Shares of Pinterest (NASDAQ:PINS) have experienced a relatively strong rally from May’s temporary dip, currently trading roughly 44% higher from last year’s levels. The company, renowned for its innovative idea-sharing platform, can largely credit this remarkable rally to the broader resurgence in social media and internet stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Additionally, the optimistic outlook for advertising prospects, evidenced by the upward trajectory of Meta Platforms (NASDAQ:META) and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG), has also contributed to an improving sentiment for Pinterest.

That said, I believe that recent share price gains might present a good opportunity for investors to sell, as Pinterest’s investment case suffers from three significant bearish catalysts. Specifically, the company has a very hard time producing compelling user metrics, controlling expenses has been horrific, and the stock’s very own valuation can hardly justify the market’s earnings growth projections. Accordingly, I am bearish on PINS stock.

Underwhelming User Growth & Lagging ARPU

The first and most prominent issue with Pinterest’s investment case revolves around its lackluster user growth and lagging average revenue per user (ARPU). In its latest Q1 results, the company reported 463 million global monthly active users (MAUs), reflecting a year-over-year increase of approximately 7%. While this growth rate might not initially sound concerning, the reality is that it was primarily fueled by emerging markets, as Pinterest’s growth in mature markets has already reached its peak.

Specifically, MAU growth in the U.S. & Canada was a mere 1%, while the majority of user expansion came from a 7% increase in Europe and a 9% increase from the rest of the world (RoW) markets. This aspect is crucial to note because these markets offer limited monetization opportunities.

The real revenue potential lies in the U.S. & Canada, where advertisers are willing to invest significantly. To put it into perspective, Pinterest’s average revenue per user (ARPU) in Q1 was $5.11 in the U.S. and Canada, compared to a meager $0.74 in Europe and an even lower $0.10 in the RoW.

Therefore, the seemingly decent MAU growth in these markets becomes less relevant when considering that Pinterest would need approximately seven users from Europe or 51 users from the RoW to generate the same revenue as a single user from the U.S. or Canada.

Simultaneously, despite the advertising environment having already improved on a year-over-year basis in early 2023, Pinterest’s global ARPU fell by one cent to $1.32, another poor result. For context, Meta’s global ARPU grew from $9.54 to $9.62.

Poor Cost Management

The second bearish factor that I believe erodes Pinterest’s investment case is the company’s poor cost management. Pinterest has had a hard time achieving meaningful profitability. Hence, I would expect effective cost control to be one of management’s top priorities. Yet, this has hardly been the case, with Pinterest’s expenses, and consequently, losses, even widening.

In Q1, operating expenses came in at $413 million, a 15% increase year-over-year. To be fair, a large chunk of this amount was related to Pinterest’s prior announcement of a restructuring plan which aims to reallocate its resources against its highest priority areas. This restructuring resulted in a charge of approximately $121 million, but $113 million of it was non-cash.

That said, even if we exclude such one-off expenses and non-cash items, Pinterest seems to have little to no room to achieve meaningful profits. In particular, Pinterest’s adjusted EBITDA, which excludes such items, came in at roughly $27 million, implying an adjusting EBITDA margin of just 4%. Thus, it seems like the company has little to no room available to deliver consequential earnings.

Hardly Justifiable Valuation

The third reason I have a bearish outlook on Pinterest stock is due to its valuation, which I find difficult to justify. Currently, the consensus EPS estimates for Fiscal 2023 point toward $0.80, suggesting that the shares are trading at a forward/normalized P/E of 36.

From my perspective, this valuation seems overly expensive for a company that is still grappling with achieving GAAP profitability. Additionally, Pinterest’s user growth in key markets like the U.S. and Canada, as well as its ARPU, has been notably lackluster.

Let’s look at Meta Platforms as an industry bellwether to provide some context. Meta Platforms continues to experience robust user growth despite already having about 3 billion MAUs, continues to grow its ARPU, and is highly profitable on a GAAP basis.

The company also returns significant amounts of cash to its shareholders. Yet, despite Meta’s massive stock rally in the past year, shares are currently trading at a lower forward P/E of just 27, offering a much better risk/reward profile.

Is PINS Stock a Buy, According to Analysts?

Regarding Wall Street’s sentiment, Pinterest features a Moderate Buy consensus rating based on nine Buys and 12 Holds assigned in the past three months. At $28.05, the average Pinterest stock price target implies 3.8% downside potential, nonetheless.

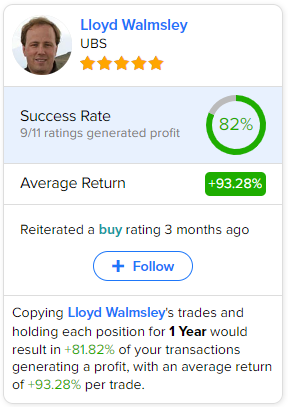

If you’re wondering which analyst you should follow if you want to buy and sell PINS stock, the most accurate analyst covering the stock (on a one-year timeframe) is Lloyd Walmsley from UBS, with an average return of 93.28% per rating and an 82% success rate.

The Takeaway

While Pinterest has witnessed a notable rally in its stock price, fueled by the recovery in social media and internet stocks, investors should consider several bearish catalysts. In particular, the idea-sharing platform faces challenges when it comes to user growth, especially in its key monetization markets, while ARPU has been lagging.

In the meantime, poor cost management practices and a valuation that seems difficult to justify further add to my concerns. Therefore, investors may find Pinterest’s recent rally an opportune time to sell the stock and book some gains before its upcoming results remind the markets of its flawed financials.