Pinterest stock (NYSE:PINS) has fallen in the past few days after its earnings stumble, reporting lower-than-expected quarterly sales. Moreover, tepid growth is expected in the first quarter on the back of a challenging economic environment. Nevertheless, its numbers show promise, especially concerning its pricing power in its core markets in the U.S. and Canada.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Furthermore, analysts do not have high expectations from the firm either way, and most of its headwinds look baked into its stock price. Therefore, we remain bullish on PINS stock.

PINS stock peaked at about $90 per share in early 2021 but is now down over 70%. So far this year, the stock is up 15% and trades at roughly 6.0 times trailing-12-month (TTM) sales, down over 48% from its five-year average. Moreover, it trades at around 37 times TTM cash flows, more than 97% lower than its five-year average. Also, it boasts a healthy cash position of $2.7 billion, which comfortably dwarfs its debt burden of $229 million. Therefore, there’s a lot to like about the stock at current prices.

Therefore, considering the recent challenging market conditions in advertising, it’s wrong to throw Pinterest under the bus. Advertising-dependent businesses such as Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) and Meta Platforms (NASDAQ:META) experienced substantial weakness during the fourth quarter.

The industry’s health is closely linked to the broader economy, and advertisers across the board have pulled back their budgets in response to soaring inflation rates and uncertainty regarding a possible recession.

Nevertheless, based on the risk/reward potential at this time, PINS stock appears to be an excellent bet for those who can wager on the stock for the long haul.

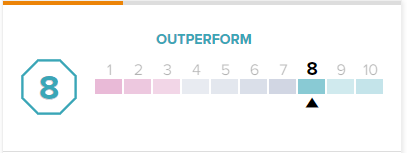

Supporting the bull thesis, PINS stock has an 8 out 10 Smart Score rating, implying that it can outperform the broader market from here.

Plenty to Look Forward To

Most investors will have been disappointed with Pinterest’s fourth-quarter results. However, there were many positives for the firm.

Considering the broader market, Pinterest’s sales growth wasn’t all that bad. Revenues improved by 4% to $877 million, falling short of expectations by about `1%. Results were affected by a drop in sales from Europe, where they fell by 7% to $123 million. However, the firm performed exceedingly better than its peers, including Snap (NYSE:SNAP) and Meta. For instance, Snap’s fourth-quarter revenues improved by just 0.1%, while Meta’s revenues declined by 4.5%.

Pinterest’s CEO, Bill Ready, was quick to beat the drum over the company’s outperformance compared to its peers. During his fourth-quarter earnings call, he said that “while 4% to 6% revenue growth typically wouldn’t be something to write home about, we’re actually outperforming compared to a lot of our peers”.

A lot of this has to do with the firm’s pricing power, especially in the North American market, where its average revenue per user grew 6% year-over-year. This comes when growth from these markets has stalled for most of its peers.

Furthermore, even though the guidance for the upcoming quarter points to low-single-digit year-over-year growth, it’s likely to exceed its estimates. Analysts forecast only 3% growth for the upcoming quarter, but given the positives in its fourth quarter, the chances of an outperformance remain high. Also, PINS boasts an excellent track record of beating revenue estimates, having done so in 11 out of the past 12 quarters.

Is PINS Stock a Buy, According to Analysts?

Turning to Wall Street, PINS stock maintains a Moderate Buy consensus rating. Out of 19 total analyst ratings, five Buys, 14 Holds, and zero Sell ratings were assigned over the past three months.

The average PINS stock price target is $28.10, implying 12.6% upside potential. Analyst price targets range from a low of $22 per share to a high of $34 per share.

The Takeaway

Pinterest’s weaker-than-expected fourth-quarter results irked investors who failed to see the long-term picture. Its performance during the quarter was significantly ahead of its peers, and the improvement in its pricing power in its core markets is a testament to the quality of its business. Likewise, global monthly active users increased at a time when the economy was in the doldrums.

However, it faces its fair share of problems, especially regarding its bottom line. The year-over-year change in its earnings per share in Q4 was a negative 41%.

Nevertheless, it’s working to fix this. To limit costs, the company has significantly reduced its staff recruitment efforts and closed some of its less utilized office spaces. The job cuts will likely support meaningful margin expansion through 2023 and improve its financial flexibility. Additionally, it seems that PINS stock has bottomed out, which adds to its attractiveness at this time.