During these long dog days of summer, it’s tempting to fall back on the ‘old reliable’ stocks, the large-cap market leaders that have driven so much of the growth we’ve seen over the past 18 months. As Oppenheimer’s equity research team notes, ‘It’s tough to argue with the action in large-cap growth.’

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But – those same stock experts are also pointing out that there are plenty of opportunities further down the market food chain, where investors can get into the small- and mid-cap stocks. For the professional analysts at Oppenheimer, several smidcaps represent some of their favorite summer picks, shares that are showing solid potential for substantial near- to mid-term gains.

We can find the financial services firm’s view of these stocks laid out clearly in its recent thematic research note. Discussing smidcaps as an option, the firm’s equity research team writes: “Given Oppenheimer’s historical thought-leadership and strength in smidcaps and the rotation that appears to be under way in the market, we asked Oppenheimer Research analysts for their high-conviction best smidcap ideas for 2024. Eligible smidcaps have a market cap of $1B to $10B. Our best smidcap ideas provide exposure to many innovators that stand to benefit from high-growth themes.”

Following Oppenheimer’s lead, we’ve opened the TipRanks database and pulled the latest details on two of the firm’s smidcap picks. Both also have Strong Buy ratings from the Street’s consensus, yet Oppenheimer sees even more upside than the Street allows. Here’s a closer look.

Genius Sports, Ltd. (GENI)

We’ll start in the world of online sports betting, with Genius Sports. This is mainly a tech company, focusing on data collection and collation from the major professional and collegiate sports leagues. The company, which was first founded in 2001, reaches out to sports audiences through iGaming services, offering sports fans a combination of immersive viewing experiences and data-driven content through widely-known brands in the world of online sports betting.

Genius Sports uses its software and data store, powered by AI and machine learning systems, to create real-time digital connections across the sports ecosystem, to back up the best in online sports betting. The company has the most up-to-date data, at every level from the teams on the playing fields to the leagues to the fans in their living rooms cheering and looking to put some skin in the game. Genius Sports supports the betting venues and makes it possible for them to support their customers.

Sports betting is big business, giving Genius Sports a large business niche for operations. The company’s tech is available in 150 countries, and it works with over 400 sports partners. Genius Sports’ partners include such major leagues as the NFL, the English Premier League, and the PGA Tour.

In the most recently reported quarter, 1Q24, Genius Sports reported a top line of $120 million. This figure was well above the published guidance of $117 million, was up more than 23% year-over-year, and beat the forecast by $2.68 million. At the bottom line, the company ran a net loss, with the GAAP EPS coming in at ($0.11), a penny below the estimates. Genius Sports currently has a market cap of $1.37 billion, squarely in the small-cap category.

Turning to the Oppenheimer view, we find analyst Jed Kelly writing up an optimistic take on GENI shares, saying of the company, “We believe Genius Sports, a top-two online sports betting (OSB) data provider, is the best option for small-cap investors to gain exposure to the exponential growth in US sports betting. GENI is firmly entrenched as a main player in the US OSB landscape after extending its National Football League and Football DataCo partnerships into 2028 and 2029, respectively.”

“Additionally,” Kelly further adds “it is not exposed to the rapid online market share consolidation from Draftkings and Fanduel that is weighing on the multiple of smaller operators under $5B market capitalization, such as PENN Entertainment/Rush Street Interactive.”

Kelly goes on to put an Outperform (Buy) rating on these shares, with a price target of $10 suggesting a one-year upside of 67.5%. (To watch Kelly’s track record, click here.)

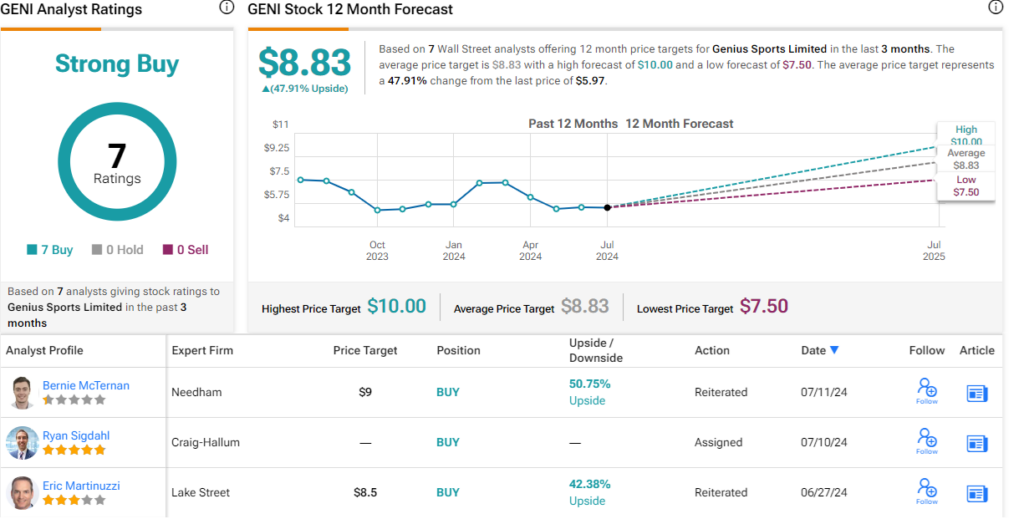

This stock has a Strong Buy rating from the Street’s analysts, based on Buys only – 7 in total. The stock is priced at $5.97, and its $8.83 average target price implies it will gain 48% in the year ahead. (See Genius Sports’ stock forecast.)

iRhythm Technologies (IRTC)

The heart is our most vital organ; even our language reflects this, as we get to the heart of a matter. And our next stock, iRhythm, does just that. The company is a medical device firm and digital healthcare company, focused on creating wearable biosensors that are smaller, lighter, and easier to use than legacy sensor devices. iRhythm’s devices monitor individual patients and create a database of aggregated data, making it possible for physicians to diagnose and treat conditions, particularly heart conditions such as arrhythmias, with greater precision.

The company’s flagship platform is Zio, a monitoring system that has been cleared by the FDA for use as an ambulatory cardiac monitor. The monitor sensor is described as a ‘small, discreet, and wearable patch,’ affixed to the patient’s chest over the heart. The Zio patch can be worn during ordinary daily activities, such as exercise, showering, and sleeping. The smaller size and greater comfort of use leads to higher patient compliance, up to 99%. The monitor has gathered more than one billion hours of heartbeat data.

This company reported $131.9 million in revenue during 1Q24, a total that was up more than 18% year-over-year and beat the forecast by over $3.5 million.

iRhythm’s bottom line, like many cutting-edge medical tech companies, runs at net loss. In the first quarter of this year, the last period reported, the company’s non-GAAP EPS was reported as a negative $1.23, some 24 cents per share lower than had been anticipated.

We should note here that iRhythm has a market cap of $3 billion, putting the company in the mid-cap category.

For Suraj Kalia, covering this stock for Oppenheimer, the key points are the quality of the firm’s heart monitor – as demonstrated by ease of use – and the large addressable market. He says of iRhythm, “The ease of use of the Zio-XT, combined with IRTC’s unique service model has allowed it to capture ~70% share in the extended Holter monitoring market. National reimbursement rates are ~30% lower than 2020, and the company is readjusting its logistics chain to optimize topline and margins. Part of this realignment includes moving some operations to the Philippines and higher use of its San Francisco independent diagnostic testing facility which enjoys a geographic premium to national rates… Targeting OUS markets and primary care provider channels in the US are additional strategic endeavors in the works.”

Kalia follows these comments with an Outperform (Buy) along with a $165 price target, implying a 71.5% upside potential in the next 12 months. (To watch Kalia’s track record, click here.)

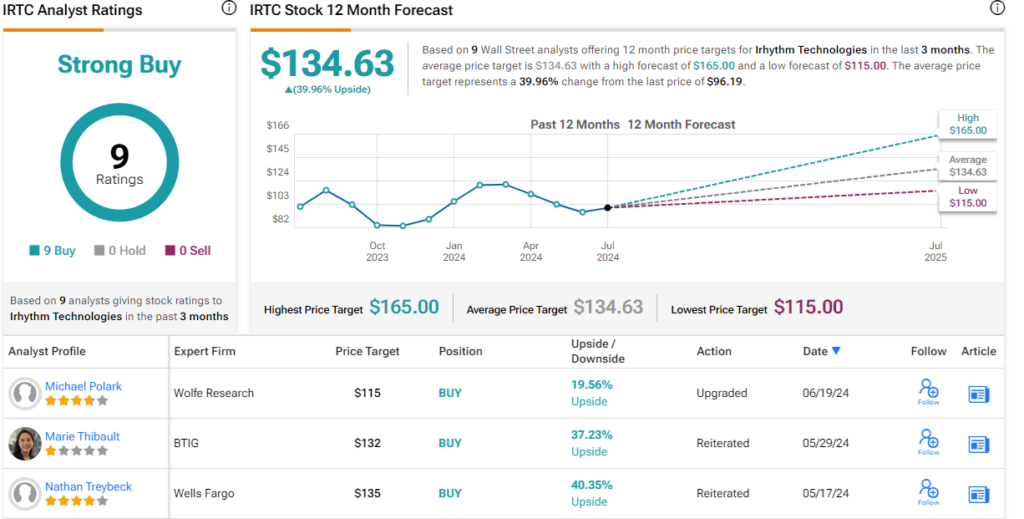

The 9 recent analyst reviews on iRhythm are unanimous, and positive, giving the stock its Strong Buy consensus rating. The shares are trading for $96.19 and have a $134.63 average price target, pointing toward a one-year gain of 40%. (See iRhythm’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.