This week hasn’t been a great one to own semiconductor stocks so far — but Nvidia (NVDA) shares might turn out to be a relatively safe port in the storm.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The week began on a down note when Citigroup analyst Christopher Danely cut his price target on Intel (INTC), and warned that more generally, investors should begin bracing for semiconductor stock declines on the order of anywhere from 10% to 30%. Danely didn’t say outright that this prediction applies to Nvidia as well as to Intel — but he didn’t say it did not apply, either.

Before you get too glum (chum) about that prediction, though, it might be worth reading a second opinion on Nvidia — and as luck would have it, Morgan Stanley’s 5-star analyst Joseph Moore has just delivered just such an opinion. In a recent note, Moore took a negative view of Intel, but a more nuanced view of Nvidia.

Bad news first: According to Morgan Stanley’s “Taiwan semis team,” there’s a possibility that Nvidia’s contract manufacturer of 5nm computer chips might be planning to delay the start of 5nm production “a bit,” which could possibly mean that production of the long-awaited Ada Lovelace GPUs will begin not in Q3, as had been hoped, but rather in Q4 2022.

That’s not great news (if true). But Moore hurries to point out that the rumored delay has “not [been] confirmed by any of the companies involved.”

For that matter, even if the rumors do eventually get confirmed, Moore doesn’t think investors should overreact to a simple timetable shift. “Supply chain movement between quarters is fairly common,” reminds the analyst, and furthermore, “5nm gaming products are not yet announced.” This is key because it means that even if production does get delayed, it’s impossible for such a delay to affect any promised deadlines for new products going on sale… because those deadlines have not yet been set!

Furthermore, “launch timing… depends on many factors, including software support, board manufacture, driver readiness, even availability of other components,” explains the analyst, any one of which factors could cause a delay. Viewed in that context, delays could crop up even if there is no timetable shift at all in 5nm production start. For now, investor (and consumer) expectation is simply that the new high end Lovelace GPUs will arrive sometime “this year.” And if that’s all anyone is counting on, then a Q4 production start (if not too late in Q4) could work just as well as a Q3 start to meet that expectation. And once those chips do arrive, Moore expects them to be “a very popular upgrade.”

The bigger worry for Nvidia investors, muses Moore, is therefore not the production schedule for 5nm chips, but rather the anticipated “gaming correction” that many analysts have predicted might arrive in early 2023. That’s an event even farther out on the calendar than the 5nm production schedule, and correspondingly less certain to materialize. Until greater visibility on the gaming market arrives, however, Moore is still recommending investors adopt an “equal weight” (i.e. neutral) stance on Nvidia stock — which he values at $182 a share, or about 3% below where the stock trades today. (To watch Moore’s track record, click here)

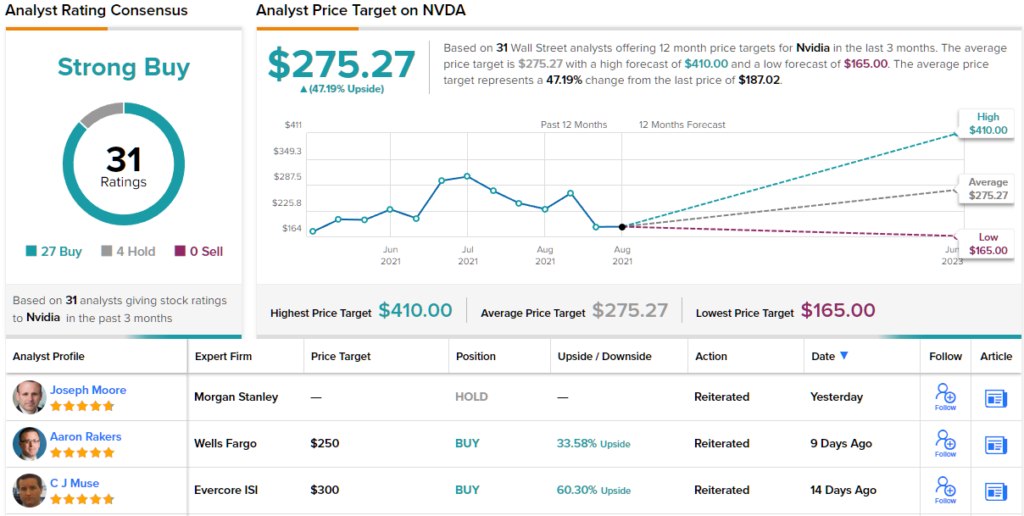

Other analysts are more optimistic. NVDA stock holds a Strong Buy consensus rating, based on 27 Buys and 4 Holds given in recent months. The stock’s average price target of $275.27 suggests it has room to run 47% above its current price of $186.5. (See NVDA stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.