Nvidia (NADSAQ:NVDA) stock continues climbing higher, with the $1.13 trillion GPU (Graphics Processing Unit) titan adding another 6%+ to its valuation this week. Undoubtedly, shares of the massive AI winner are still hot, looking to make even higher highs. Still, the stock’s valuation is getting harder to justify with every sizeable upside move, and I do believe investors would be wise to consider the risks and rivals that look incredibly hungry for a slice of the AI chip pie.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yes, it’s hard to find hair on the Nvidia growth story. The firm is firing on all cylinders, and its TAM (Total Addressable Market) may seem uncapped at this point! Also, AI has opened so many new doors for Nvidia and other high-tech companies that have invested in the trend.

Arguably, Nvidia has one of the most spectacular growth profiles in recent memory, and while I believe CEO Jensen Huang deserves a huge round of applause for the NVDA stock’s run, I can’t be bullish on shares at these heights. For now, I’m inclined to be neutral on the stock, even as Wall Street analysts rush in to hike their price targets to catch up with the euphoric surge.

Nvidia Stock’s Blast Past $1 Trillion Makes It an AI Kingpin

A market cap north of $1 trillion would have been unfathomable just a year ago when it seemed like Nvidia’s glory days were over, as shares shed around 66% of their value from peak to trough. At this juncture, investors are more than willing to pay up for top-tier exposure to AI plays. Certainly, AI may very well be the biggest trend since the rise of the internet, and though we may have yet to hit dot-com-esque valuations, I don’t think investors should chase if they’re feeling a bit of FOMO (fear of missing out).

It’s hard not to feel FOMO, given that nobody wants to miss out on the historic rise of generative AI technologies. AI has serious monetization potential, but so did the internet in the 1990s. That’s why it may be wise to pay a bit more attention on the risks rather than the potential for near-term rewards with a name as hot as Nvidia.

Nvidia Has Outperformed Its Rivals — For Now

Nvidia didn’t just find itself in the right place at the right time; it’s been laying down the foundation for the AI boom for many years. When ChatGPT landed, sparking massive interest in all things AI, Nvidia was ready to seize the opportunity. Though Nvidia seems to have had its way with rivals in the early innings of the AI boom, I would not discount Nvidia’s fellow rivals. One has to imagine that everyone wants a piece of what made Nvidia such a profound success.

AMD (NASDAQ:AMD) is an obvious rival that has AI firepower of its own, with its recently-revealed MI300X chip. Nonetheless, AMD needs to catch up to challenge the top dog in Nvidia, and Citi analyst Christopher Danely isn’t too confident that AMD can get up to speed (Danely noted that a third-party assessment saw AMD hardware at 80% the speed of Nvidia hardware).

Indeed, Mr. Danely makes a strong case for why it’s better to go with the leader in the AI chip space. It is really tough to catch up when it comes to any sort of semiconductor.

Is NVDA Stock a Buy, According to Analysts?

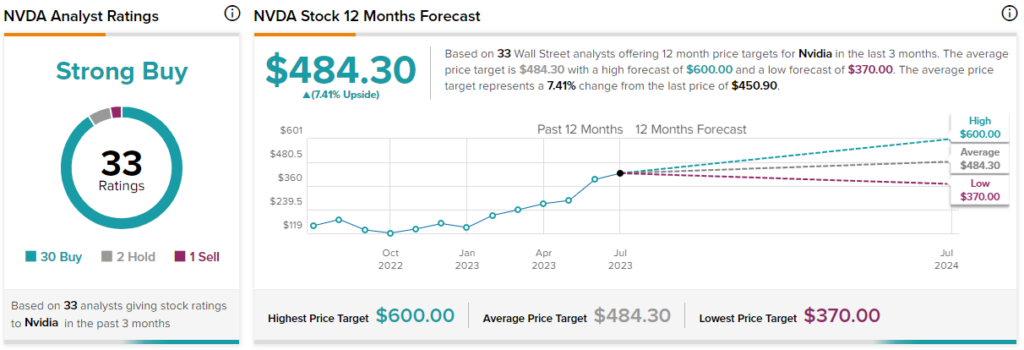

Turning to Wall Street, NVDA stock comes in as a Strong Buy. Out of 33 analyst ratings, there are 30 Buys, two Holds, and one Sell recommendation.

The average Nvidia stock price target is $484.30, implying upside potential of 7.4%. Analyst price targets range from a low of $370.00 per share to a high of $600.00 per share.

The Bottom Line on NVDA Stock

Nvidia stock’s a leader that many analysts think can stay in the lead for a while. The stock boasts a “Strong Buy” rating for a reason! Still, I think the 231 times trailing price-to-earnings multiple (well above the 35.1 times for the industry average) already reflects Nvidia’s dominance.

If a capable rival, most notably AMD, can close the gap, or if AI chip demand falls short of high expectations from here, NVDA stock could be vulnerable to another bust. After such a bust, I’d be more inclined to punch my ticket.