In this piece, I used TipRanks’ comparison tool to evaluate two pharmaceutical stocks, Pfizer Inc. (NYSE:PFE) and AbbVie Inc. (NYSE:ABBV), to determine which is better. Pfizer has plummeted more than 20% year-to-date, while AbbVie has held up much better, with a decline of about 2%. A closer look at both companies reveals why investors appear to overwhelmingly prefer AbbVie over Pfizer. However, investors may want to consider Pfizer as a buy-the-dip opportunity.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Pfizer (NYSE:PFE)

On the surface, Pfizer looks deeply discounted based on its valuation multiples, both relative to its industry and to its history. Unfortunately, the company is facing a steep patent cliff in the coming years, but given its long-term success, a bullish view looks appropriate at current levels — with the caveats that it could take a long time to play out and a better entry point may appear.

The company is trading at a trailing price-to-earnings (P/E) multiple of around 7.3 and a price-to-sales (P/S) multiple of about 2.3 versus its mean P/E of 15.8 and mean P/S of 4.0 over the last five years.

Further, the American pharmaceuticals industry is trading at a P/E of about 22.4 times, significantly lower than its three-year average of 43.9. As well, the industry is trading at a P/S ratio of 3.9 times, slightly lower than its three-year average of 4.4 times. Notably, the industry comparisons are likely skewed by the high valuations of some biotech companies.

Part of Pfizer’s current problem may be the safety issue with the updated bivalent COVID-19 vaccine it developed in partnership with BioNTech (NASDAQ:BNTX). The CDC reported the possibility of increased stroke risk in seniors in January but added that some confounding factors in the data may mean it doesn’t represent a true risk.

However, a deeper dive reveals a sizable patent cliff. Pfizer loses exclusivity for five key oral drugs between 2026 and 2029. In fact, those drugs represent about 40% of its revenue, excluding its COVID products, which will be hard to predict in the coming years. On the other hand, the company has new drugs in its pipeline that should help take up some of the slack from those patent expirations.

Pfizer has been clear about its plans to deal with that lost revenue, announcing plans for $25 billion in risk-adjusted revenue via mergers and acquisitions by 2030. With its strong track record and clear patent-cliff strategy, Pfizer looks like a solid long-term play.

Finally, Pfizer offers an attractive dividend yield of 4%, qualifying it for potential inclusion in a dividend portfolio.

What is the Price Target for PFE Stock?

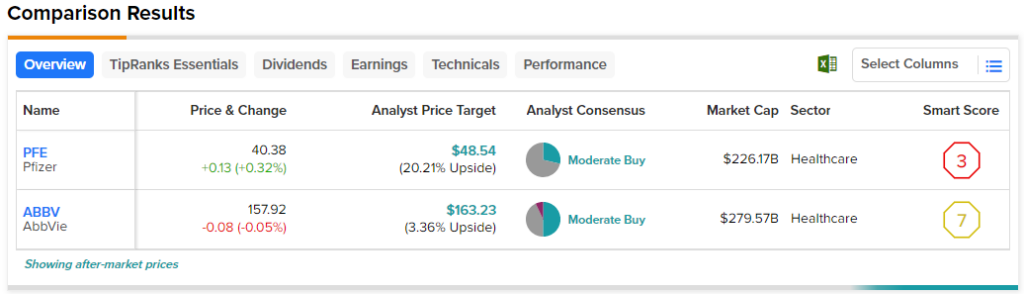

Pfizer has a Moderate Buy consensus rating based on four Buys, 10 Holds, and zero Sell ratings assigned over the last three months. At $48.54, the average Pfizer stock price target implies upside potential of 20.2%.

AbbVie (NYSE:ABBV)

At about 23.8 times earnings, AbbVie is trading slightly above its industry’s current P/E, although it’s slightly below the mean of 25 times over the last five years. Its P/S of about 4.8 is slightly above its five-year mean P/S and the industry averages. Thus, a neutral view looks appropriate at this time, although AbbVie’s near-term challenges may mean a better entry point could arrive soon.

Of note, AbbVie insiders have unloaded $8.4 million in shares over the last three months. The company is losing U.S. patent exclusivity on Humira, one of the top-selling drugs in recent years that accounted for more than one-third of its revenue.

AbbVie expects Humira sales to plummet between 35% and 55% this year, so it faces similar risks as Pfizer, except its shares haven’t sold off like Pfizer’s have. The company already has two new autoimmune-disease drugs on the market that could take up the slack from the lost Humira revenue, although it expects Rinvoq and Skyrizi to only generate $15 billion in sales by 2025.

Finally, AbbVie offers an attractive dividend yield of 3.7%, making it a potential fit for a dividend portfolio.

What is the Price Target for ABBV Stock?

AbbVie has a Moderate Buy consensus rating based on seven Buys, six Holds, and one Sell rating assigned over the last three months. At $163.23, the average AbbVie stock price target implies upside potential of 3.36%.

Conclusion: Long-Term Bullish on PFE, Neutral on ABBV

Pfizer and AbbVie both face significant challenges from patent expirations by the end of the decade, but Pfizer’s recent sell-off makes it look like the better choice. While Pfizer has displayed staying power, it requires a long-term mindset, although an even better entry point may appear. Similarly, AbbVie may sell off to the point where it also looks attractive, but we aren’t there yet.