Palantir Technologies (NYSE:PLTR) will release its second-quarter financial results on Monday, August 7, 2023. According to analysts’ predictions, the company’s business will continue to grow in Q2. Conversely, its expensive valuation could drag down the strong Q2 performance and limit the upside potential.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It’s worth highlighting that the arrival of the latest large language models and the accelerating pace of AI (Artificial Intelligence) development is transforming the enterprise software market. With years of experience in large language models and generative AI, Palantir is well-positioned to capitalize on this growth opportunity.

The company quickly launched an AI platform and continues to invest in transformational AI opportunities. Palantir CEO Alex Karp said during the Q1 conference call that the demand for its AI platform (AIP) “is without precedent.” This implies that the company could continue to deliver solid, profitable growth in the coming quarter.

Nevertheless, PLTR stock has risen quite a lot, up over 183% year-to-date. This has driven its valuation higher and indicates that the positives are already reflected in its current market price. But before we dig deeper, let’s delve into the analysts’ Q2 forecast.

Here’s What Palantir’s Consensus Estimates Indicate

Wall Street analysts expect Palantir to post revenue of $533.38 million in Q2, up from $473 million in the prior-year quarter. Moreover, analysts expect its top line to improve marginally on a quarter-over-quarter basis.

Higher sales will drive its adjusted operating income and support its bottom line. Analysts expect PLTR to post earnings of $0.05 a share in Q2, compared to a loss of $0.01 per share in the prior-year quarter.

What is the Prediction for PLTR Stock?

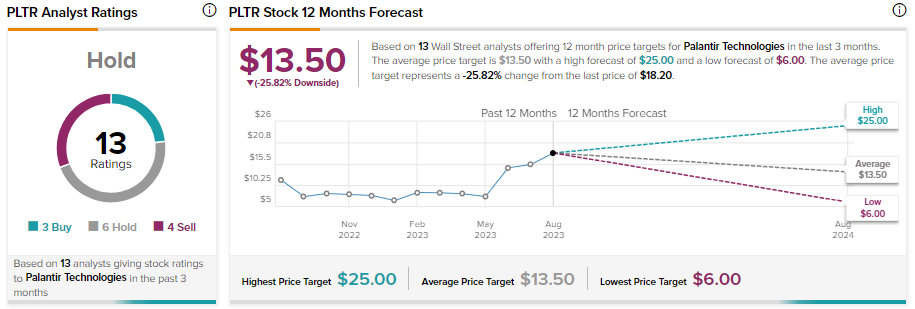

Given the recent rally in PLTR stock, Wall Street analysts are sidelined on PLTR stock ahead of Q2 earnings. Monness analyst Brian White expects the company to benefit from digital transformation, AI, Big Data, and the geopolitical landscape. However, the analyst highlighted that “revenue recognition from government-related contracts has proven lumpy,” while PLTR’s valuation appears rich. Thus, White reiterated a Hold rating on PLTR stock on August 3.

Overall, Palantir stock has a Hold consensus rating on TipRanks, reflecting three Buy, six Hold, and four Sell recommendations. Analysts’ average price target of $13.5 implies 25.82% downside potential from current levels.

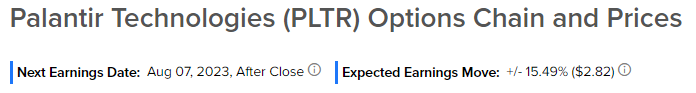

Options Activity Highlights 15.49% Earnings-Related Move

The options traders are pricing in a 15.49% move on earnings, which is smaller than the previous quarter’s earnings-related move of 23.39% but greater than the average -2.03% move in the last eight quarters.

Learn more about TipRanks’ option tool here.