Without question, Nvidia (NASDAQ:NVDA) dominated proceedings this year thanks to its graphics processors, which help power ever-advancing artificial intelligence (AI) and machine learning protocols. Nevertheless, investors may need to tread cautiously with the underlying hype train. With expectations heightened, the company just might not be able to replicate prior results. Therefore, I am tactically bearish on NVDA stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

NVDA Stock May Need a New Viable Catalyst

Since the start of the year, NVDA stock has gained over 220%, a remarkable achievement given its massive size. Sporting a market capitalization of around $1.14 trillion, Nvidia is no spring chicken. Yet, it’s performing like a technology startup with an exciting new product. Still, its recent print paints a humbler picture, suggesting that the company may need a new (and viable) catalyst.

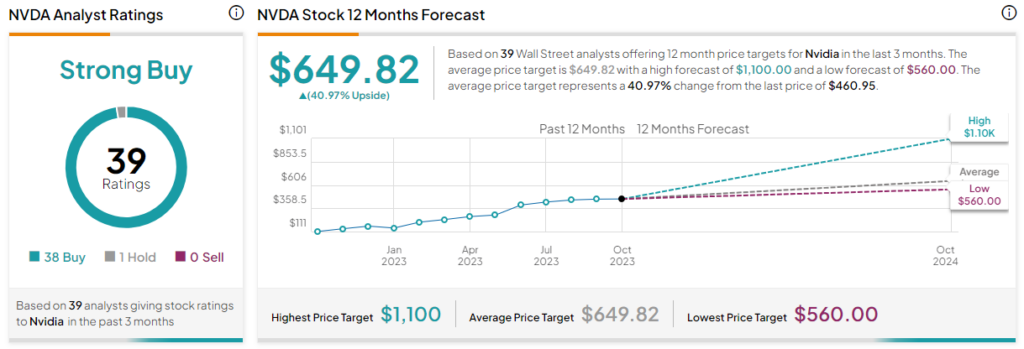

Since the end of June this year, NVDA stock has only moved up by around 9%. To be sure, the incredible rally that Nvidia enjoyed requires a healthy consolidation to reload for the next phase higher. Naturally, analysts have continued to sing the company’s praises while upping their price targets. At the highest, Rosenblatt Securities’ Hans Mosesmann forecasts NVDA hitting $1,110 per share.

Still, for shares to more than double in value will likely require an exciting new application or venture. For example, what helped catapult NVDA stock earlier was the intense focus on generative AI. Today, people across various industries are raving about the utility and intuitiveness of ChatGPT. However, NVDA stock has already priced in this enthusiasm.

Certainly, other AI applications exist to which Nvidia offers tremendous relevance. Perhaps most notably, the company specializes in automotive software that offers both driver assistance systems and specific autonomous driving capabilities. Unfortunately, this avenue may face significant challenges.

Increasingly, regulators have grown concerned about the safety of autonomous driving systems. Rising incidents suggest that driverless vehicles may be further out than previously thought. Thus, Nvidia needs something fresh and exciting to incentivize investors to hold the risk.

Even Generative AI Might Not be “All That” for Nvidia

While it might be a sacrilegious statement, given the heightened interest in digital intelligence, generative AI might not even be all that great. For instance, while people may still rave about ChatGPT, experts have also noted that the protocol can occasionally emit erroneous statements or “hallucinate” outputs. While that’s not a direct headwind for NVDA stock, such inaccuracies may impugn its market value.

Basically, powering various advanced AI protocols won’t mean much if the output occasionally generates flaws. If you can’t trust the answers 100% of the time, this flaw requires human oversight for correction. However, if an AI system requires such human intervention, why bother with it in the first place?

Now, for answering homework questions, the consequences for inaccurate outputs aren’t as dire. However, if we’re talking about driverless vehicles amid heavy car and pedestrian traffic, hallucinations can be deadly.

In other words, NVDA stock has gained handsomely from the low-hanging fruit of AI. The next step, making AI more consistently reliable, may involve substantial time and financial resources. Such a phase might yield a lower return on investment compared to the low-hanging fruit phase, making NVDA unusually risky.

A Matter of Valuation

About one year ago, NVDA stock traded at an earnings multiple of 44.1x. After soaring almost 300% during the past 365 days, the current earnings multiple stands at just over 110x. Either way, NVDA traded well above the underlying semiconductor industry’s average price/earnings ratio, and its valuation is extremely high at the moment.

Therefore, it’s a classic baseball question. Do you want to keep your starting pitcher, who might be gassed, late in the game? Or do you want to go to the bullpen?

From a practical standpoint, it might make sense to trim excessive exposure to NVDA stock and rotate into a more valuation-attractive idea. The risk-reward profile just isn’t as appealing as it was a year ago.

Is NVDA Stock a Buy, According to Analysts?

Turning to Wall Street, NVDA stock has a Strong Buy consensus rating based on 38 Buys, one Hold, and zero Sell ratings. The average NVDA stock price target is $649.82, implying 41% upside potential.

The Takeaway: NVDA Stock May Need a Break

There’s a reason why starting pitchers in baseball need a few days in between starts, and the same concept may apply to NVDA stock. To be clear, this assessment isn’t about casting aspersions on Nvidia. It’s been a phenomenal performer, as any cursory glance at the charts will reveal. However, its valuation is high now, and even the best need a break sometimes.