Palantir (NYSE:PLTR) is a software specialist offering solutions that let governments (commonly the military) and large commercial customers analyze the data they have access to across a variety of sources. The results of which are valuable insights that can be used for anything from locating terrorist networks and resolving crimes to vaccine distribution and strengthening supply chains.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

These qualities especially useful during periods of chaos. For instance, in 2021, many of its federal contracts included COVID response. After that, in 2022, the business launched scores of additional supply chain projects. Furthermore, its software offers vital insights and support in regions of conflict, which, unfortunately, is still very much needed in the modern world.

So, you would think that such a value proposition would be perfect for our times. Not quite, says Mizuho’s Matthew Broome. “PLTR’s unique software is capable of creating significant operational value for its customers, and we expect ongoing global disruptions can help to further catalyze adoption,” said the analyst. “However, growth across both its government and commercial businesses has slowed significantly, and an uncertain macro environment makes meaningful near-term reacceleration much more difficult.”

Palantir is heavily reliant on government contracts, although in recent quarters, the company has made a concerted effort to ramp up its commercial offerings. That said, given the timing of big deals and the unpredictable nature of global disruptions, on top of other macro factors, the quarterly results for the segments are “typically lumpy.” Heading into a potentially dicey 2023, there is additional risk, due to the fact most of its contracts can be cancelled by its clients.

And while Broome thinks the commercial offerings are “very high quality,” that area is a crowded one with well-established cloud vendors like Microsoft and Salesforce and “dedicated” analytics companies such as Alteryx and Qlik all providing competition. “Nonetheless,” adds Broome, “recent investments in sales capacity has catalyzed new customer activity, which we expect to support long-term growth for the commercial business.”

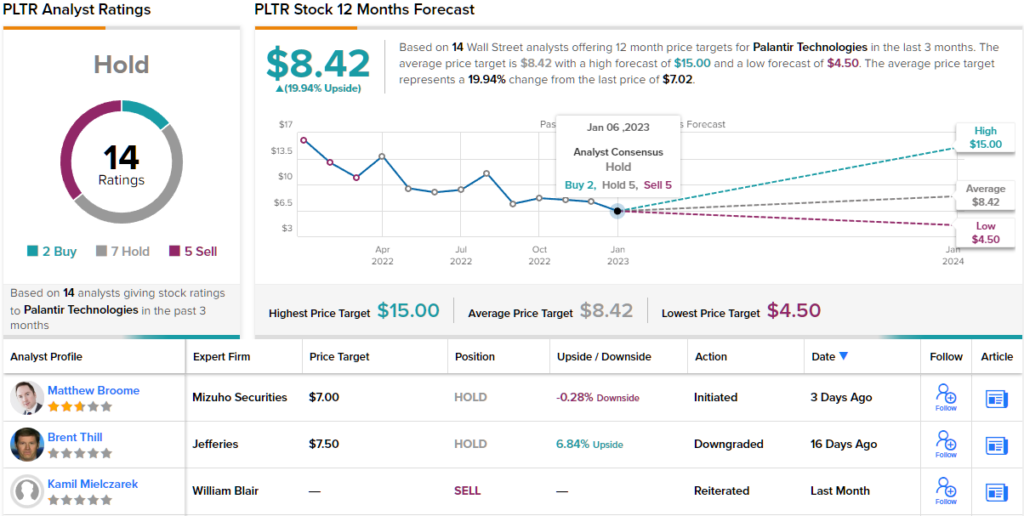

That, though, is not quite enough for Broome to get fully on board right now. As such, the analyst initiated coverage of PLTR stock with a Neutral rating, backed by a $7 price target, suggesting the shares are currently trading at their fair value. (To watch Broome’s track record, click here)

Amongst Broome’s colleagues, most agree with his prognosis; based on 7 Holds, 5 Sells, and 2 Buys, the analyst consensus rates the stock a Hold. However, some feel the shares are undervalued; the $8.42 average target implies one-year share appreciation of 22%. (See Palantir stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.