Shares of Postal Realty Trust (NYSE:PSTL) currently offer a 6.5% yield, which I believe is one of the safest among the equivalent yields its sector peers feature. This can be attributed to Postal Realty’s exceptional qualities as one of the most distinctive REITs in the market. With a vast portfolio of 1,325 real estate properties spread across 49 states, Postal Realty holds a unique position by exclusively leasing to a single tenant — The United States Postal Service (USPS). This strategic advantage provides numerous benefits that set the company apart.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Nevertheless, I remain mindful of rising interest rates, which could compress Postal Realty’s profitability prospects from here. Accordingly, I am neutral on the stock.

What Makes Postal Realty Stand Out?

Postal Realty is one of the most unique REITs you will find in the market. Over the past 30 years, the company has been an active buyer of purpose-built properties that specifically meet the needs of The USPS. During this period, it has accumulated a vast portfolio of 1,325 properties that are exclusively leased to The USPS, which is utterly remarkable.

There are great advantages that come with this setup that no other REIT seems to have been able to replicate. The closest example I can think of is Easterly Government Properties (NYSE:DEA), which exclusively leases its properties to various agencies of the federal government. Yet, even they have a way more diversified tenant base.

Postal Realty’s strategy boasts an exceptional advantage that sets it apart from the rest — an unparalleled, mission-critical relationship with USPS that is practically irreplaceable. The USPS confidently relies on Postal Realty to provide properties tailored precisely to their needs, benefiting from the company’s extensive decades-long experience in serving this esteemed client.

In return, Postal Realty enjoys a consistent and predictable stream of revenues, as its properties play a vital role in facilitating the USPS’ indispensable day-to-day operations. This is reflected in several of Postal Realty’s key metrics. Specifically, the REIT features the following:

- An industry-leading occupancy rate of 99.7%

- A 10-year historical weighted average lease retention rate of 99%

- A 100% rent collection rate with payments always made on time

- A weighted average lease term of about three years.

Undoubtedly, these extraordinary metrics are unmatched in the industry and have only been formed as a result of Postal Realty’s mission-critical and tenant-tailored strategy. All of these metrics and ratios also provide investors with a significant degree of safety and visibility, benefiting the stock’s investment case.

The fact that rental collection is set to maintain a flawless 100% rate, backed by the federal government’s support of USPS, establishes a significant advantage that no other REIT can claim, with the exception of Easterly Government, possibly.

Unique Qualities Drive Dividend Security/Growth

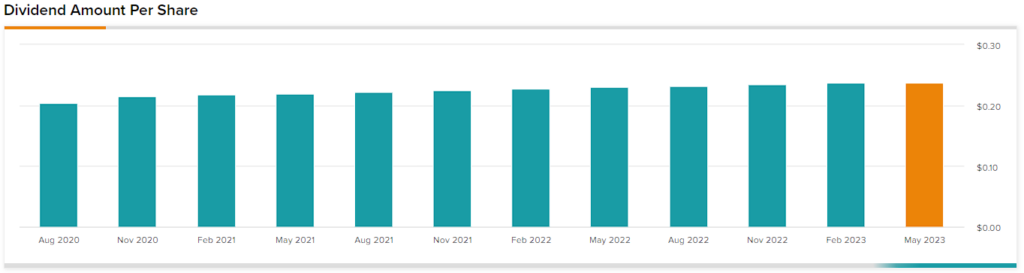

With a solid foundation built upon these aforementioned qualities, Postal Realty showcases robust dividend security and growth prospects. The company’s exceptional earnings visibility extending years ahead, coupled with the absence of risks associated with rental collections, enables its management to sustainably foster growth while comfortably covering dividends. Impressively, Postal Realty consistently increased its dividend every quarter during the initial 14 quarters following its IPO.

Although the most recent dividend did not exhibit quarter-over-quarter growth, this occurrence stands as an exception rather than the norm. Combined with the fact that the stock offers a compelling yield of 6.5%, income-oriented investors are likely to find Postal Realty’s investment case rather fitting for their portfolio.

Note that last year’s FFO/share of $0.95 implies that Postal Realty’s annualized dividend rate of $0.93 is barely covered. Still, due to the lack of uncertainty regarding Postal Reatly’s cash flow, I wouldn’t state that the dividend is at risk.

Is PSTL Stock a Buy, According to Analysts?

Turning to Wall Street, Postal Realty features a Hold consensus rating based on one Buy and three Hold ratings assigned in the past three months. At $16.50, the average Postal Realty stock price target suggests 12.78% upside potential.

The Takeaway

Postal Realty presents an exceptional investment opportunity tailor-made for income-oriented investors. It’s distinguished by its remarkable attributes that cultivate a compelling blend of lower risk, heightened cash-flow visibility, and a generous dividend yield.

However, I do harbor a notable concern regarding Postal Realty’s outlook in a climate of increasing interest rates. Although the company maintains a satisfactory leverage ratio of 35.9%, its interest expenses surpass a staggering 85% of its operating income. If the company has to refinance certain notes and interest expenses rise as a result, the elevated interest costs may dampen its potential for dividend growth.

In such a case, even with its commendable high-quality attributes, the current 6.5% yield may fail to evoke excitement among the majority of investors.