Nvidia (NVDA) and Palantir (PLTR) have been two of 2024’s hottest stocks — Nvidia’s 179.6% year-to-date gain has made it the second-most valuable company in the world by market cap, while Palantir’s 153.3% gain has put it on the map as a mega-cap tech stock to be reckoned with, not to mention a new member of the S&P 500 (SPX).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Both stocks have benefitted from being key players in the AI revolution. Both companies have exciting futures ahead of them, but there is a key difference between the two that makes one the more compelling opportunity at this point in time. Which looks like the better choice for investors right now?

Massive Gap in Valuation on a Price-to-Earnings Basis

Nvidia’s 2024 surge has taken it to a relatively high valuation multiple of 47.5 times January 2025 earnings estimates. The S&P 500 trades at 24.7 times earnings, meaning that Nvidia is nearly twice as expensive as the broader market.

However, with consensus earnings per share projected to grow to $4.01 per share for the fiscal year ending in January 2026, Nvidia looks quite a bit more palatable at 33.6 times forward earnings. While this is still fairly expensive, it’s starting to look reasonable enough for a mega-cap powerhouse projected to grow earnings per share by over 40% for the year. While Nvidia sometimes catches flack from value-oriented investors for its above-average price-to-earnings multiple, Palantir is even more expensive.

The massive 153% YTD gain has pushed shares of Palantir to an incredible valuation of 122.4 times December 2024 earnings estimates. This is more than double Nvidia’s valuation and roughly five times the broader market. With the stock expected to grow earnings per share by 19.4% to $0.43 per share for December 2025, the stock’s valuation comes down a bit but is still trading at an exorbitant triple-digit multiple of 100.8 times forward earnings.

Looking Beyond Price-to-Earnings

Plus, it’s not just price-to-earnings that makes Palantir look significantly more expensive than Nvidia. When looking at the two stocks on a price-to-sales basis, a popular metric often used for evaluating high-growth names like technology stocks and software stocks, Palantir trades at an astronomical price-to-sales ratio of 35.3, while Nvidia trades for a high but comparatively cheaper 26.3 times sales.

What About the PEG Ratio?

Lastly, it’s worth comparing the two stocks based on their PEG ratios (price-to-earnings-to-growth ratio), a popular valuation metric useful for evaluating growth stocks like Nvidia and Palantir by accounting for earnings growth. PEG ratio is calculated by taking a stock’s price-to-earnings ratio and dividing it by its earnings growth rate. The lower the PEG ratio, the better a stock looks by this measure. Investors and analysts who utilize this metric typically view a PEG ratio of 1.0x or less to be undervalued.

So, how do Nvidia and Palantir stack up on this basis? Nvidia’s PEG ratio of 1.8 is a bit higher than ideal but not prohibitive. On the other hand, Palantir trades at a significantly higher PEG ratio of 10.4, indicating that it is likely overvalued even when accounting for its earnings growth.

Palantir is no doubt an exciting company, but it’s hard to sustain a valuation multiple like this, and it leaves little room for error — if the company falls short of analyst expectations or hits any speed bumps, shares could tumble quickly.

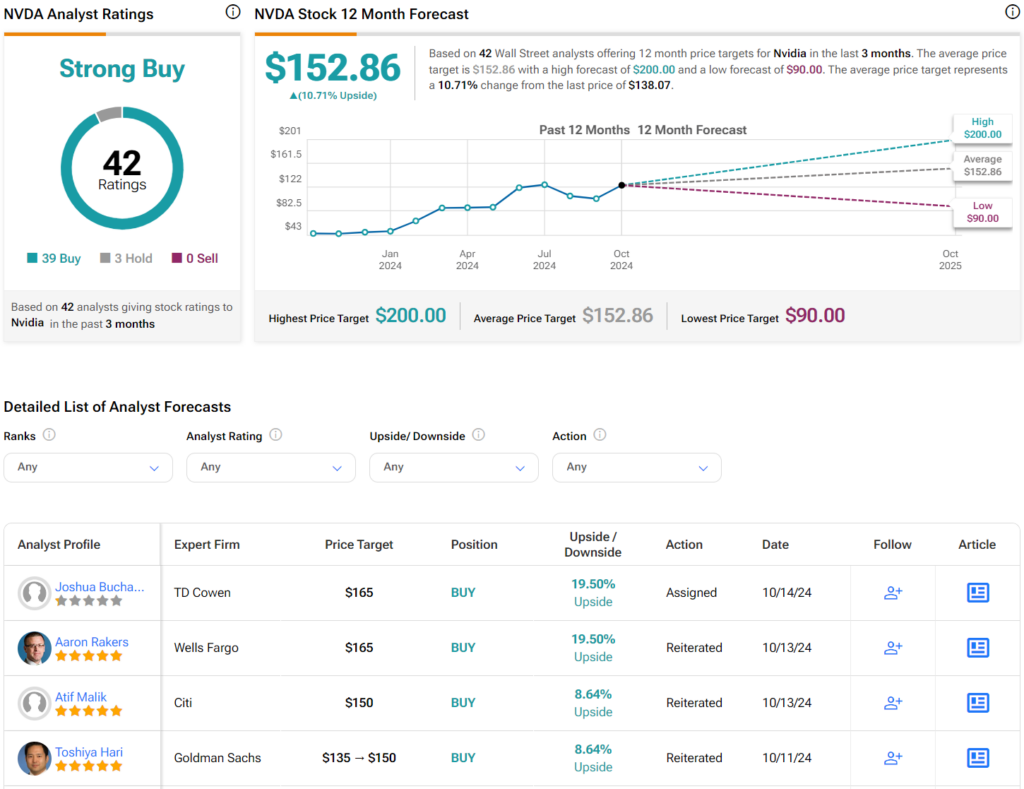

Is NVDA Stock a Buy, According to Analysts?

Turning to Wall Street, NVDA earns a Strong Buy consensus rating based on 39 Buys, three Holds, and zero Sells assigned in the past three months. The average NVDA stock price target of $152.86 implies 10.7% upside potential from current levels.

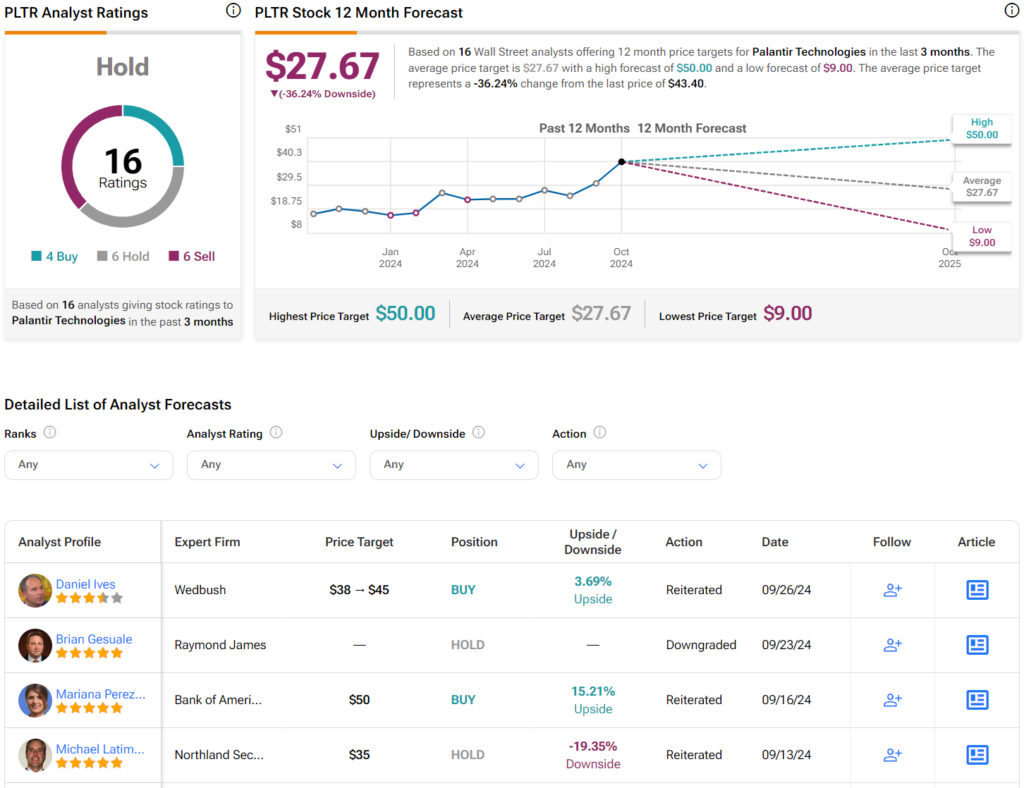

Is PLTR Stock a Buy, According to Analysts?

Turning to Wall Street, PLTR earns a Hold consensus rating based on four Buys, six Holds, and six Sell ratings assigned in the past three months. The average PLTR stock price target of $27.67 implies 36.2% downside potential from current levels.

Smarten Up

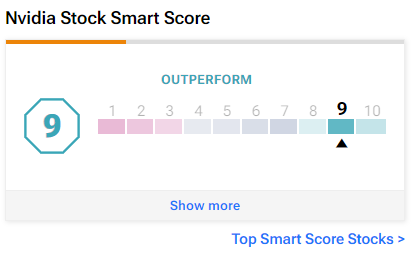

Wall Street analysts are far more constructive on Nvidia, and so is TipRanks’ proprietary Smart Score system. The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from one to 10, based on eight key market factors. Scores of eight, nine, or 10 are considered equivalent to an Outperform rating. Scores of four, five, six, or seven are considered Neutral, and scores of three or below are considered equivalent to an Underperform rating.

Nvidia boasts an Outperform-equivalent Smart Score of 9.

Meanwhile, Palantir receives a far less favorable Neutral Smart Score of 4.

Nvidia Is the Clear Choice

NVDA and PLTR are both high-flying AI stocks, and both are projected to grow earnings significantly in the year ahead. However, Nvidia is projected to grow earnings more than twice as much as Palantir. Despite this, Nvidia shares trade for a far cheaper valuation multiple. Nvidia is often criticized as an ‘expensive’ stock, but its forward earnings multiple is just a third of Palantir’s double-digit valuation, making it look downright cheap in comparison.

Plus, sell-side analysts rate Nvidia a Strong Buy and see an upside of 10.7% over the next 12 months, while they are considerably more cautious towards Palantir, rating it a Hold and forecasting a potential downside of 36.4% from current levels. This disparity in analyst views is another strong point in favor of Nvidia.

I’m bullish on Nvidia based on its significantly cheaper valuation and superior earnings growth, making it the clear-cut winner in this comparison of high-profile AI stocks. For investors looking to capitalize on the generative AI wave, Nvidia continues to look like a smart choice.