Sometimes, it’s fun to invest in penny stocks. Yet, after a wild rally, this is a time to be more careful with Phunware (NASDAQ:PHUN) stock. Phunware may be the target of a massive short squeeze, but the company’s financials aren’t ideal, so I am bearish on PHUN stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Texas-based Phunware provides a software platform to help businesses manage and track the performance of their mobile apps. However, something tells me that short-term stock traders aren’t particularly interested in what Phunware actually does. Instead, they might just be piling into a dangerous trade for the thrill of it, and that spells trouble in the long run.

Phunware: Big Rally, Big Red Flags

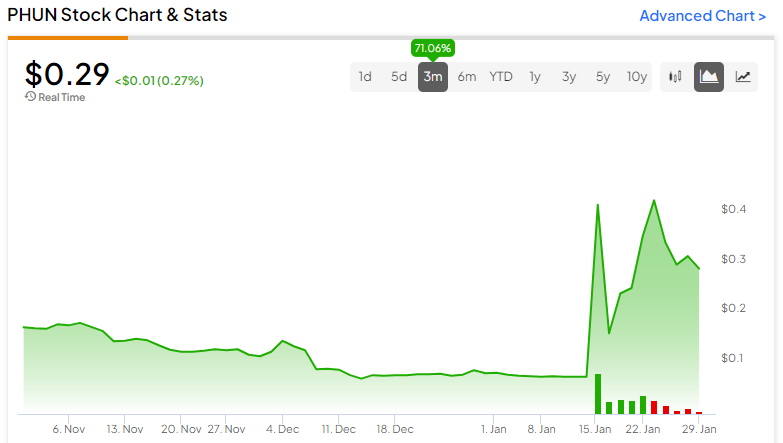

It’s lots of “phun,” no doubt, to be in the trade now, as Phunware stock recently rallied from $0.08 to $0.29. Yet, if this is the result of a short squeeze, then beware, as squeeze moves can turn around quickly at any given moment.

I suspect there’s a short squeeze in the works because there’s not a strong fundamental basis for PHUN stock to rally that much. The first red flag is Phunware’s recent financial performance. In 2023’s third quarter, the company generated net revenue of $2.792 million, down substantially when compared to $4.758 million in the year-earlier quarter.

Moving on to the bottom-line results, Phunware posted a Q3-2023 loss of $0.16 per share, which is twice as deep as the loss of $0.08 per share from the year-earlier quarter. Furthermore, this represents a bad miss, as Wall Street had expected Phunware to only lose $0.06 per share in 2023’s third quarter.

Finally, it’s a red flag that Phunware has made not just one but multiple recent announcements of share sales. Since December, PHUN has announced “offerings” (i.e., share sales) priced at $2.8 million, $7 million, and $5.6 million. Phunware’s current investors might justifiably raise share-value dilution concerns in the wake of these announcements.

Is PHUN Stock a Buy, According to Analysts?

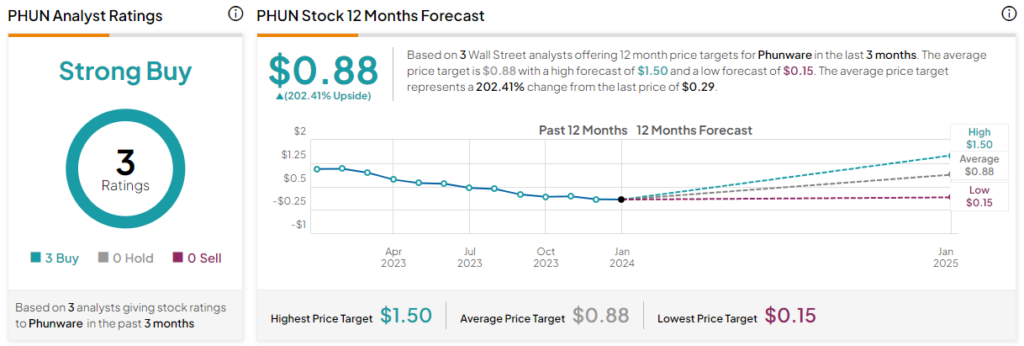

On TipRanks, PHUN comes in as a Strong Buy based on three Buy ratings assigned by analysts in the past three months. The average Phunware stock price target is $0.88, implying 202.4% upside potential.

Conclusion: Should You Consider PHUN Stock?

It’s fine that a few analysts seem to like Phunware. Plus, it’s enjoyable when stock traders get lucky and a short squeeze happens. On the other hand, it won’t be much fun if the short squeeze ends, and you’re suddenly on the losing side of the trade. Moreover, for serious investors, Phunware has some issues that need to be addressed. Consequently, I absolutely won’t consider a long position in PHUN stock.