When legendary investor Warren Buffett said to be greedy when others are fearful and fearful while others are greedy, it’s quite likely that he wasn’t speaking in absolute terms. A classic example might be Opendoor Technologies (NASDAQ:OPEN). Once a crowd favorite for spearheading a new innovation in the real estate industry, the enterprise quickly soured this year. Essentially, the business model features a fatal flaw, meaning people should stay away from OPEN stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

At first glance, though, circumstances appeared auspicious for Opendoor. Specializing in the iBuyer business model, this platform leverages advanced technologies such as artificial intelligence to make quick cash offers on homes with the ultimate goal of flipping them for profit. Supposedly, the use of AI technologies empowers quicker and superior decisions than a human could make. On paper, the narrative sounded reasonable and credible.

Further, the dramatic rise in homebuying demand – a consequence of artificially lowered interest rates – initially confirmed Opendoor’s relevance. At its peak range, OPEN stock traded briefly above $30. However, as realities started to set in, the underlying fundamental framework lost much of its appeal.

With the Federal Reserve now tasked with controlling the inflation stemming from prior monetary excesses, the benchmark interest rate started to rise. As borrowing costs spiked in tandem, fewer people qualified for home mortgages. What’s worse, home prices remained elevated against pre-pandemic norms. Combine this dynamic with mass layoffs, real estate businesses saw a decline in their total addressable market.

This headwind was particularly pronounced for OPEN stock, highlighting a fatal flaw. At the end of the day, the ultimate business model of Opendoor – buy low, sell high – offered zero distinction. Indeed, the AI angle merely represented a very expensive distraction.

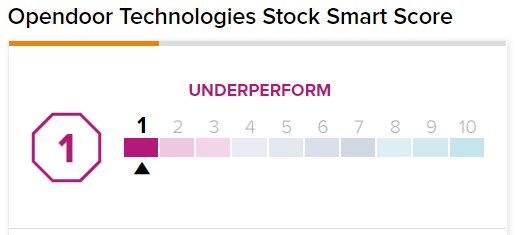

Interestingly, on TipRanks, OPEN stock has a 1 out of 10 Smart Score rating. This indicates strong potential for the stock to underperform the broader market.

OPEN Stock Faces a Possible Implosion

For those remotely interested in OPEN stock, a recent CNBC report offered a harsh reality check. On December 15, 2022, the news agency announced that home flipping profits dropped at the fastest pace in over a decade.

Anyone following the business news cycle shouldn’t be surprised at the disclosure. Most notably, the Fed remains committed to attacking the inflation crisis by raising the benchmark interest rate. In addition, consumer spending data slipped below expectations, suggesting poor sentiment for non-essential purchases. Given the convergence of these two macroeconomic headwinds, OPEN stock faces extraordinary pressures.

Again, it’s impossible not to ignore Opendoor’s fatal flaw. When you drill into the business (and not the technical stuff), it’s not unique. It’s not even vaguely distinct in the loosest definition of the word. Buying low and selling high represents a concept practically as old as time.

Put another way, for the receiver of a home-purchase offer from an iBuyer platform, what does it matter to the prospect whether the offer was formulated by a human or by a computer? When the pen goes to the dotted line, the offer is the offer.

Not only that, a fatal flaw within a fatal flaw exists. If a business model features no distinction, then it must compete on favorable pricing. However, for Opendoor, the pricing will almost always be unfavorable to what a traditional real estate brokerage can offer.

After all, an average homebuyer wants to make the acquisition because it represents a primary residence. In contrast, an iBuyer buys a home to make a profit. Therefore, the initial entry point must be – by logical deduction – lower than the retail value.

After witnessing sellers last year make extraordinary gains, current sellers will likely wait for the best deal. That’s a major obstacle for OPEN stock.

Is OPEN Stock a Buy, According to Analysts?

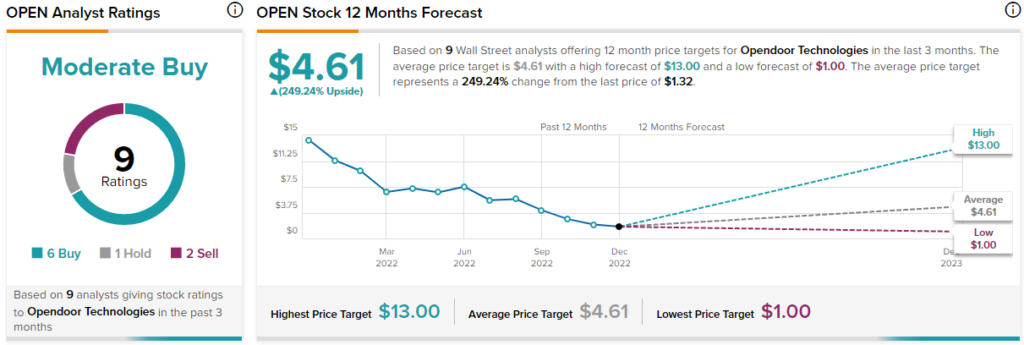

Turning to Wall Street, OPEN stock has a Moderate Buy consensus rating based on six Buys, one Hold, and two Sell ratings. The average OPEN price target is $4.61, implying 249.2% upside potential.

Ignore the Attractive Quantitative Data

Nevertheless, despite the challenges weighing on OPEN stock, its underlying financials present a different take. For instance, based on sales and book value, Opendoor appears to be an undervalued investment. However, it’s probably a value trap in the making.

Yes, the market prices OPEN stock at 0.05-times sales, well below the sector median of 2.6 times. Also, it prices shares at 0.58-times book value, below the industry median of 0.77 times. As well, its three-year revenue growth rate (on a per-share basis) stands at a meteoric 58.9%.

To be fair, Opendoor – as with other real-estate-related enterprises – amassed extraordinary sales during most of the new normal. However, as the Fed increasingly became aggressive with its rate hikes, quarterly sales (since the peak of Q1 2022) declined sharply. On a trailing-12-months basis, the data certainly looks good for now.

Still, even within the quantitative framework, Opendoor’s top line has been diminishing quarter after quarter this year. Evermore higher rates will likely exacerbate this trend, not improve it. Thus, from both a business and financial perspective, OPEN stock presents far too many risks for conservative investors.