PepsiCo (NASDAQ: PEP) is a worldwide manufacturer of beverage and food products. Among its wide portfolio of brands, most need no introduction as they represent top consumer choices. As investors worry about the economy and the market faces downward pressure, Pepsi has managed to continue on the path of revenue growth and operational effectiveness. Inelastic demand for food/beverage products makes the company’s profits resistant to worsening consumer sentiment and weakening spending. I am bullish on PEP stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Pepsi’s Surprisingly Resilient Stock Performance

While 2022 has been historically bad for stocks so far, with the S&P 500 (SPX) down 18%, PEP is one of the very few stocks that has managed to record a year-to-date gain. The stock is up by ~5% as investors seek refuge in more defensive stocks in the consumer discretionary sectors, waiting for macroeconomic headwinds to fade.

That said, PEP stock saw some significant price turbulence since the beginning of the year, with major drops occurring in March and June. Currently, PEP trades at a $251 billion market cap and pays a respectable 2.6% dividend yield.

Q3-2022 Earnings Retain Investors’ Confidence

On October 12, 2022, PepsiCo reported financial results for the third quarter of the year, with both EPS and revenue beating expectations. Non-GAAP EPS came at $1.97 ($0.13 beat), while revenue reached $21.97 billion ($1.15 billion above consensus estimates).

The company raised its FY-2022 guidance, looking for a 12% organic increase in sales versus the previous 10% forecast.

Considering international challenges and supply-chain disruptions affecting production lines across the board, the low double-digit growth that PEP is on track to record should be considered impressive, especially considering the mature and defensive nature of the business. The company is also growing at double-digit rates domestically and internationally, offering extended geographic diversification benefits to investors.

A Deeper Dive into Pepsi’s Financials

Pepsi’s convincing financial performance has persisted for many years now, with the company increasing revenue and EPS at five-year CAGRs of 5.7% and 7.6%, respectively. Pepsi’s strong performance in 2022 has the company on track to reach record revenue of $84.7 billion in 2022, with analysts expecting more growth in 2023.

Cash-flow generation has shown consistency over the past decade, with cash from operations reaching $11.6 billion in 2021 ($11.29 billion on a trailing-12-months basis), compared to $8.5 billion back in 2012. Capital expenditures have been marginally increasing, having reached $4.6 billion in 2021. Both cash flow productivity and CapEx spending will be key to sustaining high returns on equity through organic and acquisition-related growth.

Gross profit margins have remained very high, above 50% over the last decade, despite decreasing a bit in the past few years. Similarly, net margins have seen some contraction in recent years, currently standing at 11.6%. For reference, the average consumer staples gross and net margins stand at 32.6% and 4.9%, respectively, indicating that PepsiCo is significantly outperforming the vast majority of its peers.

Pepsi’s balance sheet displays a moderately healthy financial outlook. The company carries a large cash stockpile of $6.4 billion, with total current assets reaching $23.5 billion compared to $25.5 billion in current liabilities.

Pepsi has also accrued significant amounts of debt over the years, as the long-term debt balance currently stands at $36 billion. Interest payments are increasing and are consuming larger amounts of cash flow while being, at least in part, presumably responsible for the recent pressure on net margins. Adding more debt in the current environment would further increase the company’s cost of capital as interest rates continue to increase in the market.

Is PEP an Attractive Dividend-Growth Candidate?

Pepsi’s reliable business model and history of success have made the stock a frequent pick for dividend-growth investors. The current yield of 2.6% is higher than the market average and slightly lower than the sector median. The company has displayed a strong commitment toward dividend investors, with its distribution growth streak extending back 49 years. Over the past five years, dividends have grown at a 7.4% CAGR.

With the dividend yield as it stands, distributions to shareholders take up about $6.4 billion in cash flow, which is a significant amount considering that the firm generates around $11 billion in cash from operations and $8.3 billion in unlevered free cash flow as of 2021.

Aside from dividend payments, Pepsi also rewards investors through consistent, yet small, share repurchases. The company’s average share count has decreased from 1.55 billion in 2012 to 1.38 billion as of the last quarterly filing.

Pepsi’s Valuation Remains Pricey

With more investors turning towards more defensive names and relatively strong financial performance by the company, as expected, PEP’s valuation appears quite pricey. The stock trades at a forward P/E ratio of 26.4x (sector median of 18.6x) and a P/S multiple of 3.0x (sector median of 1.2x). Both multiples are also somewhat elevated compared to their 10 and five-year averages.

Is PEP a Good Stock to Buy, According to Analysts?

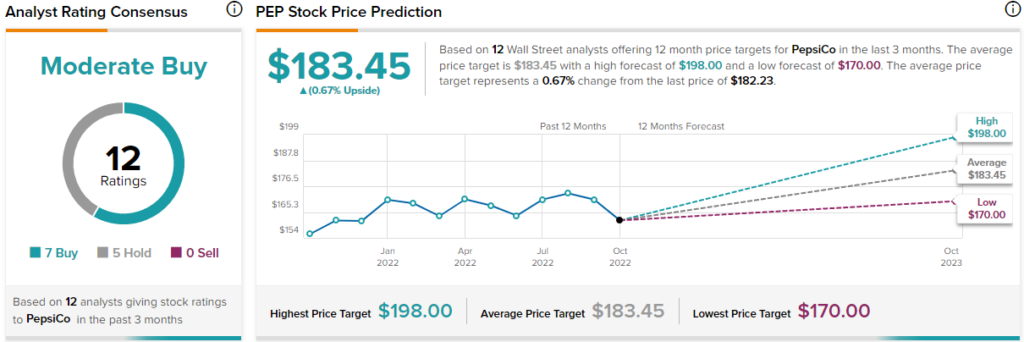

Turning to Wall Street, PepsiCo has a Moderate Buy rating based on seven Buys and five Holds assigned over the past three months.

The average PEP stock price forecast of $183.45 represents 0.7% upside potential, with a high price forecast of $198 and a low forecast of $170.

Conclusion: PEP is a Good but Expensive Stock

PepsiCo is a company that has many desirable traits, including a safe business model, decent growth, ample profitability, and a tremendous dividend-growth record. That said, the growing amounts of leverage and a rather expensive valuation are things to consider before buying.