2022 was a difficult year for Nvidia (NASDAQ:NVDA) marked by a severe deceleration in demand for its Gaming graphic cards amidst concerns of a slowdown for its Data Center offerings.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, Mizuho analyst Vijay Rakesh thinks the semiconductor giant is set up well to withstand any further bearish developments in 2023.

“Despite near-term inventory and macro concerns,” said the 5-star analyst, “we believe NVDA remains dominant in Data Center AI, establishing a wide competitive moat in terms of performance and roadmap execution. In Gaming, we see NVDA remaining the performance and market share leader, with demand remaining relatively stable.”

Gaming was once Nvidia’s main breadwinner but on the back of lowered demand, it lost its leading spot to Data Center. Nevertheless, Rakesh notes the company’s leadership position in the segment, estimating Nvidia still claims more than a 70% PC share. And after the severe pullback, checking in with the supply chain, Rakesh says there are indications inventory digestion is “potentially normalizing” with the bottom of the cycle now most likely in the rear-view mirror. Additionally, new releases of the RTX 40-series GPUs should “provide tailwinds” in the first half of the year. Rakesh also reckons that at present, around 50% of the PC market uses NVDA GPUs that are two or more generations behind, suggesting there is still a “good upgrade opportunity” in Gaming.

It’s a similar story for China Data Center. Despite the U.S. government’s restrictions on the sale of advanced GPUs for AI to China, the complaint A800 chip that is now selling on Chinese e-commerce platforms has the potential to “maintain market share in the face of geopolitical headwinds.” Later in the year could also potentially see the launch of a modified H100.

Lastly, with the ADAS (advanced driver assistance systems) industry expected to grow at a 25-30% CAGR (compound annual growth rate) between 2022-2025, the company’s $11 billion+ Automotive ADAS pipeline could be “ramping towards higher volumes,” which could help push shares higher.

To this end, Rakesh rates NVDA shares a Buy to go along with a $200 price target. That figure, however, leaves room for just modest gains of 2%. (To watch Rakesh’s track record, click here)

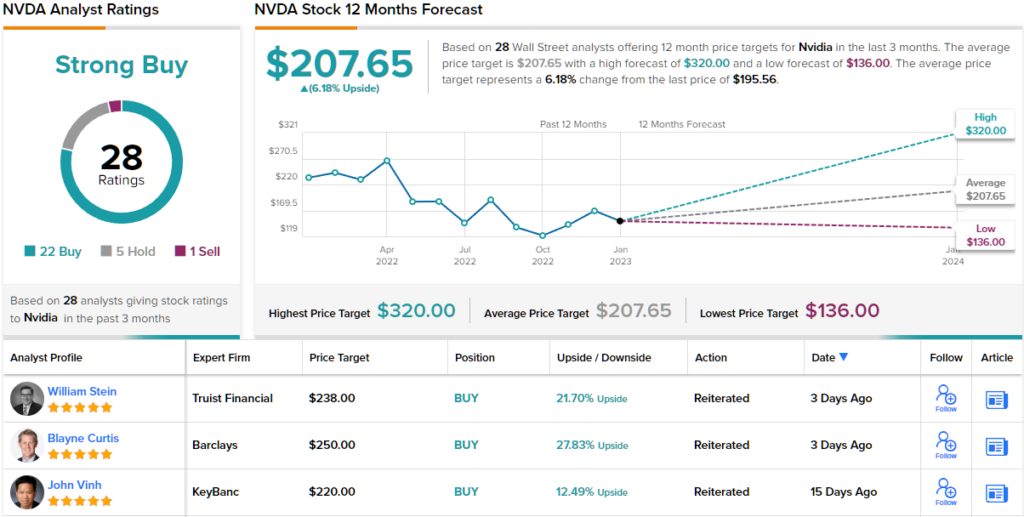

The Street’s average target is only slightly higher and at $207.65, suggests one-year share appreciation of 6%. Rating wise, it’s a different story; the stock receives a Strong Buy consensus rating, based on 22 Buys, 5 Holds and 1 Sell. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.