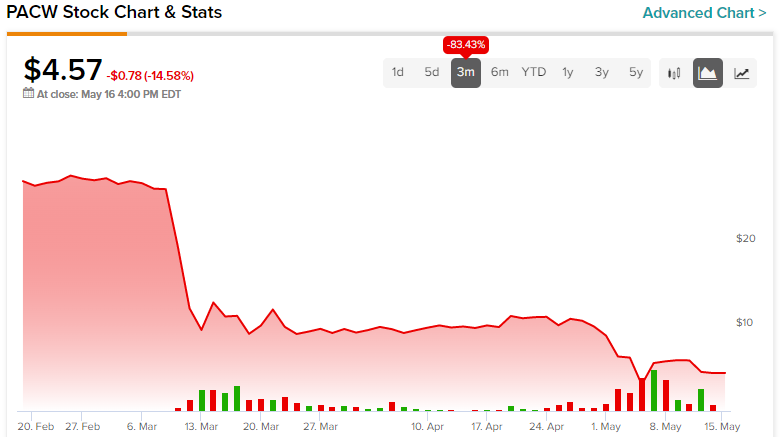

Late last week, PacWest Bancorp (NASDAQ:PACW) suffered a sharp loss of market value when its securities filing showed that deposits declined 9.5% during the week of May 5. Naturally, fading deposits indicate low confidence. However, the real headwind for the regional bank could be the loss of credibility among its shareholders. Therefore, I am bearish on PACW stock.

To be fair, CNBC reported that PacWest blamed the media for the majority of the outflows. Specifically, news that the lender was exploring strategic options spooked the bank’s clients. Further, PacWest stated that it funded those withdrawals with available liquidity. At the moment, the company has $15 billion of available liquidity compared to $5.2 billion in uninsured deposits.

Still, investors read between the lines. Last week, PACW stock fell by over 21%. Worse yet, it’s quite possible that even more pain can be headed for PacWest. After all, the deposit outflow represents just one component (albeit a big one) of this ugly mess.

PACW Stock Takes a Credibility Hit Among Shareholders

When the first two regional bank failures materialized this year, depositors that were unlucky enough to not pull out soon enough all had the same question: what would happen to their money? According to the Federal Deposit Insurance Corporation (FDIC), “The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category.”

Quickly, the federal government responded by promising that depositors’ money would be safe. However, the rub has always been the shareholders. The government clearly stated that it would not protect shareholders. Therefore, anyone deciding to invest in PACW stock or its embattled ilk risk losing everything.

Now, to be sure, holders of common stock typically stand last in line during liquidation proceedings. Everyone entering the capital markets should understand this point. However, most securities don’t just evaporate overnight. Usually, an increasing number of warning signs materialize before the end arrives.

However, with the troubled regional banks, the end really could come in the blink of an eye. As TipRanks reporter Shrilekha Pethe noted, shares of regional banks incurred cryptocurrency-like volatility. Part of the allure of cryptos is that they can skyrocket for little to no reason. However, they can also go to zero for the same.

Effectively, then, shareholders have little reason to hold PACW stock. If the underlying bank does collapse, no government agency would fight for their rights.

Uncle Sam Can’t Hold the Line Indefinitely

Another factor that underscores the anxieties over PACW stock is that the federal government has limited levers to pull. Certainly, getting in front of the first two bank failures quickly may have been the right move. However, with a third regional bank failing – along with the prospect of future failures – even depositors will have to worry.

Let’s look at it this way: if all it took to solve the current banking crisis was for government entities to keep supporting depositors, they would do just that. Unfortunately, Uncle Sam lives in the same paradigm of limited resources, just like anyone else. While the scale may be exponentially larger, at some point, government intervention will lose its potency.

Again, this circumstance disincentivizes investors from holding onto PACW stock, hence, the sharp losses.

The Financials Don’t Necessarily Help

In fairness, PacWest delivered adjusted earnings per share of 66 cents for the first quarter of 2023, beating analysts’ consensus target of 65 cents. However, the latest tally represents a low point compared to adjusted EPS of $1.01 in the year-ago quarter.

On the top line, PacWest posted revenue of $315.66 million, which missed analysts’ target by 1.4%. In addition, it represented an unfavorable comparison to the year-ago quarter, when PacWest rang up sales of $329.54 million.

Put another way, even in the financial realm, PACW stock presents a credibility challenge.

Is PACW Stock a Buy, According to Analysts?

Turning to Wall Street, PACW stock has a Hold consensus rating based on two Buys, six Holds, and zero Sell ratings. The average PACW stock price target is $17.17, implying 275.7% upside potential.

The Takeaway: PACW Stock Gives Little Reason for Hope

While the loss of deposits garnered the most headlines for PacWest, the real culprit may be credibility woes among shareholders. By now, it’s apparent to anyone holding PACW stock or similar investments that the government won’t bail them out. Only depositors will be protected and even that may be problematic if these failures continue to steamroll.