Shares of Nvidia (NASDAQ:NVDA) have been on a magnificent run this year, surging more than 200% year-to-date at the high point. With a $1 trillion market cap, Nvidia stock joins the likes of a few big-tech behemoths that have cashed in on the AI boom.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Undoubtedly, Nvidia CEO Jensen Huang and his firm have been busy innovating on the AI front for years. Huang was well aware of the AI boom that was going on. For the rest of us, it took OpenAI’s ChatGPT to convince us all about the incredible powers of large language models and AI as a whole.

The spotlight has since shifted to other companies with significant roles to play in the AI boom. Arguably, Nvidia has a front-row seat to the boom, and the GPU kingpin also used to be well-known as a play on the video gaming market and even cryptocurrency mining for a while. Nonetheless, I am bearish on the stock due to its high valuation.

Nvidia’s Role in the AI Hardware Arms Race

Nowadays, it’s almost all about the AI hardware arms race and Nvidia’s role as a top supplier. Indeed, firms from across the board are looking to get hardware up to speed to enable the latest and greatest generative AI technologies. Undoubtedly, nobody wants to be left behind as the AI rocket takes off. Despite the potential recession, demand for hot Nvidia hardware has been off the charts, helping fuel the latest spike in the stock.

Just when you think Nvidia stock could not possibly march higher, it unveiled demand that was simply sensational in its last earnings report, sending NVDA stock into the $1 trillion market cap club. Though I’m just as enthused as everyone else is about the potential of generative AI and the number of chips needed to power it in the future, I’m not keen on chasing a stock that’s virtually tripled in less than six months.

I’m not saying that Nvidia stock will crumble from here, but I do think the company is at high risk of coming up short at some point in the future as analysts revise their estimates higher in response to the latest strength. As such, this is why I’m reluctantly bearish but would love to reconsider the stock after a sizeable move lower.

Nvidia: It Seems Like GPU Demand Can Only March Higher

Shockingly, estimates on GPU demand were too modest before Nvidia stock’s May spike. The stock had already more than doubled on a year-to-date basis before the sudden spike.

With expectations now corrected to the upside, the pendulum of risk may now have swung in the other direction. Given that generative AI (like large language models) could help fuel the fourth major industrial revolution, it’s not easy to gauge what demand will be like in the future and how wildly it will fluctuate.

Could Nvidia have another spike up its sleeves? It’s entirely possible. However, I worry about what happens after companies have had their GPU fill. Demand busts can follow booms, and though Nvidia will always have a brand new offering that brings in upgrades, I’m unsure if anything can match the recent demand surge over the medium term.

Though AI-ready chips are a hot commodity these days, there’s no telling when demand could fall off a cliff. The demand boom could exhaust itself at any time. For now, I find it remarkable that not even recession fears can stop Nvidia’s epic rise. The magnitude of the AI revolution may very well be much stronger than the headwinds a “mild” recession would bring in. Again, though, it’s hard to tell.

Nvidia Stock’s Nosebleed Valuation is a Tad Concerning

For now, I’m following the mantra of “what goes up, must come down.” If a stock can triple quickly, it can also see its value cut by two-thirds. Further, it’s becoming increasingly difficult to pinpoint GPU demand, given the magnitude of the AI boom on the horizon. It certainly does seem like animal spirits are alive and well. Nobody wants to be caught missing out on the AI industrial revolution, after all.

Nonetheless, Nvidia stock can’t keep swinging home runs with every swing. Eventually, it’ll miss the mark, and you can be sure the punishment will be severe. At 57 times forward price-to-earnings (well above the five-year average of around 40 times), NVDA stock is punching above its weight class. If the company falls short of delivering perfection, I fear the stock could have a long way to fall from here.

Indeed, Nvidia is more than just an AI chip play. The company is betting big on AI applications and software, with a foot in the door of virtual reality (think the Omniverse), and it’s still a play on gaming. The addressable market is massive and seems to be boundless. Still, until the stock comes down, it’s a risky endeavor to chase just because others around you are buying the stock with expectations of limitless potential from AI.

Is NVDA Stock a Buy, According to Analysts?

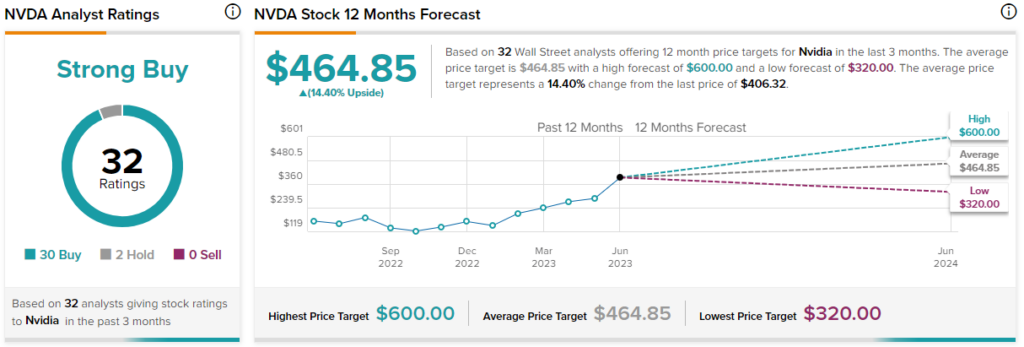

Turning to Wall Street, NVDA stock comes in as a Strong Buy. Out of 32 analyst ratings, there are 30 Buy recommendations and two Hold recommendations.

The average Nvidia stock price target is $464.85, implying upside potential of 14.4%. Analyst price targets range from a low of $320.00 per share to a high of $600.00 per share.

The Takeaway

Nvidia stock looks beyond expensive right here. Some folks out there even view NVDA stock as a bubble. Others, like HSBC analyst Frank Lee, think the stock’s run can continue all the way to $600 (implying 47.7% upside potential. There are many ways to justify the nosebleed-level valuation. However, I’d much rather wait for shares to come down before initiating a position.