Oracle (NYSE:ORCL) is scheduled to report its second-quarter Fiscal 2024 results on December 11, after the market closes. Strong momentum in the company’s cloud business, particularly due to the growing demand for its generative artificial intelligence services, might have supported ORCL’s performance in the quarter.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Currently, the Street projects that Oracle will report earnings of $1.33 per share, up about 10% from the year-ago quarter. Furthermore, analysts expect the company’s sales to have increased by 6.3% from the same quarter last year.

Mixed Analysts’ Opinions

One analyst, Mark Murphy from J.P. Morgan, has maintained a neutral stance on ORCL stock. The analyst believes that while the company’s cloud unit is attracting customer interest, its growth trajectory might be hampered by challenges related to expanding GPU-equipped data centers.

Meanwhile, Jefferies analyst Brent Thill assigned a Buy rating on Oracle stock. Thill anticipates strong Oracle Cloud Infrastructure (OCI) growth for Q2, driven by a broader software industry recovery as indicated by positive signals from other companies. Additionally, the analyst considers ORCL stock attractive due to its favorable risk/reward profile.

Is Oracle Stock a Buy or Sell?

Overall, Wall Street is cautiously optimistic about Oracle. The stock has a Moderate Sell consensus rating based on 14 Buys and 11 Holds. The average ORCL stock price target of $131.97 implies 16.2% upside potential. Shares have gained nearly 38% year-to-date.

Insights from Options Trading Activity

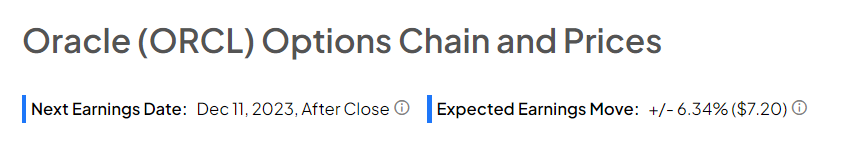

TipRanks now presents options activity to help investors plan their trades ahead of earnings releases. Options traders are pricing in a +/- 6.34% move on Oracle’s earnings, compared with the previous quarter’s earnings-related move of -13.5%.

Ending Note

Oracle is expected to deliver improved financial results in the upcoming quarter, with support from significant investments in AI technology. During its investor day held on September 21, Oracle introduced new generative AI products like the Oracle Clinical Digital Assistant and disclosed the integration of AI features into its NetSuite financial software. With these advancements, ORCL aims to enhance efficiency and cost-effectiveness for its clients.