Pembina Pipeline (PBA) (TSE: PPL) provides transportation and midstream services. It operates through the following segment: Pipelines, Facilities, Marketing and New Ventures, and Corporate.

The company currently offers a pretty attractive dividend yield while also receiving the backing of the analyst community. However, when it comes to analyzing its competitive advantage, the results are a little mixed.

Quantifying Pembina Pipeline’s Competitive Advantage

There are a couple of ways to quantify a company’s competitive advantage using only its income statement. The first method involves calculating a company’s earnings power value (EPV).

Earnings power value is measured as adjusted EBIT after tax, divided by the weighted average cost of capital, and reproduction value (the cost to reproduce/replicate the business) can be measured using a company’s total asset value. If the earnings power value is higher than the reproduction value, then a company is considered to have a competitive advantage.

The calculation is as follows:

EPV = EPV adjusted earnings / WACC

C$19,894 million = C$1,691 million / 0.085

Since Pembina has a total asset value of C$31,376 million, it can be said that it does not have a competitive advantage. In other words, assuming no growth for Pembina, it would require C$31,376 million of assets to generate C$19,894 million in value over time, which is not ideal.

The second method to determine if a company has a competitive advantage is by looking at its gross margin because it represents the premium that consumers are willing to pay over the cost of a product or service. An expanding gross margin indicates that a competitive advantage is present and sustainable.

If a company has no advantage, then new entrants would gradually take away market share, leading to a decreasing gross margin over time due to pricing wars.

In Pembina’s case, its gross margin has expanded in the past several years, going from 14% in Fiscal 2014 to 27.3% in the past 12 months. As a result, its gross margin indicates that a competitive advantage is present in this regard.

Thus, it can be said that the company may not have a theoretical competitive advantage, but it does have the pricing power to improve its profitability metrics. As a result, I would argue that, in reality, it does have a competitive advantage when looking at its operations.

Dividend

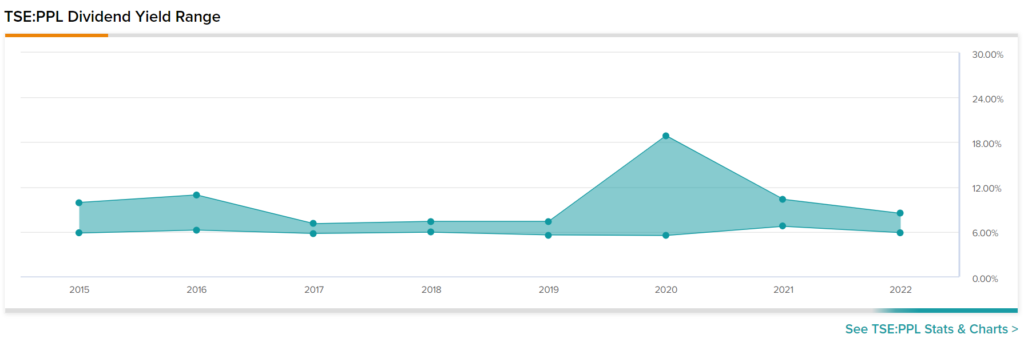

For income-oriented investors, Pembina pays a 5.55% dividend yield on an annualized basis. When taking a look at Pembina’s historical dividend yield, you can see that it has remained relatively flat:

At 5.55%, the current yield is on the low end of the range, indicating that income-oriented investors are paying a premium relative to yields they have been able to receive in the past.

Analyst Recommendations

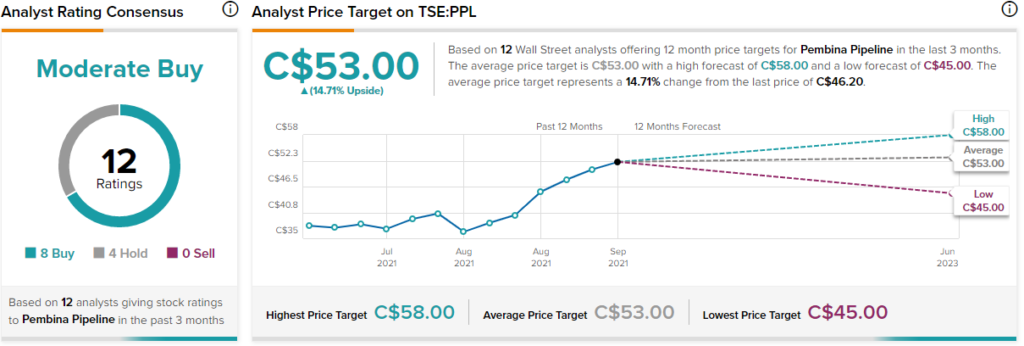

Pembina has a Moderate Buy consensus rating based on eight Buys and four Holds assigned in the past three months. The average Pembina Pipeline price target of C$53 implies 14.7% upside potential.

Final Thoughts

Pembina Pipeline is a defensive stock that has performed well year-to-date, rallying about 20%. Although its dividend yield is relatively low compared to its historical range, it is still providing investors with a pretty good yield of 5.55%. In addition, it has the backing of analysts who see decent upside potential.

As a result, investors may want to take a closer look at the company after its recent pullback in share price.