Plains All American Pipeline (NYSE:PAA) has been firing on all cylinders lately, with impressive advancements being made across all of the oil and gas midstream partnership’s fronts. Despite experiencing some difficulties during the pandemic, which resulted in a slash in its distribution (dividend) and the stock price plummeting, Plains All American has since bounced back with remarkable profitability, distribution growth, strategic unit repurchasing at low prices, and rapid deleveraging.

With units remaining attractively priced and the partnership’s outlook appearing optimistic, I am bullish on PAA stock.

Continuous Improvements Post-COVID-19

Plains All American had a rough time during the COVID-19 pandemic, similar to all of its energy peers in the oil and gas midstream space. In Fiscal 2020, the company saw its revenues and adjusted EBITDA fall by 30.8% and 21.0%, respectively, as a result of an extremely challenging operating environment.

Since then, however, in line with the energy sector’s recovery, the pipeline giant has recorded continuous improvements. In Fiscal 2021, revenues jumped by 80.3%, while in Fiscal 2022, revenues grew by a further 36.1% to a new all-time high level of $57.3 billion. The partnership’s adjusted EBITDA also grew by 26% to $2.875 billion.

Moving into 2023, management expects that the partnership’s Permian Basin assets are well-positioned to benefit from steady production growth, forecasting that adjusted EBITDA should land between $2.45 billion and $2.55 billion. While this implies a decline compared to the previous year as commodity prices have eased, it still signals a highly-profitable year.

Capital Allocation Excellence

With the partnership’s profitability improving dramatically from its COVID-19 lows, management has been committed to efficiently allocating capital to drive shareholder value creation. In my view, they have done an exceptional job in this aspect by implementing a well-rounded and cautious approach.

Particularly, the partnership’s capital allocation priorities include deleveraging, repurchasing units at cheap prices, and resuming the distribution toward its pre-COVID levels. Thus far, it has been a smooth process. Let’s break it down!

Deleveraging

The oil and gas midstream industry is very capital-intensive, resulting in most players being highly leveraged. Following the Plains All’s distribution slash back in 2020, the partnership managed to free sufficient capital to accelerate paying down its obligations. For context, the partnership’s long-term debt has fallen from $10.5 billion in Q3 of 2017 to $7.24 billion at the end of Fiscal 2022.

By the end of Fiscal 2023, management expects that the partnership’s leverage ratio will decline further, from 3.7x to about 3.5x. Continuous deleveraging should improve Plains All’s profitability over time and will be particularly beneficial, given the ongoing interest rate hikes.

Distributions

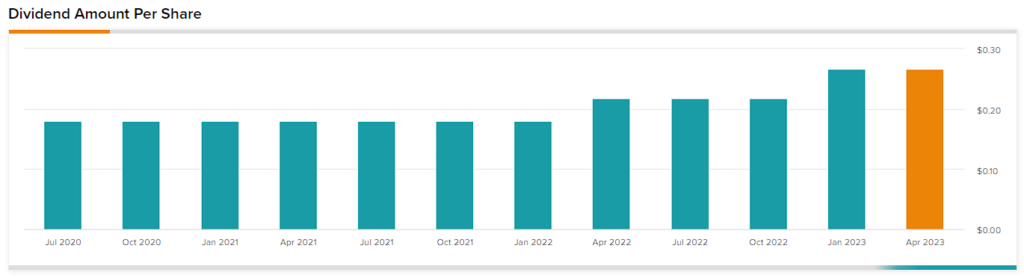

As previously mentioned, Plains All American chose to cut its payouts back in 2020 in response to the substantial ambiguity surrounding the energy industry’s future prospects at the time. The quarterly distribution was cut in half, from $0.36 to $0.18. In retrospect, the partnership could have avoided a cut, as the sector recovered swiftly in the following years. Nevertheless, that proved to be a great move that allowed faster deleveraging.

Since then, the quarterly distribution has been increased twice, with the most recent hike being by 23% to $0.2675. The annualized rate of $1.07 is widely covered by my projected DCFU (distributable cash flow per unit) for Fiscal 2023 (derived from management’s adjusted EBITDA outlook) of about $2.33, meaning there is ample room for management to pursue further increases.

Unit Repurchases

Another development that arose as a result of excess distributable capital and the significant decline in the value of Plains All’s stock is the implementation of unit repurchases. It’s actually the first time in time in the partnership’s history that it’s repurchasing shares, with the unit count already falling from 728.5 million to 698.4 million recently.

Unit repurchases can be extremely accretive to DCFU, moving forward. Besides the partnership’s unit count declining, Plains All is also saving tons of cash on future distributions. Despite the stock’s consistent recovery in recent quarters, units still yield a substantial 8.2%, meaning the company is retiring expensive equity on the cheap.

What is the Price Target for PAA Stock?

Turning to Wall Street, Plains All American has a Moderate Buy rating based on seven Buys and four Hold ratings assigned in the past three months. The average PAA stock price target of $16.32 implies 25.6% upside potential.

The Takeaway

Plains All America Pipeline has managed to recover strongly from the highly challenging energy landscape that persisted during the pandemic. Last year’s results were exceptional, while management’s guidance for Fiscal 2023 appears rather optimistic.

With promising balance sheet progress due to continuous deleveraging and growing capital returns both in terms of distributions and unit buybacks, the stock’s investment case appears particularly compelling. In the meantime, current unitholders should have a notable margin of safety, as the stock is trading with an 8.2% yield and at a forward price/adjusted EBITDA multiple of about 3.64. Hence, I am bullish on PAA stock.