Right now, it looks like 2023 will go down as the year AI went mainstream, with the tech giants riding the AI wave and responsible for much of the market gains. Companies further down the food chain, with AI exposure, such as Palantir (NYSE:PLTR), have also been enjoying the spoils. To wit, Palantir shares are up by a huge 183% year-to-date.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With Palantir set to report Q2 earnings next week (Monday, Aug 7), Monness 5-star analyst, Brian White, finds the company’s current valuation rich. White is currently on the PLTR sidelines, holding a Neutral rating with no fixed price target in mind. (To watch White’s track record, click here)

White does, however, have an idea about what’s in store from the Q2 readout. His 2Q23 revenue estimate stands at $540.7 million, above the Street at $532.7 million. The forecast takes into account growth of 14% year-over-year, less than the 18% seen in 1Q23, and far below the 26% uptick recorded in the same period last year.

White expects operating profit of $125.4 million, amounting to a 23.2% operating margin. At the bottom-line, his EPS forecast of $0.05 is the same as consensus. For the record, Palantir is looking for Q2 revenue in the range between $528-532 million and adjusted income from operations of $118-122 million.

Digging a bit deeper into the details, growth for Palantir’s government segment – where the bulk of its revenues are generated – has witnessed deceleration over the past two quarters. However, White also notes that for the past three quarters, this division has still been able to “outpace” the commercial segment.

“Looking forward,” says White, “we expect commercial activity to remain susceptible to the vicissitudes of the economy, while the timing of closing deals in the government market has proven unpredictable with lumpy revenue recognition.” That said, the US having proved to be more resilient in recent quarters, White anticipates the outperformance in the U.S. market will continue.

As for the Q3 guide, White is calling for revenue of $563.9 million, amounting to an 18% y/y increase vs. the Street at $552.1 million. His EPS forecast of $0.05 is the same as consensus once again.

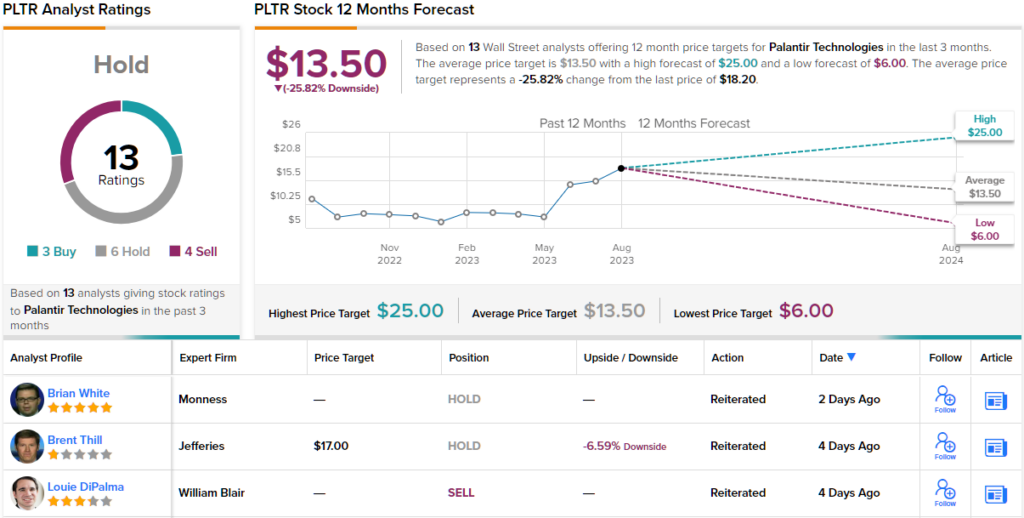

Like White, most on the Street are currently sitting this one out. Based on 6 Holds, 4 Sells, and 3 Buys, the analyst consensus rates the stock a Hold. However, most think the shares are somewhat overvalued; going by the $13.50 average target, they will see downside of ~26% over thew next year. (See Palantir stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.