Shares of secretive data analytics company Palantir (NYSE:PLTR) have been surging in the past two weeks, induced by a spectacular quarter. Indeed, big data has been a source of significant gains of late, with the stock now up 60% from its May 2023 lows. As Palantir looks to make good on its latest upbeat profit forecast while AI enthusiasm continues to build, Palantir stock may have a stage set to continue its march higher.

CEO Alex Karp is a great manager with a lot to prove. Those who give the man the benefit of the doubt may stand to be rewarded further. Though I’m not a big chaser of hot stocks, it’s hard to be anything but bullish after Palantir’s post-quarter pop.

Palantir Stock: A Truly Impressive Quarter

Palantir’s pop was thanks to a stellar earnings result and a forecast of more positive things to come. The company clocked in its very first GAAP operating profit alongside 18% in year-over-year revenue growth. Amid turbulent conditions, the quarter was definitely applaud-worthy. Though the post-quarter rally seemed excessive, it may be warranted and could be the start of something special for a secretive tech firm that’s been disappointing for investors who stuck with it since shares peaked in early 2021.

The company not only pointed to more profits to come for all quarters in 2023, but it also pulled out the “AI” card. The company unveiled its generative AI platform, which could change the game for existing clients and open the door for firms looking to get the most out of data analytics and next-generation AI.

What are Palantir’s plans when it comes to its AI strategy? Karp put it pretty simply in the company’s recent conference call, his firm’s “strategy on AI is to just take the whole market.”

As Palantir looks to grow profitably, it may be tough to stop Palantir stock from staging a recovery. Even if interest rates stay high, Palantir seems to have the tides turning in its favor.

Unlike most other companies touting “AI” in conference calls, data analytics and AI fit very well together. After all, data is an essential input into AI models. Big data and AI may very well be what brings Palantir into focus as companies (and governments) take data more seriously.

Palantir Books Tiny Profit from Gold Bet

Palantir is an exciting, mysterious, and unique technology company, not just because it’s a big data play that’s done a lot of behind-the-scenes work for the government, but because Mr. Karp seems like an independent thinker who’s willing to zig when others zag. Karp has been a critic of Silicon Valley for quite a while now. Further, his firm invested a considerable sum ($50 million) in gold bars — a move not typical of your average innovative tech firm.

The company recently sold its gold stake, booking a very modest gain ($0.2 million) thanks to gold’s recent rally. As it turned out, Palantir was right to go for gold over crypto or using the funds to go on a hiring spree ahead of rapid-fire rate hikes.

Indeed, I found it rather intriguing that Palantir would go the route of gold when many tech-driven folks looked to cryptocurrencies as a hedge against inflation.

It’s unclear as to what Palantir will do with the funds raised from its gold sale. I believe the firm could allocate more capital to AI and efficiency-driving efforts to further improve upon the company’s profitable growth trajectory.

Despite the stock’s impressive run, PLTR shares trade at just north of 12 times price-to-sales. That’s well below many of its fast-growing peers in the data analytics space.

Is PLTR Stock a Buy, According to Analysts?

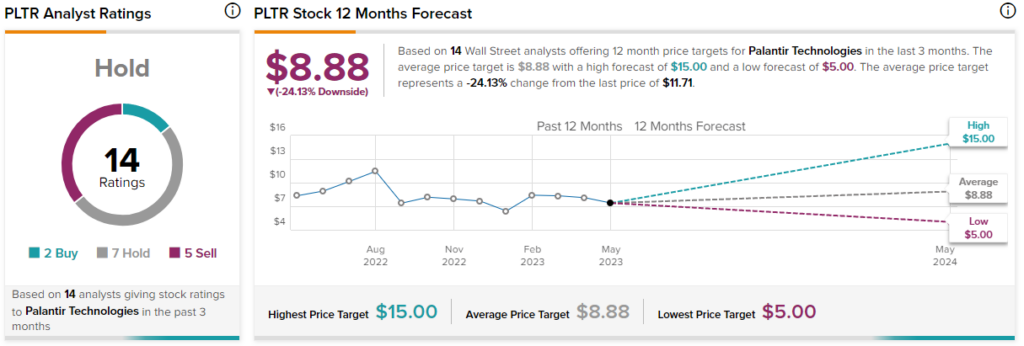

Turning to Wall Street, PLTR stock comes in as a Hold. Out of 14 analyst ratings, there are two Buys, seven Holds, and five Sell recommendations. The average Palantir stock price target is $8.88, implying downside potential of 24.1%. Analyst price targets range from a low of $5.00 per share to a high of $15.00 per share.

The Bottom Line on PLTR Stock

Palantir has a nice seat to the coming AI-driven industrial revolution. As the company looks to commercial corporations for its next leg of growth, I do think the firm can keep driving revenues higher without compromising on the front of profitability.

The company’s margins are improving, and they could improve further from here as Karp looks to capture an unprecedented demand for enterprise AI. Though the current outlook has impressed Wall Street, I’d not be surprised if Palantir continues crushing expectations, moving forward.