3D printing – or additive manufacturing, in the jargon – has matured from a hobby for hardcore computer design experts to become a growing segment of industry and manufacturing. Like many industries, 3D printing has had its ups and downs in recent years. The COVID pandemic boosted demand, while the high inflation and interest rates that prevailed in 2021 and 2022 put a damper on the business.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The upshot, according to Cantor Fitzgerald analyst Troy Jensen, is a manufacturing sector that is ready to jump in an improving economy, with a built-up reserve of demand just waiting for orders – and that will bring an opportunity for investors. As Jensen puts it, “We believe there is pent-up demand in the industry, which could potentially be unleashed when economic conditions stabilize or improve. Factors such as a decline in interest rates and a more favorable economic environment are expected to contribute to the reacceleration of growth in the additive manufacturing sector. This assumes the negative impacts of the mentioned geopolitical and economic factors subside, allowing companies to revisit and resume their interest in additive manufacturing for reshoring or near-shoring strategies.”

Jensen goes on to point out 3D printing stocks that stand to gain on that pent-up demand, and investors can go along for the ride as these shares lift higher. Checking into the TipRanks data, we can look at Wall Street’s broader view of these stocks – the details diverge, and that makes for an interesting story. Here’s a closer look.

3D Systems Corporation (DDD)

The first stock on our list, 3D Systems, is a South Carolina-based firm that has been in business since the 1980s. The company designs, builds, and sells a range of solutions in the 3D printing industry; specifically, 3D Systems offers 3D printers, 3D printing materials, and the software needed to control the systems. 3D Systems was an early innovator in the field, and today can boast of holding more than 1,000 global patents, and has over 130 available 3D printing materials.

Where this technology was once considered a novelty, today 3D printing is becoming ever more essential – and this firm’s customers use the tech to produce more than 1 million discrete parts every day. The company’s customer base spans multiple industries, including aerospace and defense, healthcare, factory production, dentistry, jewelry, metal casting – there are very few areas where 3D printing cannot find an application.

3D Systems reported a string of net-loss quarters over the past few years, but the company reported a net profit in its last quarterly report. That report covered 3Q23, and showed a non-GAAP diluted EPS of $0.01. While modest, this was 8 cents per share better than had been expected, and 6 cents better than the 5-cent loss reported in the prior-year period. The company’s improved quarterly earnings were derived from total revenue of $123.8 million, a figure that was down 6.4% year-over-year and came in $3.8 million below the forecast.

In his coverage of this stock, Cantor analyst Jensen notes the company’s strong product portfolio and turn toward profitability, as well as its potential to remain profitable going forward, writing, “3D Systems has an expansive line of additive manufacturing technologies spanning machines, materials, software, and services. Under the leadership of CEO Jeff Graves, 3D Systems has repositioned itself by divesting non-additive businesses and strategically acquiring complementary technologies to become a pure-play additive manufacturing technology supplier with the most expansive portfolio in the industry. The company is also a leader in healthcare applications and has a significant investment in regenerative applications, which could be a significant potential catalyst for the company, but several years away. We believe recent cost-cutting initiatives will drive higher levels of profitability, which has been the missing element for the stock.”

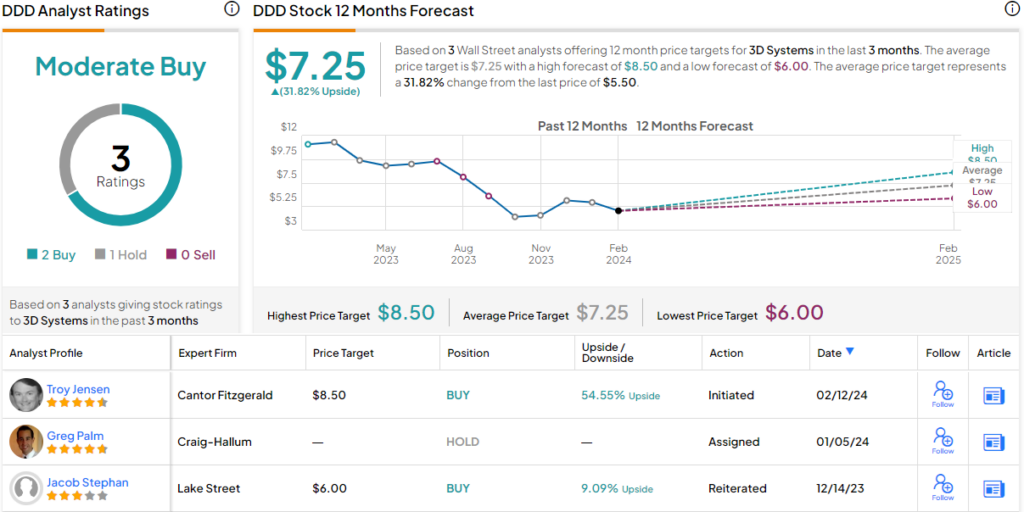

Summing up, Jensen opens his coverage here with an Overweight (Buy) rating, and an $8.50 price target that suggests a one-year upside of 54.5%. (To watch Jensen’s track record, click here.)

There are only 2 other recent analyst reviews here, and they are split – 1 to Buy, 1 to Hold, for a Moderate Buy consensus rating. The $7.50 average target represents upside of 32% from current levels. (See 3D Systems’ stock forecast.)

Stratasys (SSYS)

Next up, we’ll take a look at the Minnesota-headquartered Stratasys, another old player in the world of 3D printing. Stratasys, like 3D Systems above, got its start in the 1980s, and today offers a full range of 3D printing solutions, services, software, and materials – and even product manufacturing-on-demand. That last exemplifies the greatest single advantage of 3D printing in the modern world’s industrial sector – what once could take days or weeks, the manufacture of a single part to exact specifications needed right now – can now be done in a matter of hours, and done on-site.

Stratasys’s products and services include several lines of 3D printer machines, along with software for operations and 3D printing materials for a wide range of applications. The company services a customer base in numerous industries, such as aerospace and automotive, medical and education, and general consumer products. Manufacturing on demand is a particularly important part of the company’s work, and is applicable to almost any industry you can think of. Stratasys offers this service using a variety of machines, materials, and specifications. Finally, the company backs its products and its service with a solid customer support division.

Turning to financial results, we find that Stratasys brought in $162.1 million at the top line in its last reported period, 3Q23. This was flat year-over-year, but it beat the forecast by $850,000. The company’s bottom line, reported as a non-GAAP net income of 4 cents per diluted share, was a penny better than had been expected.

In Jensen’s view, Stratasys is benefiting from a combination of factors, including new product introductions, portfolio expansion, and the bottled-up demand discussed above. “Our Overweight rating is based on our view that new product cycles at Stratasys should help accelerate growth, while industry pent-up demand and a consolidation wave offer a favorable environment for growth and profitability,” the analyst said. “Stratasys is positioning itself for growth through an array of new product cycles. The company has established a leadership position in FDM technology and expanded its product portfolio through both organic product development and strategic acquisitions. We believe the introduction of SLA, DLP, and SAF printers has allowed Stratasys to diversify into new markets, and we anticipate these products and the recently unveiled F3300 (high-end FDM printer) will help reaccelerate growth in 2024 and beyond.”

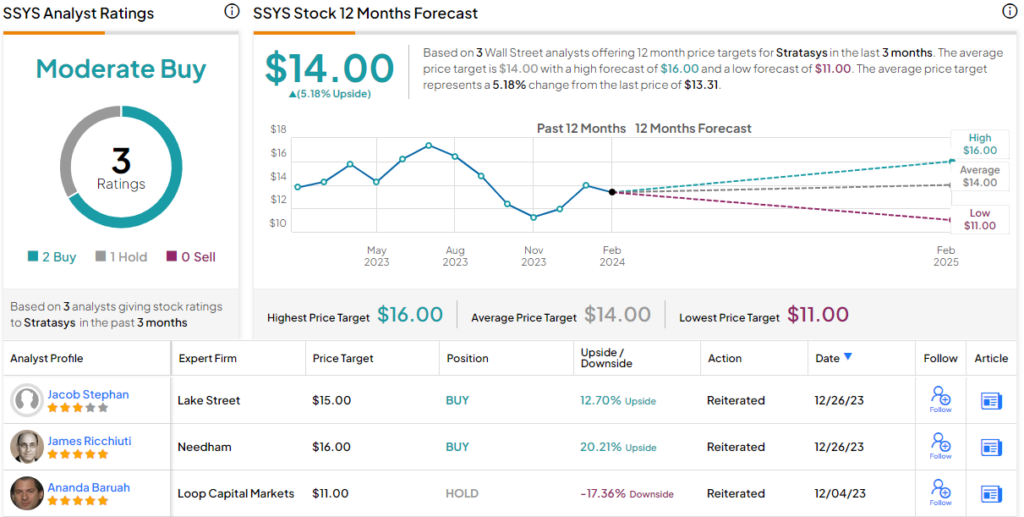

That Overweight (Buy) outlook here is another initiation-of-coverage rating, and his price target of $24 shows his confidence in a robust one-year upside potential of 80%.

Overall, the Moderate Buy consensus rating on SSYS shares is based on 3 recent analyst reviews that break down 2 to 1 in favor of Buy over Hold. Other analysts are not as bullish here as Jensen; the $14 average target price implies a modest gain of 5% on the one-year timeframe. (See Stratasys’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.