Shares of GPU kingpin Nvidia (NASDAQ:NVDA) have endured a lot of damage amid the broader market sell-off. Even after losing two-thirds of its value from peak to trough, Nvidia still commanded a premium valuation multiple. However, it likely deserved to, given its virtually unmatched growth profile and ability to execute. Therefore, I am bullish on NVDA stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Nvidia is arguably one of the most exciting stories in the large-cap semiconductor space. With a brilliant founder CEO in Jensen Huang and a massive (and seemingly growing) total addressable market encompassing many of the hottest trends in tech, it’s tough not to be enticed by Nvidia while it’s still down more than 50% from its peak.

Over the year, the company has run into various hurdles, including America’s ban on top chip exports to China. Indeed, such a ban could take a big bite out of sales for an unknown period. Still, there are reasons for hope, with Nvidia recently shedding light on a “slower” chip that can still be sold to the Chinese market in accordance with a U.S. ban.

At this juncture, little is known about how deeply such export bans will cut into top semiconductor companies. Regardless, the move introduces a lot of uncertainty into an already cloudy (and expensive) growth story ahead of a global economic downturn. Investors hate uncertainty, and there’s no shortage of it in 2022.

As Nvidia looks to navigate around hurdles while navigating a harsher environment, I do view Nvidia as an intriguing growth option, even as this market continues to turn a shoulder on high-multiple growth stocks. In my mind, Nvidia stands head and shoulders above the pack in the semiconductor space.

Recession and Geopolitical Tensions Could Exacerbate Sales Pressures for Nvidia

With a recession around the corner and a U.S. export ban that could exacerbate sales pressures, the recent downfall in Nvidia stock seems more than warranted. There’s also some risk that geopolitical tensions could induce more such bans to keep top innovations out of the hands of China. Indeed, it seems like an export ban will just result in a lose-lose situation.

Nvidia will need to comply and pay the price. Though the company has an advanced solution that goes around U.S. ban criteria, one has to wonder if federal regulators will make amendments moving forward. Further, it’s unclear how much demand would be impaired by such a ban.

In any case, Nvidia’s caught up in the midst of a U.S.-China chip war. It’s a scary situation for Nvidia shareholders to be in. However, I do think there’s a lot of regulatory risk that’s already baked in. Further, the export ban goes to show just how powerful Nvidia’s latest and greatest chips are. By the time a Chinese firm creates a comparable chip, Nvidia may already have raised the bar, perhaps significantly.

Nvidia Stock May Not be Expensive Relative to Its Growth

Undoubtedly, Nvidia is one of the market’s hottest growth kings, and its premium may not be high enough considering longer-term secular trends that could power demand over the next decade and beyond. For now, there’s a lot of focus on near and medium-term headwinds. Nvidia has company-specific issues it will need to tackle in addition to industry headwinds.

The video-gaming and data center segments have shown subtle signs that they’re not immune to the forces of a downturn. Further, COVID-19 lockdowns in China and a challenged consumer balance sheet may also impact quarters to come.

Even as weaker activity in gaming, crypto, and the data center weighs on demand in 2023, I think it’s tough to overlook the long-term fundamentals. At the end of the day, Nvidia produces the technology that could power the hottest innovations of the near future. It’s not easy to gauge when and how fast demand will pick up while everybody is focusing on the recession-induced damage to come.

Is Nvidia Stock a Buy?

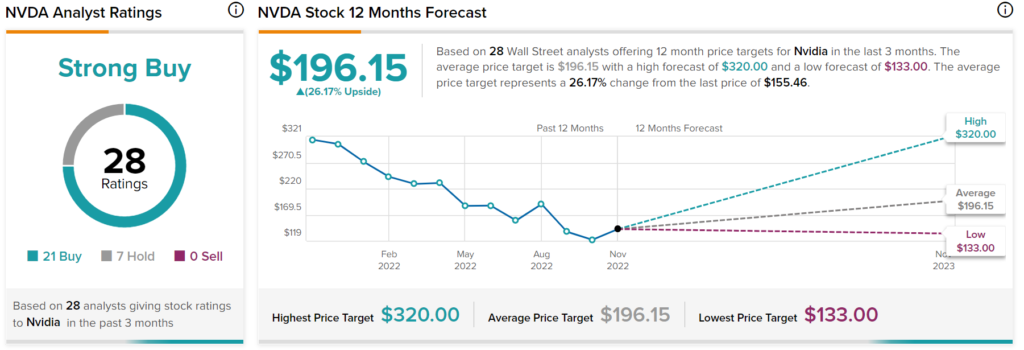

Turning to Wall Street, NVDA stock has a Moderate Buy consensus rating based on 21 Buys and seven Holds assigned in the past three months. The average Nvidia price target is $196.15, implying upside potential of 26.17%. Analyst price targets range from a low of $133.00 per share to a high of $320.00 per share.

Conclusion: NVDA Shares Remain Vulnerable to Rising Rates

At writing, NVDA stock trades at 69.2 times trailing earnings and 14.2 times sales. That’s still quite expensive. Undoubtedly, such a lofty price tag leaves Nvidia vulnerable to a further increase in interest rates (5-7% could prove detrimental to the stock). That said, Nvidia is behind some of the most impressive chips out there. There’s a reason why the U.S. doesn’t want top chips exported to China. Further, there’s a good chance NVDA stock deserves an even higher multiple, given it’s on the very cutting edge of semiconductor innovation.