Wall Street analysts are almost unanimous in their view that semiconductor giant Nvidia (NVDA) will rocket higher. However, options traders apparently have a different take, placing contrarian wagers against NVDA stock. The situation has now become a matter of which narrative investors trust more. In my opinion, the market is the ultimate arbiter, and it’s not giving the warm and fuzzies over the tech juggernaut. Therefore, I am bearish on NVDA.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Pessimistic NVDA Stock Wagers Go Against the Tide

To be sure, it’s not surprising that some options traders have flipped sides regarding the sentiment battle over NVDA stock. Last week, the tech company – which manufactures the advanced graphics processors that make artificial intelligence what it is today – incurred a fall of 5.1%. This Monday, it was down another 6.4%.

Still, the overall narrative seems bullish on NVDA stock. According to a Bloomberg report, the generative AI ecosystem could become a $1.3 trillion economy by 2032. That implies a compound annual growth rate (CAGR) of 42% over the next 10 years, per the article. If so, that’s an excellent reason to consider riding out the volatility in Nvidia.

Further, multiple experts – such as analysts from Piper Sandler and other institutions – have pounded the table on NVDA stock. Despite the stock’s fall, the red ink could turn out to be an opportunity. However, that’s not what options traders are signaling.

On Friday, options flow data for Nvidia stock – a screener that focuses exclusively on big block transactions likely placed by institutional or professional investors – revealed that net trade sentiment slipped to negative $5.55 million, thus favoring the bears.

In other words, when you tally all the premiums associated with options with bullish sentiment and perform the same exercise for bearish sentiment, the net total is negative. This implies that institutional sentiment has shifted negatively despite the positive stories that we hear about generative AI.

Keep in mind that Friday wasn’t the only time that options flow turned pessimistic. Since at least last Wednesday’s session, traders have been betting against NVDA stock. Notably, TipRanks’ unusual options activity screener for Nvidia also corroborates this assessment.

Between the July 31 session to August 2, traders placed 32 transactions that were deemed bearish in nature. In contrast, only 18 transactions were deemed bullish. By logical deduction, it’s imprudent to assume that Nvidia will continue marching higher without at least considering the possibility of a correction.

Financials Present a Tough Backdrop

Regardless of one’s view on NVDA stock, the consensus is that Nvidia’s upcoming fiscal second-quarter earnings report – scheduled for August 28 – will be especially critical. Most likely, the company won’t just need another beat; rather, it must deliver convincing results combined with encouraging forward guidance. However, that scenario is hardly guaranteed.

One of the biggest concerns centers on the declining magnitude of the earnings beats. For example, in Q2 of Fiscal 2024, Nvidia posted earnings per share of 27 cents, beating the consensus view of 21 cents. This yielded an earnings surprise of 28.6%. However, in the subsequent three quarters, the earnings surprises landed as follows: 17.6%, 13%, and 8.9%.

Essentially, analysts are getting a bit jaded about Nvidia constantly beating per-share profitability estimates. It needs something truly special to impress the Street. However, a company can only dominate for so long before it requires a breather.

That’s not a dig against NVDA stock. Both things can be true: Nvidia can be a great long-term investment thanks to its numerous innovations, and it could also be due for a correction.

To be fair, NVDA stock looks relatively undervalued at the moment. Right now, shares trade hands at 30.9x trailing-year sales. However, given that analysts project current year (Fiscal 2025) sales to hit $120.73 billion, NVDA’s projected sales multiple is roughly 20.5x (assuming the same share count of 24.6 billion).

That’s closer to NVDA’s five-year average price-to-sales ratio (23x). However, during a corrective cycle, a publicly traded asset could drop far lower before reverting back to the mean. Therefore, it wouldn’t be shocking to see NVDA stock fall back to around $50, where strong horizontal support lies. That would put the sales multiple at around 10.2x. At that point, Nvidia would look extremely enticing on the long side.

Is NVDA Stock a Buy, According to Analysts?

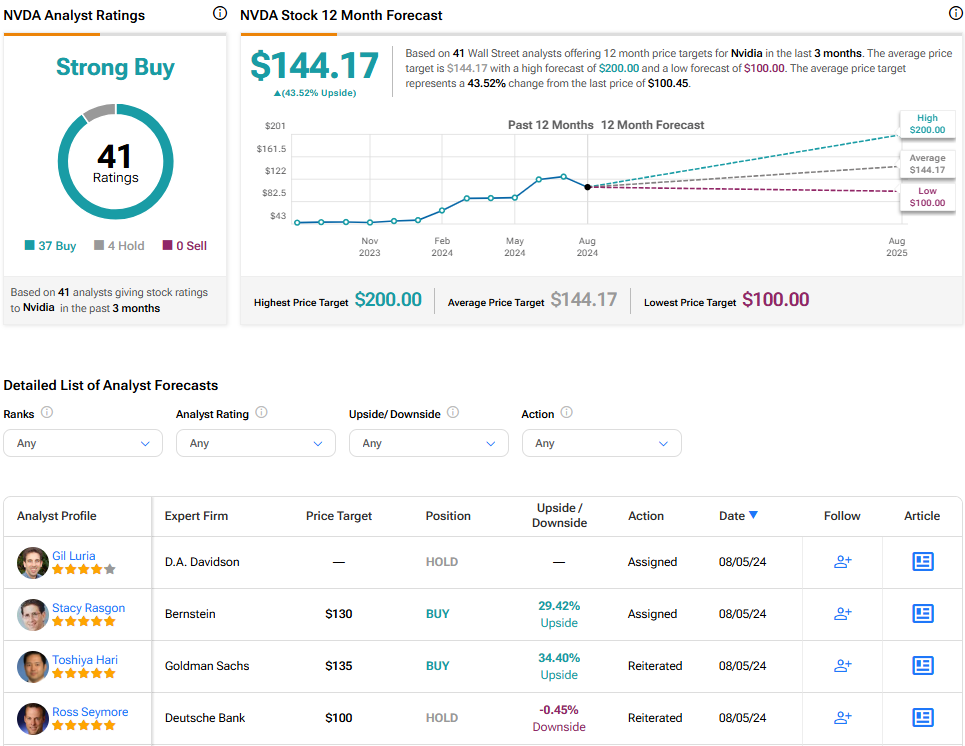

Turning to Wall Street, NVDA stock has a Strong Buy consensus rating based on 37 Buys, four Holds, and zero Sell ratings. The average NVDA stock price target is $144.17, implying 43.5% upside potential.

The Takeaway: Options Traders Cloud the Immediate Narrative for NVDA Stock

Few experts doubt the long-term narrative of Nvidia and its advanced graphics processors. The question really comes down to the near-term trajectory of NVDA stock. Options traders have been placing bearish wagers against the equity throughout its corrective cycle, suggesting more downside ahead. Further, anything short of a blisteringly robust Q2 earnings print could add to the growing skepticism. Therefore, investors may want to wait on the sidelines until the correction fully fades.