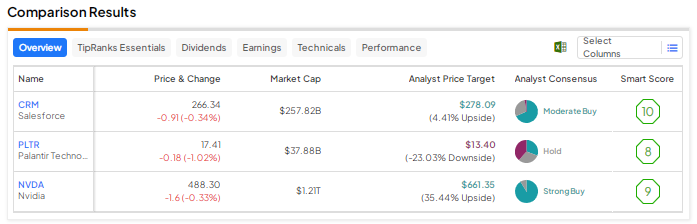

The Federal Reserve’s commentary about potential rate cuts in 2024 has improved investor sentiment about growth stocks. Despite macro pressures, several growth stocks fared well this year and proved their ability to navigate through challenging times. We used TipRanks’ Stock Comparison Tool to place Palantir (NYSE:PLTR), Salesforce (NYSE:CRM), and Nvidia (NASDAQ:NVDA) against each other to pick the most attractive growth stock, as per Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Palantir Technologies Stock (NASDAQ:PLTR)

Palantir stock has rallied by an amazing 171% year-to-date, driven by the generative artificial intelligence (AI) frenzy and the company’s efforts to improve its profitability. In particular, Q3 2023 marked the fourth consecutive quarter of GAAP profitability for the company.

Palantir’s commercial business is growing at a solid rate. The company expects this momentum to continue, supported by its recently launched Artificial Intelligence Platform (AIP) offering. During the Q3 conference call, the company attributed the 37% year-over-year growth in its commercial customer count to 181 customers to the growing adoption of its AIP product.

However, several analysts remain concerned about Palantir’s significant exposure to government business, which could slow down over the near term due to budget constraints.

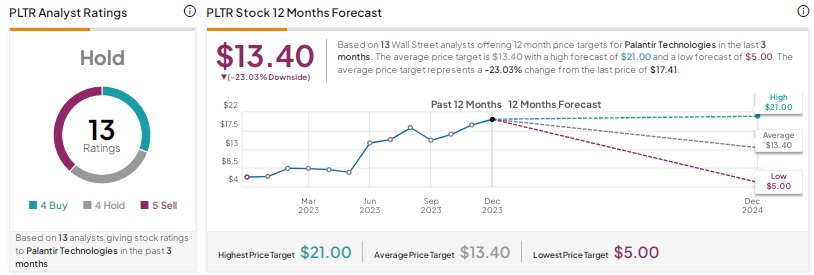

What is the Prediction for PLTR Stock?

Recently, Palantir secured a one-year extension on a contract with the U.S. army worth $115 million. William Blair analyst Louie DiPalma did not have an upbeat reaction to this development. The analyst noted that the original contract in 2019 had a duration of four years, and the company has not been awarded a new four-year commitment this time, “with the Army’s ‘phase 3’ plans to split the Vantage platform into pieces and award a multivendor contract.”

DiPalma, who has a Sell rating on the stock, added that PLTR stock might start to reflect this reality over the next three months once investors realize that the U.S. army awarded a short-term, one-year $115 million ceiling extension for the company’s second-largest contract.

Overall, Wall Street is sidelined on Palantir stock, with a Hold consensus rating based on four Buys, four Holds, and five Sells. The average price target of $13.40 implies a possible downside of 23% from current levels.

Salesforce Stock (NYSE:CRM)

Shares of Salesforce, a dominant player in the customer relationship management software space, have jumped 101% this year. The company has been focusing on enhancing its profitability amid growing concerns about a slowing revenue growth rate. Corporations have optimized their spending due to macro pressures, which has weighed on Salesforce’s top-line growth.

In Q3 2023, the company delivered better-than-expected earnings and in-line revenue. Salesforce’s revenue grew 11% to $7.84 billion in Q3, and the company guided for around a 10% increase in its fourth-quarter top line. Also, the company raised its full-year operating margin outlook, reflecting its continued efforts to drive productivity and profitability.

Is CRM Stock a Good Buy Now?

Last week, Wells Fargo analyst Michael Turrin downgraded CRM stock to Hold from Buy, citing the year-to-date rise in the stock. He believes that much of the gains from the margin expansion story have been captured. He expects Salesforce stock to be range-bound in 2024, with his firm’s due diligence suggesting that the next growth catalysts for the company are further off than anticipated.

In contrast, Morgan Stanley analyst Keith Weiss upgraded his rating for Salesforce stock to Buy from Hold and raised the price target to $350 from $290. He thinks that investors are not fully appreciating potential revenue drivers, including the recent price hikes, product bundling, and the shift to data cloud.

Wall Street is cautiously optimistic about Salesforce, with a Moderate Buy consensus rating based on 26 Buys, 11 Holds, and one Sell. Following a solid year-to-date rally, the average price target of $278.09 implies 4.4% upside potential.

Nvidia Stock (NASDAQ:NVDA)

Semiconductor giant Nvidia has impressed investors with its stellar revenue and profit growth rates in recent quarters, fueled by the demand for its advanced graphics processing units (GPUs) used in building and training generative AI applications. NVDA stock has skyrocketed 234% so far in 2023.

In the third quarter of Fiscal 2024, the company’s revenue surged 206% while adjusted EPS increased almost six times year-over-year to $4.02. From large internet companies and global cloud service providers to AI start-ups, the customer base and demand for Nvidia’s GPUs are increasing. Moreover, the company is seeing robust demand for its chips in other end markets like gaming and automotive.

Is Nvidia Stock a Buy, Sell, or Hold?

On December 15, Bernstein analyst Stacy Rasgon reaffirmed a Buy rating on Nvidia shares with a price target of $700, as he continues to be bullish even though the stock has more than tripled this year. In fact, he called NVDA the cheapest of the “AI narrative” stocks.

The analyst highlighted that Nvidia will release a follow-up to its highest-end H100 data center GPU by Q2 2024 and another faster GPU by the end of next year. The new products could launch at higher prices and drive robust revenue for the chip maker into 2025.

With 31 Buys and three Holds, Nvidia earns a Strong Buy consensus rating. The average price target of $661.35 implies 35.4% upside potential.

Conclusion

Analysts are highly bullish on Nvidia stock and cautiously optimistic about Salesforce. They are sidelined on Palantir. Wall Street sees continued upside in Nvidia despite a phenomenal rise in its shares due to the generative AI wave.