The big topic at Nvidia’s (NASDAQ:NVDA) recent GTC event concerned the opportunity around AI, with the company stressing it is well-positioned to be at the forefront of this secular trend.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The event came hot on the heels of the release of OpenAI’s ChatGPT-4, the improved AI bot trained on both images and text. And fittingly, at the event, NVDA’s CEO Jensen Huang sat down with OpenAI co-founder Ilya Sutskever to talk about all things AI. Needham analyst Rajvindra Gill logged in to get the lowdown and came away with a “clearer understanding of why larger models are needed for accurate prediction.”

Sutskever touched on the history of neural networks and the progress made to get to where AI is at right now. One of the criticisms of current models is a lack of accuracy, and the next step will be centered around reliability with the need for users to trust the AI’s responses are accurate.

The response might be as straightforward as the AI “supporting retrieval” (providing source links), asking for clarification, or stating that it cannot answer without more information. Sutskever said these advances will occur within the next two years.

Having gained 83% year-to-date, NVDA stock has been a beneficiary of all this year’s AI talk, but Gill feels the “magnitude of what both Jensen and Ilya discussed, specifically adding video and audio to multi-model systems, has a much broader reach.” And based on “near-term data center strength, receding gaming headwinds, and greater traction in inference and software markets,” Gill anticipates NVDA’s valuation to increase.

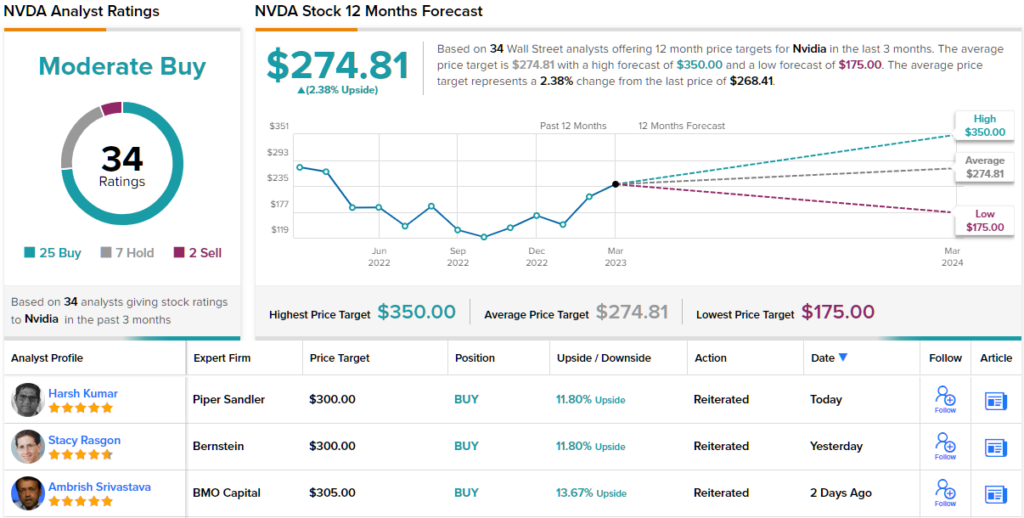

In fact, based on “multiples towards the higher end of historical ranges,” the 5-star analyst raised the price target from $270 to $300, suggesting the shares have room for 12% growth in the year ahead. Unsurprisingly, Gill’s rating stays a Buy. (To watch Gill’s track record, click here)

Elsewhere on Wall Street, with the addition of 24 Buys, 7 Holds and 2 Sells, the stock claims a Moderate Buy consensus rating. Most appear to think the shares have soared enough for now; the average price target currently stands at $274.81, suggesting modest gains of ~2%. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.