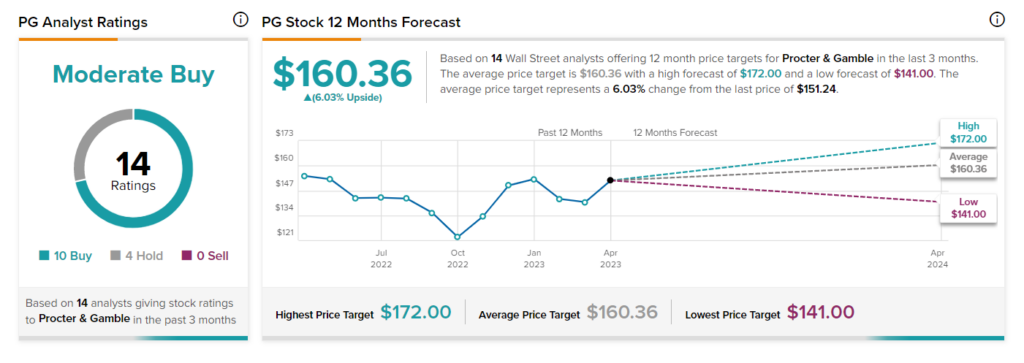

Turning to Wall Street, Procter & Gamble has a Moderate Buy consensus rating based on 10 Buys and four Holds assigned in the past three months. At $160.36, the average Procter & Gamble stock forecast implies 6% upside potential.

Concluding Thoughts

P&G’s portfolio of premium brands, which includes Pampers and Gillette, among others, should continue to perform well, contributing to the company’s top-line growth. Also, P&G’s effective capital distribution strategies keep enhancing the value of its shareholders.