In this piece, I evaluated two software stocks, Palantir Technologies (NYSE:PLTR) and Splunk (NASDAQ:SPLK), using TipRanks’ comparison tool to determine which stock is more attractive. After analyzing the two, I found that SPLK takes the win here. Palantir specializes in big-data analytics, while Splunk offers software for search monitoring and analysis of machine-generated data.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Palantir stock is up 138% year-to-date, bringing its 12-month return to 59%, although it has plunged 17.6% just in the last five days. Splunk is up 14% year-to-date but remains in the red for the last 12 months, off 14%. It, too, has tumbled in the last five days, falling 5.35%.

Despite these year-to-date rallies, the recent price declines could signal trouble. Neither company is profitable, so we’ll use their price-to-sales (P/S) ratios to compare their valuations to each other and their industry.

The U.S. application software industry as a whole isn’t profitable either. It’s currently trading at a price-to-sales (P/S) of 7.7 versus its three-year average P/S of 10. Palantir is trading at a much higher P/S than the industry, while Splunk is trading at a steep discount to it. Thus, a deep dive is needed to see whether Palantir’s premium and Splunk’s discount are warranted.

Palantir Technologies (NYSE:PLTR)

At a P/S of 16.1 and a mean P/S of 23.2 since November 2020, Palantir Technologies immediately looks overpriced relative to its industry, although it typically trades at a premium to its industry. While the company has finally begun turning a profit, it’s simply too expensive at current levels. However, given the long-running hype around Palantir, it seems unlikely to plunge significantly from current levels, suggesting a neutral view might be appropriate.

Notably, insiders have unloaded over $4 million worth of Palantir shares in the last three months, including a meaningful number of auto-sell transactions eight days ago. A review of the company’s stock price action indicates that those auto-sells occurred around the recent peak close to $20/share.

We saw a similar jump in auto-sell transactions in July around the previous peak. When multiple insiders set similar price points to automatically sell their company’s shares, it suggests they may see it as fairly valued or at least unlikely to rise significantly higher from that price.

Ultimately, it makes sense that Palantir Technologies would trade at a premium to its unprofitable industry as it finally becomes profitable. In fact, the second quarter marked the company’s third straight quarter of GAAP (generally accepted accounting principles) profitability, meaning it’s profitable even after adjusting for things like stock-based compensation.

Additionally, Palantir raised its full-year revenue guidance to over $2.2 billion and its adjusted income from operations guidance to more than $576 million. The company also authorized $1 billion in stock repurchases, although it probably wouldn’t be wise to buy back shares at current prices.

However, Palantir shares tumbled due to its rich valuation and concerns about the company’s slowing revenue growth. It fell to 13% in the second quarter, causing the company to miss consensus estimates for its second-quarter earnings slightly.

What is the Price Target for PLTR Stock?

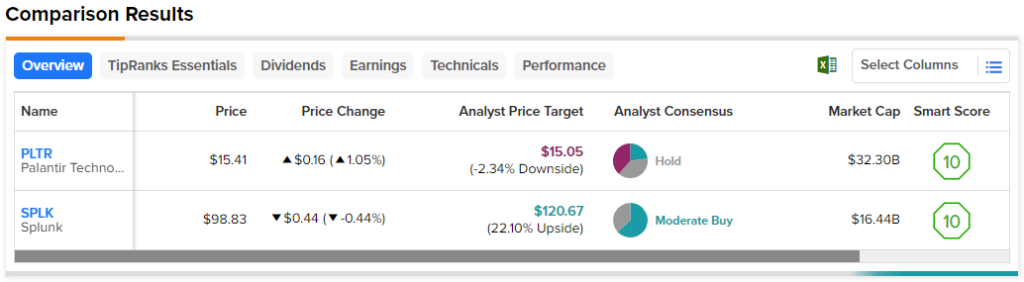

Palantir Technologies has a Hold consensus rating based on three Buys, five Holds, and five Sell ratings assigned over the last three months. At $15.05, the average Palantir Technologies stock price target implies downside potential of 2.3%.

Splunk (NASDAQ:SPLK)

At a P/S multiple of 4.4, Splunk is trading at a steep discount to its industry and its five-year mean P/S of nine. However, like Palantir, Splunk is moving into profitability. Thus, a bullish view looks appropriate.

Splunk’s profitability numbers are moving in the right direction. Its net income margin improved from -50% in 2022 to -8% in the fiscal year that ended in January 2023, and it’s now at -5% for the last 12 months.

The company is set to release its next earnings report on August 23, but in its last quarter, it smashed earnings estimates and came out slightly ahead of the consensus on revenue. In fact, in that quarter, Splunk generated a net income margin of 21.4%.

Generally, analysts expect Splunk to be profitable in 2026. At that rate, the company would have to grow its net income at an average of 45% per year. However, if the most recent quarter demonstrates anything, it’s that Splunk is certainly growing rapidly, making such high growth look feasible.

Finally, hedge funds snapped up 3 million shares of Splunk in the last quarter, suggesting the company has the confidence of some of Wall Street’s savviest investors.

What is the Price Target for SPLK Stock?

Splunk has a Moderate Buy consensus rating based on 17 Buys, 10 Holds, and zero Sell ratings assigned over the last three months. At $120.67, the average Splunk stock price target implies upside potential of 22.1%.

Conclusion: Neutral on PLTR, Bullish on SPLK

Palantir and Splunk are both moving in the right direction based on fundamentals, but it seems likely that a better entry point will appear at some point for Palantir. On the other hand, Splunk is trading at such a deep discount that it seems too good to pass up, especially with profitability approaching.