Palantir (NASDAQ:PLTR), a software company that specializes in big data analytics, reported Q1 results last week. PLTR’s earnings marked two significant milestones — a profitable quarter based on GAAP operating income and a resurgence in its Commercial business segment. These were the exact developments that investors had been eagerly anticipating, especially during the tough times when Palantir’s stock was under scrutiny.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

By attaining profitability, the company can now create tangible shareholder value and prevent excessive dilution. Additionally, the Commercial business’s resurgent growth in an era when firms are slashing expenses reinforces the essential nature of Palantir’s software in facilitating actionable decision-making.

Thus, it’s no wonder why the stock has rallied by about 22% since its earnings announcement, driven by a change in market sentiment. With Palantir’s top-line growth projected to be sustained near 20% over the next three years (based on consensus estimates) and margins expanding, my outlook on the stock has turned bullish.

Q1 Results: Pleasing Investors with Strong Numbers

Investors were pleased with Palantir’s Q1 results, as the company delivered impressive figures across various categories, especially in the most crucial areas. Let’s dive in.

Top-Line Growth

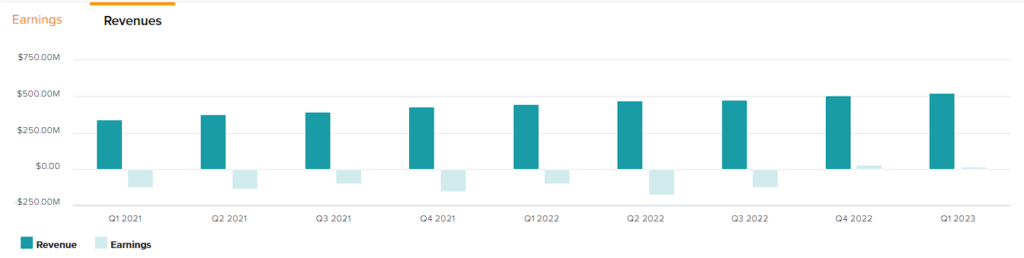

Revenues for the quarter landed at $525 million, implying a year-over-year increase of about 18%. This pace of growth may not sound monumental, but it’s actually quite impressive for a couple of reasons.

Firstly, Q1 is typically the slowest quarter for Palantir due to the seasonal nature of its business. During this period, companies tend to spend more conservatively to avoid surpassing their annual budgets.

Secondly, the current macroeconomic climate has led to a challenging environment for most tech companies, with many experiencing a slowdown in revenue growth due to cost-cutting measures prompted by rising interest rates. Despite these headwinds, Palantir’s Commercial segment managed to post re-accelerating growth, generating $236 million in revenue and achieving $176 million in total contract value (TCV), marking a 70% year-over-year increase.

This impressive performance was primarily driven by the company’s U.S. Commercial business, which exceeded $100 million in revenue for the first time and achieved a 26% year-over-year growth rate. Excluding revenue from strategic commercial contracts, U.S. Commercial revenue actually grew 46% year-over-year and 24% sequentially.

In addition to the strength of Palantir’s U.S. Commercial revenue growth, its U.S. Commercial customer count rose 50% year-over-year and 8% quarter-over-quarter, celebrating the ninth successive quarter of sequential growth. In fact, Palantir’s U.S. Commercial customer base has increased sevenfold from the same period in 2021, reaching 155 at the end of the quarter.

Despite the enterprise software industry’s weakening trend over the past two years, Palantir’s sustained customer growth and contract value growth during the current market landscape is a testament to its ability to provide value to its customers and speaks volumes about the functionality of its products.

Profitability

Regarding profitability, Palantir’s Q1 results marked the first-ever quarter of GAAP operating income ($4 million) and the second-ever quarter of GAAP net income ($17 million). This marked another landmark in the company’s sustained growth, assuring that Palantir can continue delivering robust growth and keep investing deeply in the transformational AI opportunities before us without continuously burning cash.

Given how rich Palantir’s margins are, the company should have ample room to grow its profitability in the coming years as its growing revenues unlock economies of scale. For example, in Q1, its adjusted gross margin was a staggering 81%, excluding stock-based compensation expense, and adjusted income from operations was $125 million, indicating an adjusted operating margin of 24%. Notably, the adjusted operating margin came in 600 basis points ahead of Palantir’s initial guidance, marking its third successive expansion quarter.

For Fiscal 2023, the consensus adjusted earnings-per-share estimate stands at $0.21, implying a nearly 260% increase from Fiscal 2022. Wall Street expects this metric to then grow by roughly 20% in Fiscal 2024 and then by roughly 30% in Fiscal 2025. This optimistic outlook likely reflects that the market foresees the current economic uncertainty to abate in the next couple of years, paving the way for Palantir to accelerate its profit growth even further thereafter.

Is PLTR Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Palantir features a Hold consensus rating based on two Buys, seven Holds, and five Sells assigned in the past three months. At $8.88, the average PLTR stock price target implies 6.2% downside potential, nonetheless.

If you’re wondering which analyst you should follow if you want to buy and sell PLTR stock, the most profitable analyst covering the stock (on a one-year timeframe) is Tyler Radke from Citigroup (NYSE:C), with an average return of 20.03% per rating and a 58% success rate. See below.

Final Thoughts

Palantir’s Q1 results exceeded investors’ expectations, with the company once again achieving profitability and a resurgence in its Commercial segment. Palantir’s sustained customer growth and contract value growth in the current market landscape are a testament to the value its products provide. Further, with strong growth momentum and expanding margins, Palantir’s outlook is optimistic. Hence, I am bullish on the stock.