Palantir Technologies (NYSE:PLTR) stock jumped over 167% in 2023. While shares of this enterprise software company witnessed an explosive rally, analysts’ stock price forecast for PLTR suggests a downside potential from current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But before we dig deeper, it’s worth noting that the rapid deployment of AI (artificial intelligence) and the company’s expertise in large language models and generative AI led to a rally in its share price. Moreover, the launch of its AI platform (AIP) and strong financial performance supported the uptrend.

Is Palantir a Buy, Sell, or Hold?

Palantir recently delivered a better-than-expected Q3 performance. What stood out is that PLTR closed 80 deals of $1 million or more, 29 deals of $5 million or more, and 12 deals of $10 million or more in Q3. Further, these deals are highly diversified across multiple industries. This growth is led by the strong demand for AIP.

While Palantir’s revenue growth accelerated, margins improved, and AIP presents significant growth opportunities, the stock has rallied quite a lot. This implies that the positives are already reflected in its current price, keeping analysts sidelined.

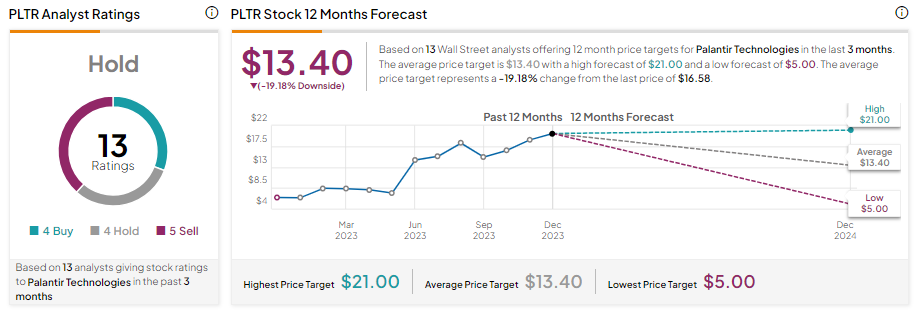

Palantir stock has a Hold consensus rating based on four Buys, four Holds, and five Sell recommendations assigned over the last three months. Further, the average PLTR stock price target of $13.40 implies about 19.18% downside potential from current levels.

Bottom Line

The recent rally in Palantir stock has driven its valuation higher. Its forward enterprise value-to-sales (EV/Sales) multiple of 15.5 is significantly higher than the sector median of 2.94, making it expensive on the valuation front. This is reflected in analysts’ consensus rating and average price target.