Nvidia (NASDAQ:NVDA) stock has rallied quite a lot, gaining about 235% year-to-date. However, given the AI (Artificial Intelligence)-led opportunities and NVDA’s leadership in this space, the stock may continue to rise in 2024.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company forecasts that its top line could triple in Q4 of the current fiscal year. Furthermore, this positive momentum is expected to be sustained into 2024, driven by robust demand across the Data Center segment.

Additionally, the company is making substantial expansions to its supply chain, signaling continued strength in demand for the upcoming quarters. Against this backdrop, let’s explore what the analysts suggest for Nvidia stock.

NVDA Stock: Analysts Weigh In

The majority of analysts covering NVDA stock advocate purchasing it at current levels. On December 15, Bank of America Securities analyst Vivek Arya reaffirmed a Buy rating for Nvidia, designating it as his top semiconductor pick for 2024. Arya’s optimistic outlook is reflected in his $700 price target, suggesting a substantial upside potential of 43.18%.

While Nvidia stock has appreciated in value, Bernstein analyst Stacy Rasgon finds its valuation attractive. Rasgon suggests buying NVDA stock near current levels. The analyst added that Nvidia trades at a forward price-to-earnings multiple of 25, which is lower than Advanced Micro Devices’ (NASDAQ:AMD) forward earnings multiple of 41. Rasgon has a price target of $700 on Nvidia stock.

Meanwhile, DBS analyst Fang Boon Foo maintained a Buy rating on NVDA stock on December 7. The analyst said that NVDA, through its robust financial performance, has dispelled doubts about AI being merely hype. Instead, AI is now seen as the key driver of earnings for the company. Additionally, the analyst sees sustained global demand for AI chips and envisions Nvidia reaping incremental advantages from the growing adoption of generative AI across various industries.

Is Nvidia Stock Expected to Rise?

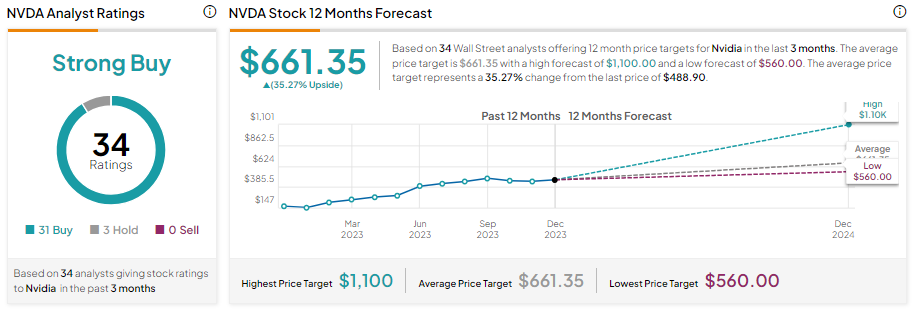

Analysts’ average price target suggests Nvidia stock is expected to rise. With 31 Buy and three Hold recommendations, Nvidia stock has a Strong Buy consensus rating. Moreover, analysts’ average price target of $661.35 implies 35.27% upside potential from current levels.

Bottom Line

Nvidia stock has generated significant returns for its investors so far in 2023. Further, analysts continue to show confidence in it and expect the stock to grow more over the next 12 months. The AI-led demand, supply-chain expansion, and NVDA’s focus on accelerating its product development position it well to deliver solid financials, supporting its share price in 2024.