AI hype has been behind significant run ups in recent months. Companies with exposure to the game-changing tech have seen shares go on a tear and you can add Palantir Technologies (NYSE:PLTR) to that list.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Since the big data firm’s early May 1Q print and the launch of its AI platform (AIP), shares have added ~$12 billion in market-cap and climbed over 60%.

That surge, though, says Raymond James analyst Brian Gesuale now “reflects a material element of our near-term bullishness.”

“The recent run in shares coupled with a premium valuation make finding a catalyst more challenging in the near term,” the 5-star analyst went on to add.

Accordingly, Gesuale has now downgraded Palantir’s rating from Strong Buy to Outperform (i.e., Buy), although at the same time, he has increased the price target from $15 to $18. This new figure suggests the shares still have room for 14.5% growth over the course of the next year. (To watch Gesuale’s track record, click here)

So, essentially, Gesuale’s point is that the downgrade is merely a valuation issue. However, it doesn’t diminish his unwavering “long-term enthusiasm” for AI and Palantir’s positioning.

Gesuale has identified three distinct cycles the shares have been through since Palantir went public in the fall of 2020. The first saw the stock rise from $9 to ~$40 as a “government software prime.” The second cycle saw shares collapse to $6, the result of revenue decelerating, SBC (stock-based compensation) peaking and SPAC revenue muddying fundamentals. The third cycle began in May with the narrative being partly defined by the AI opportunity.

And looking into the future, it’s this AI opportunity that will ultimately help drive growth. The recent launch of the AIP will see to that. This year, Gesuale expects the platform will see 40 customer adds, followed by 90+ a year in 2024/2025. This means that by 2025 the AIP will already account for nearly 50% of total commercial customers. Numbers wise, Gesuale reckons the platform will generate $365 million in product revenue by then, making up 22% of commercial sales.

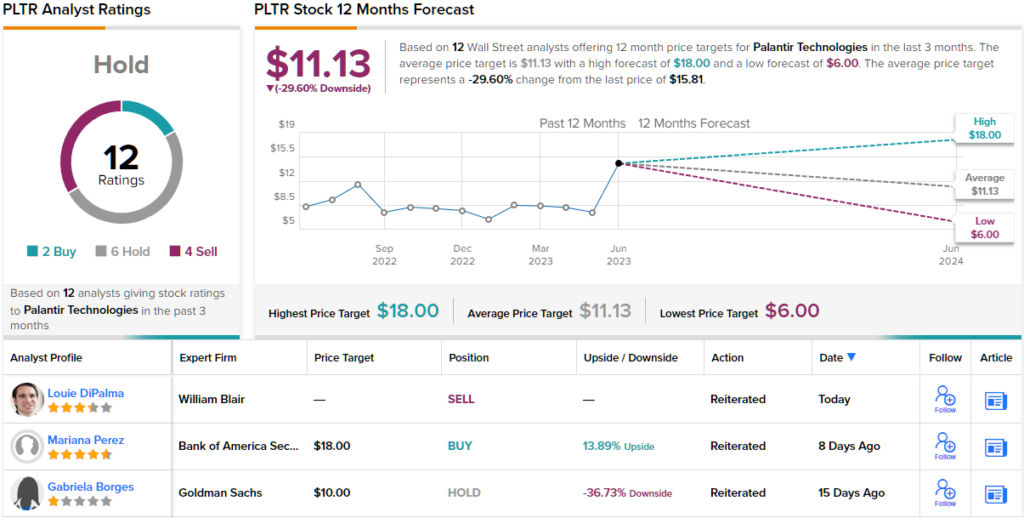

So, that’s Raymond James’ take, what does the rest of the Street have in mind for Palantir? Most are staying on the sidelines for now. The stock claims a Hold consensus rating, based on 6 Holds, 4 Sells and 2 Buys. Moreover, a majority of analysts anticipate downside potential for the shares — the average target price of $11.13 indicates a projected ~30% discount a year from now. (See Palantir stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.