Small-cap mutual funds focus on investing in companies with market capitalization between $300 million and $2 billion. These mutual funds are worth considering by investors looking for diversification and high long-term returns. Entering 2024, investors could consider – PRDSX and TSGUX – two tech-focused mutual funds with over 10% upside potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a closer look at the two small-cap index mutual funds.

T. Rowe Price QM U.S. Small-Cap Growth Equity Fund

The T. Rowe Price QM U.S. Small-Cap Growth Fund seeks long-term capital appreciation by investing at least 80% of its assets in small-cap stocks with solid growth potential. As of today’s date, PRDSX has 316 holdings with total assets of $7.27 billion.

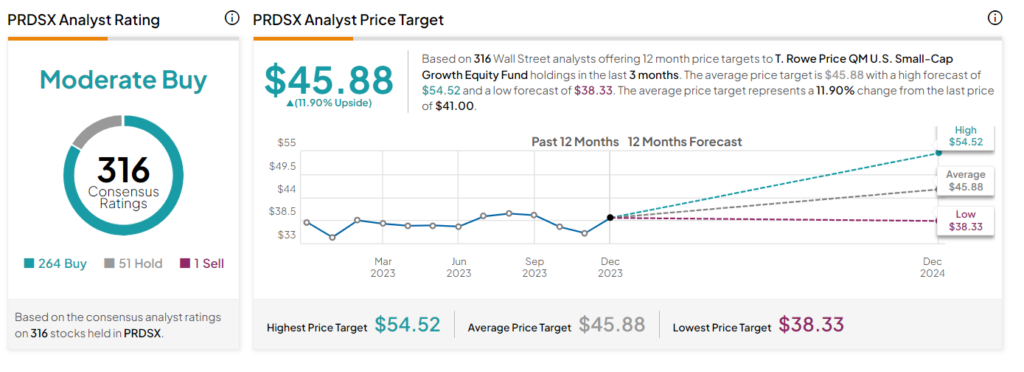

On TipRanks, PRDSX has a Moderate Buy consensus rating. This is based on 264 stocks with a Buy rating, 51 stocks with a Hold rating, and one stock with a Sell rating. The average PRDSX mutual fund price target of $45.88 implies an 11.9% upside potential from the current levels.

PRDSX has gained 19.1% over the past year. Its top three holdings are the T Rowe Price Government Reserve Investment Fund, TechnipFMC (FTI), and Saia (SAIA).

Morgan Stanley Pathway Funds – Small-Mid Cap Equity Fund

The TSGUX fund targets capital appreciation by investing primarily in small- and mid-capitalization companies. As of today’s date, TSGUX has 2,553 holdings with total assets of $495.08 million.

On TipRanks, TSGUX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 2,553 stocks held, 1,659 have Buys, 814 stocks have a Hold rating, and 80 stocks have a Sell rating. The average TSGUX fund price target of $18.46 implies 10.6% upside potential from the current levels.

Over the past year, TSGUX has gained 14.4%. Its top three holdings include Invesco, 3M Company (MMM), and Willscot Mobile Mini Holdings Corp. (WSC).

Ending Thoughts

Investing in mutual funds comes with several advantages, such as higher liquidity, lower risk compared to individual stocks, and low investment requirements. Investors with an eye for small-cap stocks could look deeper into both PRDSX and TSGUX, which have the potential for further upside.