The summer is now upon us and it’s sunny days for the markets too. June represented the best month for the S&P 500 since January with the bellwether index delivering gains of 6.5% during the month.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The good news, according to Ari Wald, Oppenheimer’s Head of Technical Analysis, is that the rally is set to extend itself further, if history is anything to go by.

“We reiterate our expectation for a summertime rally because internal breadth continues to improve, plus the S&P has posted an above-average return of 1.3% in July of a first-term, pre-election year since 1929,” Wald noted. “This compares to a 0.6% gain for any month during this period.”

Moreover, going forward, Wald has high hopes for the stocks drawing less attention. “We remain encouraged about emerging strength in the areas that have limited market participation,” he explained. “For instance, the equal-weighted S&P 500, Russell 2000, and Russell 1000 Value have each reversed their short-term downtrend, by our analysis. The market implications are bullish because leaders and laggards rally together.”

With this in mind, we thought we’d take a closer look at three less obvious stocks that are receiving the thumbs up from Oppenheimer analysts. According to the firm’s experts, these stocks are poised to deliver substantial gains in the coming months, with one expected to generate impressive returns of 140%. We’ve used TipRanks’ database to gain insights into the general Street sentiment toward these equities. Let’s dig in.

Extreme Networks (EXTR)

The first Oppenheimer pick we’re looking at is Extreme Networks, a leading global provider of networking solutions and services for enterprises and organizations. The company offers a comprehensive portfolio of products, including switches, routers, wireless access points, and network management software, designed to meet the evolving needs of modern networks. Its motto of “one Network, one Cloud, one Extreme” emphasizes the company’s mission to simplify networking, harness the power of the cloud, and deliver exceptional solutions and experiences to clients.

It appears that customers are responding positively to that slogan. Over the past several quarters, Extreme’s revenue has been steadily improving, accompanied by consistent bottom-line beats. In the most recently reported quarter, the third fiscal quarter of 2023 (March quarter), both positive trends continued. The revenue reached $332.5 million, reflecting a 16% year-over-year increase and a 4% quarter-over-quarter uptick. This figure surpassed the consensus estimate by $13.08 million. Additionally, the adjusted EPS of $0.29 exceeded the forecast by $0.03 and demonstrated improvement compared to the $0.21 recorded in the same period a year ago.

Looking ahead, for FQ4, the company is guiding for revenue in the range between $340 million- $350 million, at the mid-point some distance above consensus at $332.39 million.

Extreme saw out the quarter with free cash flow of $45.8 million, and repurchased a total of 1.35 million EXTR shares during the period for a cost of $25 million.

The stock has put in a good showing this year, boasting 43% gains. Extreme also has a supporter in Oppenheimer’s Timothy Horan, who sees more gains ahead and lays out the reason to keep on backing the networking firm.

“Extreme has one of the best Wi-Fi and Switching equipment and software for enterprises,” said the 5-star analyst. “This is provisioned and managed over the cloud. Its new universal equipment supports compute, security, and now AI, all at the edge and directly in the hands of enterprises. This is now a substantially larger TAM, and in our view, EXTR has the ability to gain market share.”

Conveying his confidence, Horan rates EXTR an Outperform (i.e., Buy) alongside a $35 price target, suggesting the shares will add another 34% in the months ahead. (To watch Horan’s track record, click here)

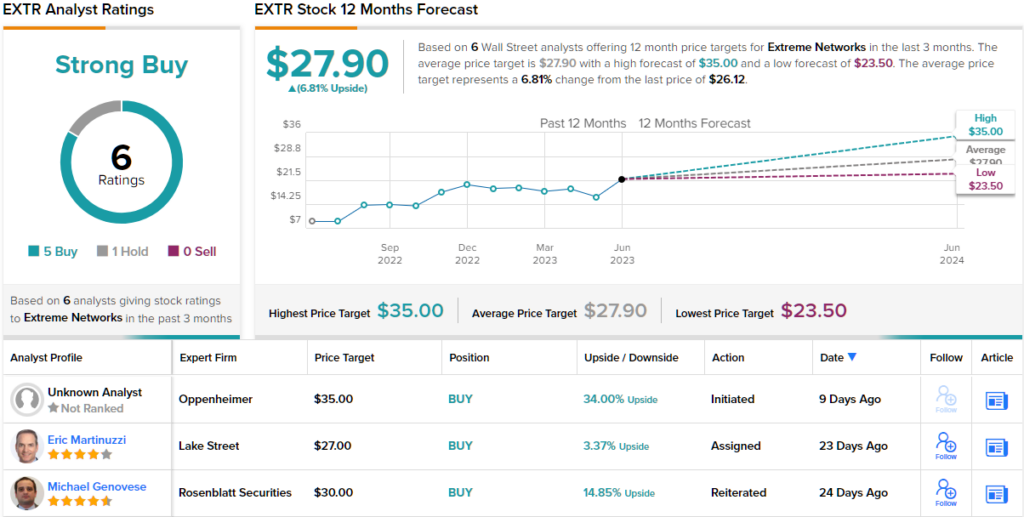

Looking at the consensus breakdown, based on a total of 5 Buys vs. 1 Hold, the stock claims a Strong Buy consensus rating. The shares are priced at $26.12, with a $27.90 average price target suggesting ~7% increase from current levels. (See EXTR stock forecast)

Viking Therapeutics (VKTX)

Let’s now switch gears and turn to the biotech sector. Viking Therapeutics is a clinical-stage biopharma company focused on the development of novel therapies for patients afflicted with metabolic and endocrine disorders.

The company’s lead asset is VK2809, a thyroid-beta agonist intended to treat patients with NASH (nonalcoholic steatohepatitis, the most serious version of nonalcoholic fatty liver disease (NAFLD)). Viking recently released data from the phase 2b VOYAGE study, in which the main target was met. The drug showed it lowered liver fat in patients with non-alcoholic steatohepatitis (NASH) in a statistically significant manner. There’s another catalyst on the horizon for the drug, with the company slated to release 52-week biopsy data from the study in 1H 2024.

Elsewhere in the pipeline, based on promising initial data, a phase 2 trial assessing VK2735 as an obesity drug is slated to kick off shortly. An oral formulation of VK2735 is also being tested in a phase 1 study that the company recently initiated.

Viking’s promising pipeline has propelled its shares forward this year, boasting an impressive year-to-date gain of 67%. However, the stock faced a setback when it declined by 30% over two sessions last week, following updates from competitors regarding their programs.

However, considering the share price drop, Oppenheimer analyst Jay Olson thinks that not only is the decline unmerited, but that developments elsewhere bode well for Viking’s pipeline.

“We see VKTX shares’ underperformance as unwarranted, and think there’s overall favorable read-across to VKTX’s programs,” Olson said. “On NASH, we see the totality of MDGL’s Ph3 MAESTRO-NASH results at EASL as providing further validation to VK2809 with recent positive topline results from the Ph2b VOYAGE study. On obesity, as competition clearly intensifies, we believe VK2735 remains an attractive asset. Furthermore, the oral formulation of VK2735 should benefit from PFE’s announcement to discontinue development of lotiglipron.”

Olson really does think the shares are undervalued. Along with an Outperform (i.e., Buy) rating, his $140 price target implies one-year share appreciation of a strong 140%. (To watch Olson’s track record, click here)

So, that’s Oppenheimer’s view, what does the rest of the Street make of VKTX’s prospects? All are on board, as it happens. The stock has a Strong Buy consensus rating, based on a unanimous 10 Buys. Moreover, the $33.39 average target, suggests shares have room for 113% growth in the year ahead. (See VKTX stock forecast)

HashiCorp, Inc. (HCP)

Last but not least is HashiCorp, a provider of infrastructure software that plays a crucial role in the ongoing digital transformation. HashiCorp assists businesses in effectively operating within cloud environments, making it a key enabler of modernization efforts. With its suite of automated solutions, HashiCorp focuses heavily on open-source products to deliver value across industries and organizations of all sizes. These solutions not only accelerate product readiness but also reduce operational costs and enhance workflow efficiency. In essence, HashiCorp empowers its customers to adopt a streamlined operational approach, driving productivity and maximizing operational effectiveness.

Since going public in late 2021, the company has consistently experienced a steady increase in revenue, and this positive trend continued in the recently reported first quarter of fiscal 2024 (April quarter). The revenue surged by an impressive 36.7% year-over-year, reaching $137.98 million and surpassing analysts’ expectations by $4.85 million. Additionally, the adjusted EPS of -$0.07 exceeded the anticipated -$0.14 estimated by analysts. The company saw out the quarter with 4,392 customers, up from the 4,131 clients reached at the end of Q4.

Those were pleasing results; however, the shares suffered a significant blow in the aftermath of the earnings release, plummeting by 26% in a single session. This decline was attributed to a familiar scourge— an underwhelming outlook. For FY24, HashiCorp reduced its revenue forecast from the prior $591 million to $595 million range to between $564 million – $570 million, while also falling short of consensus expectations for $575.32 million.

The Street duly handed out its punishment, but Oppenheimer’s Ittai Kidron is more forgiving. “Given 1Q is a seasonally soft quarter with low visibility into full-year trends, we believe management is prudently embedding a high degree of conservatism into FY24 guidance,” explained the 5-star analyst. “The current outlook assumes no changes to procurement timelines and for large contracts to push into FY25. In our view, we see potential for budgetary pressures to ease in 2HFY24 if macro conditions remain stable, setting up the potential for upside to the current outlook…”

“Overall,” Kidron summed up, “we remain positive on HashiCorp’s long-term opportunity and view the current challenges as temporary.”

Quantifying this stance, Kidron rates HashiCorp shares an Outperform (i.e. Buy) along with a $42 price target. Should the figure be met, the stock will be changing hands for a 59% premium a year from now. (To watch Kidron’s track record, click here)

Turning now to the rest of the Street, where based on an additional 9 Buys and 5 Holds, the stock receives a Moderate Buy consensus rating. The forecast calls for 12-month returns of ~24%, considering the average target stands at $32.60. (See HashiCorp stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.