Most of the big names have already dialed in their latest quarterly reports, but there are still some yet to deliver their latest financial statements. On Wednesday (May 24) after the close, Nvidia (NASDAQ:NVDA) will announce its first quarter of fiscal 2024 results (April quarter).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Going by recent conversations with component suppliers in the chip giant’s supply chain, Truist analyst William Stein thinks investors are in for a pleasant surprise.

“We have recently learned of an uptick in demand for AI GPUs,” notes the 5-star analyst. “Upside should be expected owing to the ever-increasing demand to build generative AI tools like ChatGPT. What is more surprising to us is the uptick is for lagging edge (A100/A800) GPUs. We expect this to result in revenue and margin upside in the CQ1 (April) result and CQ2 (July) outlook.”

According to the suppliers, during March, they saw an uptick in demand, and this has carried on into April and into the “forecasting horizon.” As Stein alludes to above, that would be expected for the H100 – Nvidia’s latest-generation Hopper architecture systems – particularly given all the excitement around ChatGPT. But the fact the “upside indicators” are coming from the A100 (lagging-generation, Ampere architecture systems) and A800 (the Ampere architecture GPU intended for the China market) is more puzzling.

Whether the boost in demand for A-series GPUs is down to a “cost-benefit performance analysis favoring A-series over H-series,” or just overall demand ticking higher, or possibly due to continued supply chain snags for H-series GPUs, is unclear.

In any case, this new information merits a change to Stein’s estimates. The analyst increased his Datacenter end market sequential sales growth forecast from 6% in each of Q1 and Q2 to 8.5% for both. Additionally, the CY23 datacenter end market growth outlook has increased from +17% to +24% and the CY24 datacenter end market sales growth forecast raised from +16% to +28%.

Whatever the reason behind the uptick in demand, Stein touts Nvidia as ‘the’ AI company, claiming its leader status is less down to its semi devices and more because of its “culture of innovation, ecosystem of incumbency, and massive software investment.”

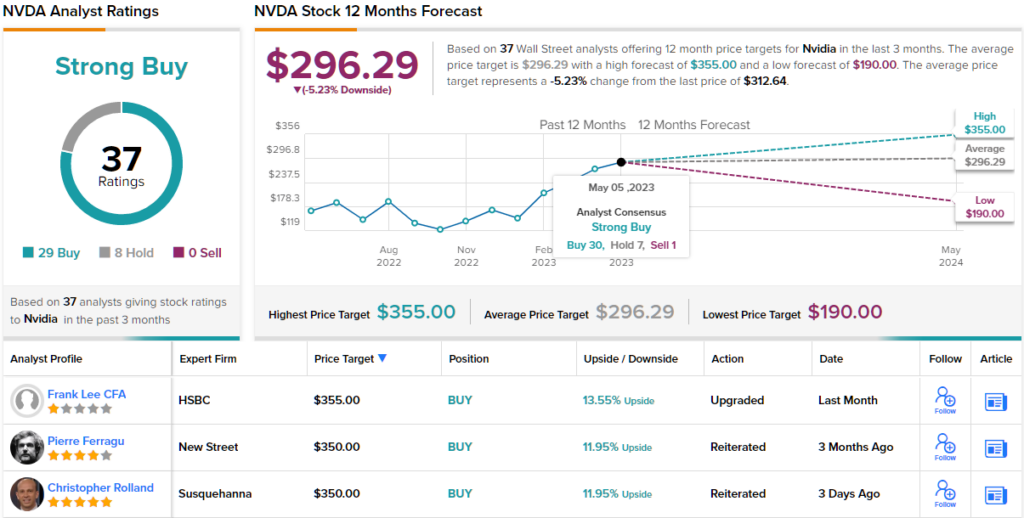

Over the past 3 months, 37 analysts have chimed in with NVDA reviews and these break down into 29 Buys and 8 Holds, all resulting in a Strong Buy consensus rating. That said, given the share’s year-to-date outperformance (up 114%), the $296.29 average target implies shares have soared enough for now. (See Nvidia stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.