After listening to Safra Catz, the CEO of Oracle (ORCL), discuss the company’s Q2-2022 earnings and give an update on the company’s third-quarter expected profits and the overall strategy the company is pursuing moving forward, I am bullish on this stock.

When describing the company’s strategy, Catz stated that Oracle was the only company in its space that offers IT infrastructure in the cloud and industry-specific enterprise resource apps that meet customers where they are in their transition to the cloud. Oracle then provides the most robust set of options to aid and speed client workloads once they are in the cloud.

An example Catz gave for how much Oracle software can improve workflow and cut the time required to do things such as year-end and quarter-end close is that she was able to host the end of the quarterly conference call to announce Oracle’s earnings nine days after the period closed.

As an accountant, I was impressed by that fact. The speed at which all those transactions were booked, reconciled, and the books were closed is fantastic.

As far as data points, the one thing that impressed me the most was not that the company showed a robust 6% growth in revenue for the quarter or that the Cloud-as-a-Service (CaaS) now accounts for over 75% of the company’s business (meaning that they will earn monthly fees from each of those sales each month).

What impressed me was the number of new clients waiting to be onboarded to the CaaS package is growing each month. That means that the revenue for the CaaS portion of the business will continue to grow and push earnings higher each quarter.

I like this business model and think that Oracle’s ability to provide IT infrastructure and the software apps that go along with the infrastructure make Oracle the clear winner in the ERP/cloud-computing space.

Recent Results and Dividend

Oracle brought in revenues of $41.4 billion over the last twelve months with a net income of $10.26 billion.

The company has reported third-quarter earnings of $1.21 per share, beating analyst estimates of $1.11 per share by $0.10. It has also reported $4.94 in earnings per share for the previous four quarters, beating analyst estimates of $4.50 by $0.44 during that period.

Oracle currently pays a dividend of $0.32 per quarter. This is a dividend yield of 1.58%, and it grew 33% during the last year. This is outstanding growth in the dividend and something I will be watching closely to see if this amount of growth is continued.

The company has a solid balance sheet. Oracle has a current ratio of 1.65, so it has enough current assets on hand to pay its bills for more than a year and a half of bills at its current burn rate.

When I calculated the stock’s intrinsic value by modeling discounted cash flows, I pegged it at $171.18. I believe that the company’s continued growth in top-line revenue, net income, and earnings per share will act as a catalyst for the market to catch up to the stock’s intrinsic value.

Wall Street’s Take

19 Wall Street analysts currently cover ORCL and have issued 12-month price targets. Of the 19, six rate the stock as a Buy with a high forecast stock price of $126 and a low stock price of $87. 13 analysts who cover Oracle rate it a Hold.

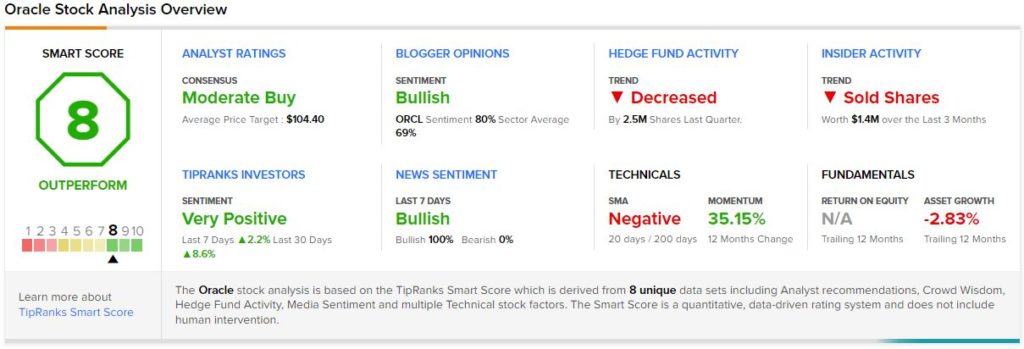

The stock comes in as a Moderate Buy, and the average Oracle price target of $104.40 implies 28.3% upside potential.

Of the last 15 bloggers that have blogged about Oracle, 80% are bullish, while the sector average is approximately 69% are bullish on the technology sector in the last three months.

Conclusion

Based on the intrinsic value of this stock, the Wall Street analyst’s estimates, blogger estimates covering Oracle, and management’s growth plan, I am bullish on this stock. I think that Oracle is the clear leader in the cloud ERP space, and it will continue to create shareholder value for years to come.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure