Several tech stocks, including Nvidia (NASDAQ:NVDA), have witnessed a sell-off recently due to persistent macro challenges and concerns about elevated interest rates. Nvidia stock has declined about 8% over the past month. Nonetheless, the stock has rallied by an impressive 191% year-to-date, thanks to the demand for its advanced graphics processing units (GPU) that are needed to build and train generative artificial intelligence (AI) models. Despite macro uncertainty and worries over slowing demand, analysts remain bullish on NVDA stock and see the pullback as an attractive opportunity to build a long-term position in the leading chip giant.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nvidia’s Recent Performance

Last month, Nvidia crushed Wall Street’s expectations by reporting a 101% growth in its fiscal second-quarter revenue to $13.51 billion. Further solid margins and top-line growth fueled a 429% jump in adjusted earnings per share (EPS) to $2.70.

In particular, the company’s Data Center segment generated a 171% revenue growth, backed by a spike in demand for its HGX platform from cloud service providers and large consumer internet companies. During the Q2 2023 earnings call, CFO Colette Kress called the HGX platform the “engine” of generative AI and large language models (LLMs), which is being deployed by major companies, including Amazon’s (NASDAQ:AMZN) Amazon Web Services, Alphabet’s (NASDAQ:GOOGL, GOOG) Cloud, Meta Platforms (NASDAQ:META), Microsoft (NASDAQ:MSFT) Azure, and Oracle (NYSE:ORCL) Cloud.

Analysts Optimistic on NVDA’s Future Growth

Expressing his bullish stance, Morgan Stanley analyst Joseph Moore said on Monday that the recent pullback in the stock due to worries about slowing AI orders for Nvidia from Microsoft has created yet another opportunity to buy the AI leader. Moore highlighted that an analyst at a data-centric boutique research firm noted that Microsoft was lowering its H100 requirements for 2024, a concern that was heightened by an SEC filing revealing that NVIDIA has significant exposure to a single cloud customer, which the analyst thinks is “very likely Microsoft.”

Moore contended that while he can’t comment on specific 2024 budgets for any single customer, checks show that demand is well above supply for NVDA’s H100 chips in many regions and with several customers. Also, supply chain reports indicate that Microsoft is pushing for more product than they are currently getting, which assures that “there isn’t a near term air pocket with that customer.”

Moore reiterated a Buy rating on NVDA stock with a price target of $630, as he expects the company to benefit from continued AI investments, growth in inference platforms, and a B100 GPU product cycle.

Like Moore, Truist analyst William Stein is also bullish on Nvidia and reaffirmed a Buy rating on the stock with a price target of $668 on Tuesday. Stein called Nvidia and semiconductor company Monolithic Power Systems (NASDAQ:MPWR) his favorite ideas. He believes that NVDA’s chips are the “default choice” for most engineers building AI systems. He also thinks that the company has sustainable market leadership in gaming and autonomous driving end markets.

What is the Prediction for Nvidia Stock?

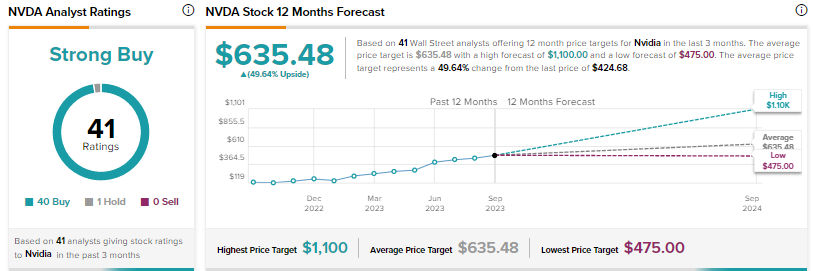

With 40 Buys against just one Hold recommendation, Nvidia stock earns a Strong Buy consensus rating on TipRanks. The average price target of $635.48 implies about 50% upside potential from current levels.

Conclusion

Despite macroeconomic woes, Wall Street remains bullish on Nvidia and sees continued upside in the stock even after a phenomenal year-to-date rally. Analysts expect the demand for Nvidia’s AI chips to boost its revenue and earnings over the long term.