There’s no denying that Occidental Petroleum (NYSE:OXY) stock is a favorite holding of Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) CEO Warren Buffett. However, this shouldn’t be your only reason to invest in Occidental Petroleum. The company has good and bad points, but overall, I am bullish on OXY stock as a long-term traditional and clean energy play.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Occidental Petroleum drills for fossil fuels, but as we’ll discuss in a moment, the company also promotes net-zero initiatives. It’s a company that Buffett and Berkshire Hathaway own a sizable stake in.

In fact, Berkshire Hathaway reportedly bought approximately $246 million worth of Occidental Petroleum shares in October, thereby increasing Berkshire’s stake in the energy giant to 25.8%. Clearly, there must be something that Buffett likes about Occidental Petroleum, so let’s unpack this fascinating company and see if OXY stock is worth considering.

Occidental Petroleum: Decent Value and So-So Dividends

Buffett typically doesn’t explain why Berkshire Hathaway makes stock purchases and sales. Consequently, retail traders are left to their own devices to figure out why the Oracle of Omaha would like Occidental Petroleum so much.

Surely, Buffett likes to collect passive income, and Occidental Petroleum does offer a dividend yield of 1.1%. However, compared to the energy sector’s average dividend yield of 3.752%, Occidental’s payouts aren’t anything to write home about.

What about its valuation? After all, Buffett is famous for finding beaten-down bargains. Occidental Petroleum’s GAAP trailing 12-month price-to-earnings (P/E) ratio of 10.1x looks great at first glance. Still, it’s actually higher than the sector median P/E ratio of 9.4x.

So far, Occidental Petroleum looks like a decent investment but not a screaming Buy. On the other hand, it’s not all about traditional valuation metrics for Buffett. Above all else, he wants to buy shares of a great company at a good price.

In the energy sector, being a great company means preparing for the future and for a net-zero world. Sure, Occidental Petroleum drills for oil and natural gas, but the company also has a partnership with gigantic asset manager BlackRock (NYSE:BLK) to develop the world’s largest direct carbon capture facility.

This project is massive. It’s called STRATOS, and it’s designed to capture as much as 500,000 tonnes of carbon dioxide per year. Hence, if you believe that the future of energy is net zero and carbon capture (an idea that BlackRock is willing to back, and perhaps Buffett might agree with this concept, as well), then check out Occidental Petroleum stock.

Occidental Petroleum: An Earnings Beat, but Not Necessarily Earnings Growth

Since Occidental Petroleum just announced its third-quarter 2023 financial results, maybe we can find more clues about why Buffett would favor this company. Certainly, Buffett would prefer to invest in companies with good financials and growth in key areas.

In some respects, Occidental Petroleum checks the right boxes. For example, the company reported Q3-2023 earnings of $1.18 per share, beating the consensus estimate of $0.88 per share. Plus, Occidental’s net income attributable to common stockholders totaled $1.156 billion, nearly double Q2-2023’s income of $661 million.

On the other hand, that $1.156 billion was far below Occidental Petroleum’s income of $2.546 billion in the year-earlier quarter. Personally, I would like to see Occidental get its income back above the $1.5 billion mark and then above $2 billion in the coming quarters.

What about oil production volumes? Occidental Petroleum is busy drilling and pumping, but its growth isn’t spectacular. For 2023’s third quarter, Occidental reported worldwide production of 1,220 thousand barrels of oil equivalent per day (MBOE/D). That’s basically in line with the prior quarter’s 1,218 MBOE/D, though it’s above the year-earlier quarter’s 1,180 MBOE/D.

Finally, Occidental Petroleum’s Q3-2023 net sales of $7.158 billion came in higher than the $6.702 from the prior quarter but fell short of the year-earlier quarter’s net sales of $9.39 billion. Hence, Occidental’s results vary based on the oil price and other factors, so investors should monitor the company’s financials to see if the company can improve its top- and bottom-line figures.

Is OXY Stock a Buy, According to Analysts?

On TipRanks, OXY comes in as a Moderate Buy based on six Buys, seven Holds, and one Sell rating assigned by analysts in the past three months. The average Occidental Petroleum price target is $71.43, implying 16% upside potential.

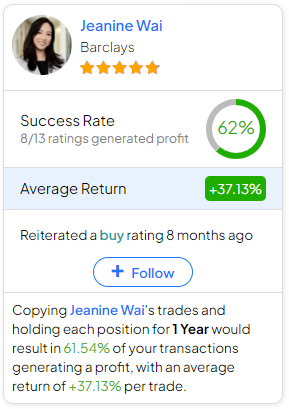

If you’re wondering which analyst you should follow if you want to buy and sell OXY stock, the most profitable analyst covering the stock (on a one-year timeframe) is Jeanine Wai of Barclays, with an average return of 37.13% per rating and a 62% success rate. Click on the image below to learn more.

Conclusion: Should You Consider OXY Stock?

As we’ve discovered, there are bright spots, as well as areas for improvement with Occidental Petroleum. Nonetheless, it’s easy to see why Buffett would appreciate an aggressive oil driller like Occidental Petroleum, as the company is also willing to advance net-zero projects.

Besides, while Occidental Petroleum’s valuation and dividend yield aren’t necessarily the best in the business, they’re still decent. Therefore, if you’d like to try out a Buffett-backed bet with diversified energy exposure, OXY stock is one to consider.