Palantir Technologies’ (NASDAQ:PLTR) Q2 results came in quite strong, with the company meeting analysts’ growth estimates, achieving its third consecutive quarter of GAAP profitability, and raising its Fiscal 2023 guidance. Beyond its strong growth, a captivating part of Palantir’s report emerged through the launch of a share buyback initiative. As a Palantir shareholder, I remain bullish following this report. That said, I would still urge you not to take the outcome of share repurchases seriously. Let’s see why!

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q2 Results: Governmental, Commercial Demand Driving Growth

Palantir’s Q2 results were marked by robust demand emanating from both government and commercial clients. This vigorous demand not only manifested in the company’s notable top-line growth but also became strikingly evident through the considerable expansion of its client base. Of particular significance was the swift and enthusiastic adoption of Palantir’s newly-introduced AIP platform, underscoring the company’s resonance within the AI market.

Specifically, Palantir posted $533 million in revenue, marking a 13% year-over-year increase and beating its previous guidance. Notably, revenue from their major clients saw strong growth, with a solid 15% rise in last-12-month revenue per customer among the top 20 clients, reaching $53 million per customer. Just take a second to think how massive this number is. It’s more than some publicly-traded companies record in revenues, which just showcases how important Palantir’s software is for those who utilize it.

Here is Palantir’s Q2 growth broken down:

- Commercial revenue grew 10% year-over-year to $232 million

- U.S. Commercial revenue grew 20% year-over-year to $103 million.

- International Commercial revenue grew by 4% year-over-year to $129 million.

- Government revenue grew 15% year-over-year to $302 million.

- U.S. Government revenue grew 10% year-over-year to $225 million.

- International Government revenue grew 31% year-over-year to $76 million.

Note that these growth metrics may initially come across as underwhelming, as they fall within the low to mid-teens range rather than a more exhilarating 20% or higher. However, it’s essential to consider Palantir’s growth within a broader context. In a challenging macroeconomic landscape where businesses are working to manage their budgets diligently, the fact that there is a notable uptick in investment toward Palantir’s ultra-expensive software is truly remarkable.

More importantly, it’s incredibly impressive to see Palantir’s customer count growing very fast. Its customer accounts grew 38% year-over-year and by 8% compared to Q1, reaching 421 customers, demonstrating powerful momentum in the company’s ability to onboard and convert new customers during a challenging market. Even if, say, half of these customers stick with Palantir over the long run, revenue growth could accelerate significantly in the coming quarters.

Further, another factor that should be proven a fantastic catalyst for Palantir’s growth toward the medium term is Palantir’s AIP. This is Palantir’s AI product that links highly sensitive and classified intelligence data to create a real-time picture of the environment in question.

Impressively, AIP was launched just 10 weeks ago, and Palantir is already seeing phenomenal inbound interest. In fact, Mr. Karp mentioned that Palantir is currently in discussions with more than 300 enterprises to deploy AIP within their organizations.

Profitability & Share Buyback

Profitability-wise, Palantir celebrated its third-consecutive quarter of GAAP net income, which came in at $28 million. This was also Palantir’s second-consecutive quarter of a positive operating income, which came in at $10 million and represented a 2% margin. The reason that net income exceeded operating income is that Palantir has invested its $3.1 billion cash position (they have no debt) primarily in U.S. Treasury bills that are generating some nice additional income.

With Palantir’s cash position growing for four consecutive quarters, given the company’s positive cash flow generation during this period, management has taken the strategic step of unveiling a $1 billion share repurchase program. It’s worth noting that the company maintains a pristine debt-free balance sheet, underscoring the rationale behind initiating the return of surplus funds to shareholders while sustaining growth through self-funded operations. However, should you actually be excited about this?

Well, despite investors celebrating Palantir’s first-ever capital-return initiative, I wouldn’t take this program too seriously. At this point, such an amount would be basically just offsetting stock-based compensation, which amounted to about $500 million over the past 12 months.

Besides, trading at around 17 times this year’s projected sales, it’s impossible to argue that Palantir will be repurchasing its shares at a bargain price, even if its future growth prospects were to justify this as a “fair” multiple. In my view, this announcement was mostly for garnering attention in the media and won’t actually have a tangible effect in terms of creating shareholder value.

Is PLTR Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Palantir features a Hold consensus rating based on three Buys, six Holds, and four Sells assigned in the past three months. At $14.50, the average PLTR stock forecast implies the potential for 14.9% downside, which may sound rather worrisome.

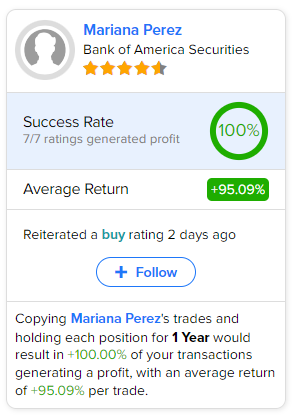

If you’re wondering which analyst you should follow if you want to buy and sell PLTR stock, the most profitable analyst covering the stock (on a one-year timeframe) is Mariana Perez from Bank of America Securities (NYSE:BAC), with an average return of 95.1% per rating and a 100% success rate. Click on the image below to learn more.

The Takeaway

Palantir’s Q2 results showcased robust growth across its commercial and government segments, reaffirming its relevance in a challenging market. Also, the company’s AIP platform’s rapid adoption and expanding customer base point to promising quarters ahead.

Meanwhile, the share buyback program signals management’s confidence and financial strength, but its impact on shareholder value might be limited, considering the stock’s valuation and potential offsetting effects from stock-based compensation.

Nevertheless, as Palantir strides forward, investors should focus on the company’s sustained growth trajectory and strategic initiatives, which appear quite promising. Thus, despite Wall Street’s downside projections, I remain bullish on the stock.