One of the top-trending ideas identified by TipRanks recently, cybersecurity specialist Palo Alto Networks (NASDAQ:PANW), for all intents and purposes, represents a no-brainer, in my view. That’s especially true for investors willing to ride the underlying narrative over the long run. With the digital threat environment becoming even more dangerous, circumstances point to a bright future for Palo Alto. Therefore, I am bullish on PANW stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

PANW Stock Offers Relevance but Also Suffers Risks

Although one of the key themes of this year centers on innovative technologies like artificial intelligence, significant attention must also be placed on digital security. Sadly, human nature being what it is, it won’t take long for innovation to turn into destruction. Therefore, PANW stock naturally commands relevance. At the same time, it’s not without flaws.

As TipRanks contributor Steve Anderson pointed out, the main positive about plying one’s trade in cybersecurity is that, generally, demand should be robust. However, that narrative would be always true if all other circumstances were equal. Obviously, they’re not. Primarily, economics plays a major role, thus imposing a critical headwind against PANW stock.

To be sure, Palo Alto appears to rank among the top cybersecurity enterprises. However, Anderson reported that many businesses will likely decide that upgrading their digital security profiles can wait a few months. Undoubtedly, less-resilient corporations will probably go without upgrades for even longer. It’s not that they want to. Rather, it’s the reality of present circumstances stemming from negative catalysts like high inflation.

On a related note, cybersecurity doesn’t exactly represent an accretive expenditure. Stated differently, enterprises only care about cybersecurity when they suffer a data breach. Of course, that’s a bit of a hyperbolic statement but the general idea is that protective protocols don’t advance growth. Still, like auto insurance, companies would be gambling recklessly without effective protection.

Palo Alto Networks Sells Itself

Despite wading into uncertain economic waters, Palo Alto Networks practically sells itself. As an established top-tier cybersecurity specialist, few competitors offer similar acumen. Therefore, patient investors shouldn’t be overly distressed by rising competition from Microsoft (NASDAQ:MSFT). To be sure, it’s distracting. However, when it comes to cybersecurity, now isn’t the time to experiment.

According to data from Cybersecurity Ventures, the global cost associated with digital breaches and similar crimes may hit $10.5 trillion by 2025. Further, tech giant International Business Machines (NYSE:IBM) stated that the average cost of a data breach this year amounted to $4.45 million. For smaller organizations, such an impact could be crippling.

After all, it’s not just about the breach itself but also the downtime incurred in addressing the crime. Moreover, if nefarious actors hold a company’s vital digital assets for ransom, that could also be a nail in the coffin. With so much that could go wrong without protection, businesses would be foolish to risk it.

As for Microsoft, even covering analysts acknowledge that the tech juggernaut may take time to truly expand into the Secure Service Edge (SSE) space. Still, that might be time that companies needing adequate protection might not have. Thus, it’s not terribly surprising that PANW stock gained over 75% since the start of this year.

Guidance Matches the Broader Narrative

A few weeks ago, Palo Alto reported its earnings results for its fourth quarter of Fiscal Year 2023. On paper, it was a mixed bag. While earnings per share at $1.44 handily beat the consensus EPS target of $1.28, revenue of $1.95 billion missed the mark by $10 million. Still, PANW stock swung higher following the disclosure based on impressive EPS guidance.

According to TipRanks reporter Vince Condarcuri, “Management now expects revenue and adjusted earnings per share for Q1 2024 to be in the ranges of $1.82 billion to $1.85 billion and $1.15 to $1.17, respectively. For reference, analysts were expecting $1.93 billion in revenue along with an adjusted EPS of $1.11.”

While the revenue component is a bit disappointing, the profitability metrics point to consistent demand. They also suggest that organizations are willing to pay a premium for Palo Alto’s arguably superior offerings. That’s excellent news for PANW stock.

Is PANW Stock a Buy, According to Analysts?

Turning to Wall Street, PANW stock has a Strong Buy consensus rating based on 31 Buys, two Holds, and no Sell ratings. The average PANW stock price target is $279.81, implying 15.28% upside potential.

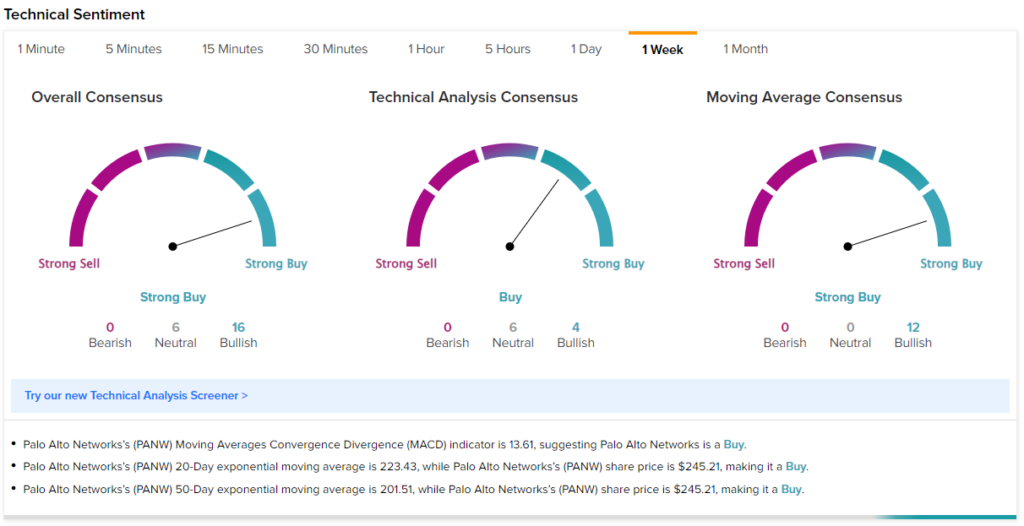

Similarly, the technical analysis tool on TipRanks suggests that PANW stock is attractive based on its current momentum. See below.

The Takeaway

At the end of the day, the equation undergirding PANW stock is simple. Digital threats are only rising. Fortunately, Palo Alto commands the acumen to address such threats, which are also becoming increasingly costly. Even with economic and competitive concerns, cybersecurity remains incredibly relevant. If you’re willing to be patient, PANW looks like a no-brainer stock.