Shares of Oracle (NYSE:ORCL) appear to be still offering a tantalizing blend of value and growth, despite the stock trading nearly 50% higher from its 52-week lows.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company remains a cash cow that is still growing despite how mature its legacy business segment has become while returning boatloads of cash to shareholders. Yet, the stock is trading at a relatively conservative valuation compared to most of its peers.

Surging Growth Paving the Way for Record-Breaking Profits

Oracle’s accelerating growth is setting the stage for the company to achieve new earnings-per-share records in Fiscal 2023. As a reminder, up until 2020-2021, Oracle’s revenues had been rather stagnant for around a decade.

That said, Oracle has been on fire in the past couple of years, skyrocketing its revenue growth. The reason? More and more customers realize that Oracle’s second-generation infrastructure cloud is simply superior in terms of performance, security, and reliability. It’s a cut above the older, first-generation hyper-scale cloud providers.

This was again evident in the company’s most recent Fiscal Q2-2023 results, with total Cloud revenue (that is, SaaS and IaaS), including Cerner, coming in at $3.8 billion, up 48% in constant currency. Separately, IaaS revenue reached $1.1 billion, up 59%, while SaaS revenue reached $2.8 billion, up 45% over the prior-year period. However, even if we exclude the acquisition of Cerner, which contributed to significantly boosting revenues, total Cloud revenue growth was still strong at 27%.

The company also recorded an equally strong pace of growth in application subscriptions and its software license revenues, resulting in total revenues growing 25% (on a constant-currency basis) to $12.3 billion. Excluding Cerner, organic growth was 9%. Long-time Oracle investors must find these numbers thrilling as the company has finally started to unlock its true potential and is delivering meaningful growth after years of financial stagnation.

At this point, it’s worth noting that besides growing demand for its products, another contributor that helped Oracle grow its customer base was discounted prices.

It’s no secret why Oracle is making these moves. The company is looking to level the playing field against its heavy-hitting peers in the industry Amazon’s (NASDAQ:AMZN) AWS, Microsoft’s (NASDAQ:MSFT) Azure, and Alphabet’s (NASDAQ:GOOGL) Google Cloud. This has come to an expense to gross profit margins, which fell to 76.1% based on the company’s last twelve-month (LTM) numbers, down from above 80% two years ago.

Nevertheless, revenue growth has outperformed the pace of declining gross margins, resulting in growing gross profits. This, along with Oracle’s commitment to repurchasing large amounts of its stock, has positioned the company to once again achieve record earnings per share this year.

Analysts expect the company to achieve earnings per share of $4.91 for Fiscal 2023, up slightly compared to last year. Earnings-per-share growth is then expected to jump to the mid-teens in Fiscal 2024-25, as results will exclude the expenses recorded for Cerner, while the company is set to unlock further operating efficiencies from this acquisition.

Booming Capital Returns: A Sound Business Strategy

Oracle has been incredibly consistent with growing its capital returns to shareholders, which should be a great indicator of the underlying success of its business strategy. With EBITDA margins that have historically hovered close to 40%, Oracle can afford to return tons of its operating cash flows in the form of dividends and buybacks.

Oracle has been on a roll when it comes to increasing its dividend per share over the past decade, with the latest increase being by a whopping 33.3%. However, the increase came over two years ago, which raises some concerns about the consistency of its dividend growth.

It’s not all doom and gloom, though. Oracle still has three quarters to increase its dividend in order to maintain its current growth streak. Furthermore, the company is financially sound and has room to increase its dividend, as its forward payout ratio is currently at 26% based on the projected earnings per share of $4.91 for the year. So, investors might see an increase sooner than later.

Besides dividends, Oracle has an extended track record of aggressive stock repurchases. However, buybacks have slowed down lately, with Oracle repurchasing just under $2 billion worth of stock during the first two quarters of Fiscal 2023 versus nearly $16 billion in the comparable period last year.

Nonetheless, this slowdown is just a temporary blip caused by the company’s recent acquisition of Cerner and the need to keep a solid cash reserve. In my view, Oracle’s buyback machine will be back in full force, moving forward.

Also, to give a sense of the scale of Oracle’s buybacks, the company has made such aggressive repurchases that it has cut its share count in half over the past decade. That’s what I call commitment to returning capital to shareholders.

Is ORCL Stock a Buy, According to Analysts?

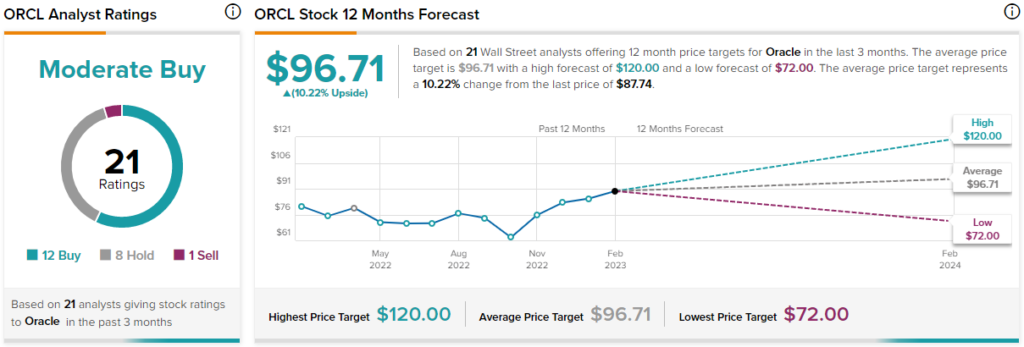

Turning to Wall Street, Oracle has a Moderate Buy consensus rating based on 12 Buys, eight Holds, and one Sell assigned in the past three months. At $96.71, the average Oracle stock forecast implies 10.2% upside potential.

The Takeaway

Oracle has been on a roll in recent years, with its accelerating growth setting the stage for a record earnings-per-share figure in Fiscal 2023.

By combining its operating momentum, strong track record of capital returns, and reasonable valuation multiple (shares are trading at a P/E of 18 compared to the sector median of 19), Oracle appears to be offering a compelling investment opportunity for those looking for a balance of value and growth potential.