It’s clear now that we saw the market bottom out last October. The S&P 500 is up about 1,000 points, or ~27%, from that trough. The question for investors now is, what happens next?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Mike Wilson, the well-known strategist from Morgan Stanley, has a reputation as an uber-bear, but he’s pulling back from that in a recent note. “The data we have today suggests to us that we are in a policy-driven, late-cycle rally,” Wilson says. He goes on to note several supportive factors, including a reduced rate of inflation, the deceleration of the Fed’s tightening policy, and the widespread consensus that the last rate hike, of 25 basis points, was the last of this tightening cycle – and that the Fed will shift toward easier money later this year.

Wilson also draws attention to similarities between current conditions and 2019, the last time the Fed was pushing monetary easing, noting, “The 2019 analogy, in and of itself, suggests more index level upside from here.”

Looking ahead, Wilson believes we’re in for gains as 2023 heads towards its close, and his colleagues among the Morgan Stanley stock analysts are taking that thought and running with it. The firm’s analysts are picking out stocks with ‘more upside ahead,’ and have tagged two that they feel will surge by 50% or better from their current levels. Let’s take a closer look.

Altus Power (AMPS)

The first Morgan Stanley-endorsed name takes us to the utility sector, where Altus Power works in the solar energy niche. The solar energy segment as a whole has received a policy boost from the Biden Administration, a boost that was codified with the Inflation Reduction Act signed into law last year. Altus is a customer-focused company offering solar power installations for commercial, industrial, and community use across the US. The Connecticut-based company has operations in the upper Mississippi Valley, in the southeast, and the southwest, but the bulk of its operations are in the northeast and in California.

In addition to solar power installations, Altus offers energy storage and electric vehicle charging services. The company boasts that every installation is tailored to the specific customer needs; its commercial operations are designed to bring the customer on board with the project development process in order to streamline the permitting, construction, and commissioning processes, while the community ops focus on sustainable and renewable options to provide clean energy for residents. Altus boasts that it has installed over 4.55 billion kilowatt-hours of solar power since 2009.

Altus will report its 2Q23 results later this month, but a look back at Q1, and the months since, is revealing. The company reported $29.4 million in revenues for Q1, which was up 53% year-over-year. The company’s bottom line, measured by GAAP, was 3 cents, beating the estimates by 6 cents. The company claimed a total portfolio of approximately 686 installed megawatts of power generation, a total that included 8 megawatts which had been completed in April and May.

This brings us to one of Altus’ key strengths: the company’s commitment to continually expanding its network. Since the Q1 results were released, Altus has also announced the acquisition of 4.4 megawatts of power generation facilities in California, adding to the 112 megawatt total portfolio in that state. And, also in July, Altus announced it had added a new 10-megawatt solar power system plus a 15-megawatt-hour battery storage system to its assets in Massachusetts. Altus now operates in 25 states.

Covering Altus for Morgan Stanley, analyst Andrew Percoco sees the company’s community installations as a unique asset that can be built on for further growth.

“While AMPS is often pegged as a rooftop C&I developer, which is true, it doesn’t fully encompass the wider market opportunity, which includes community solar (24% of existing portfolio). While the community solar market is small today, it provides a unique opportunity for the company to leverage the rooftop and land access from its C&I customers to provide clean and affordable energy to residential customers that do not have the ability to add rooftop solar,” Percoco opined.

“Based on our math, we see more upside opportunity than downside risk to the company’s 2023 guidance – note that the company exited 2022 with ~$79m of annualized EBITDA and after accounting for its True Green acquisition, which we estimate adds $17-$19m of contracted EBITDA in 2023, putting the company in reach of the low-end of its guidance, before considering the additional assets it is putting in service this year,” the analyst added.

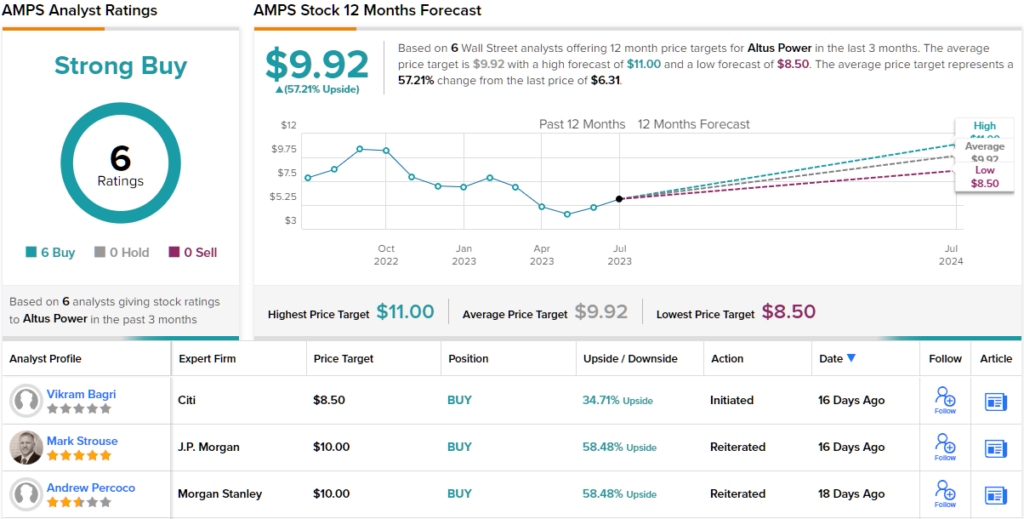

To this end, Percoco sets an Overweight (i.e. Buy) rating on AMPS, as well as a $10 price target that indicates his confidence in a 58% one-year potential upside. (To watch Percoco’s track record, click here)

Overall, this solar power firm gets a unanimous Strong Buy consensus rating, based on 6 positive analyst reviews set recently. Altus shares are trading at $6.31, and the $9.92 average price target suggests an upside of 57% in store for the next 12 months. (See AMPS stock forecast)

United Airlines Holdings (UAL)

The next Morgan Stanley pick is United Airlines, one of the major US legacy air carriers – and by some metrics, the world’s largest airline. The company offers more available seat miles than any other airline, but it is the third largest by total fleet size, with 893 aircraft in operation. That could soon change, as of this past December, United placed a blockbuster order with Boeing for 100 modern 787 wide-body Dreamliner passenger jets – and an option to buy another 100 going forward.

United certainly has the infrastructure to expand its fleet. The company operates out of multiple hubs in the US – in such major locations as Chicago, Denver, Houston, LA, San Fran, New York/Newark, and DC – and flies approximately 5,000 daily routes to more than 342 locations on six continents. Among the North American air carriers, United has the most comprehensive global route network.

The company has clearly benefited in recent quarters from the general post-COVID economic rebound. People want to travel, and are doing so now that pandemic restrictions are lifted. United has seen its quarterly earnings show consistent year-over-year gains since the beginning of 2022.

The last reported quarter, 2Q23, was no exception. The company’s top line of $14.2 billion was up more than 17% year-over-year, and beat the forecasts by over $250 million. At the bottom line, United reported a solid non-GAAP EPS profit of $5.03, which was 97 cents ahead of the estimates. Perhaps the best metric, for investors, was the guidance on full-year adjusted EPS – United is predicting earnings in the range of $11 to $12 per share for the full year 2023 compared to the consensus forecast of $9.65.

The recent earnings caught the attention of Morgan Stanley analyst Ravi Shanker, who wrote of United, “UAL has been the consensus long of the Airlines group YTD and the 2Q result, conference call commentary, and forward outlook gave no reason to dampen that enthusiasm. The bigger surprise was the ‘similar or slightly better’ Domestic PRASM commentary for 3Q which is a much better outlook than peers. Perhaps this reflects slightly different comps or just better mix at UAL but either way, it changes the narrative of UAL being an ‘international only’ story. The late June disruptions kept the beat and raise from being even bigger but sets up for an easier comp for 2024 – if UAL can get past its bottlenecks at Newark in the long-term.”

Tracking this forward, Shanker rates the stock as Overweight (i.e. Buy), with a one-year price target of $80, suggesting a 52% gain from current levels. (To watch Shanker’s track record, click here)

Overall, United has picked up 15 recent Wall Street analyst reviews, and these include 10 Buys, 4 Holds, and 1 Sell to give the stock its Moderate Buy consensus rating. The shares are selling for $52.42 and the $69.31 average price target implies a 32% upside on the one-year horizon. (See UAL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.